Freight bankruptcies swell to 21 in Q3

Commercial Credit Group owed $762K for multiple trucks

Five more freight carriers filed for bankruptcy at the end of September, bringing the third-quarter total to 21 as transportation financing woes continue.

These transportation firms recently filed for Chapter 11 bankruptcy protection, according to U.S. Bankruptcy Court documents obtained by Equipment Finance News:

- GMB Transport filed Sept. 23 in the Northern District of New York;

- L.S. Trucking filed Sept. 23 in the Northern District of California;

- Precision Express filed Sept. 23 in the Eastern District of Arkansas;

- Sky Rock Trucking filed Sept. 29 in the Northern District of Texas; and

- WBK Transport filed Sept. 26 in the Eastern District of Texas.

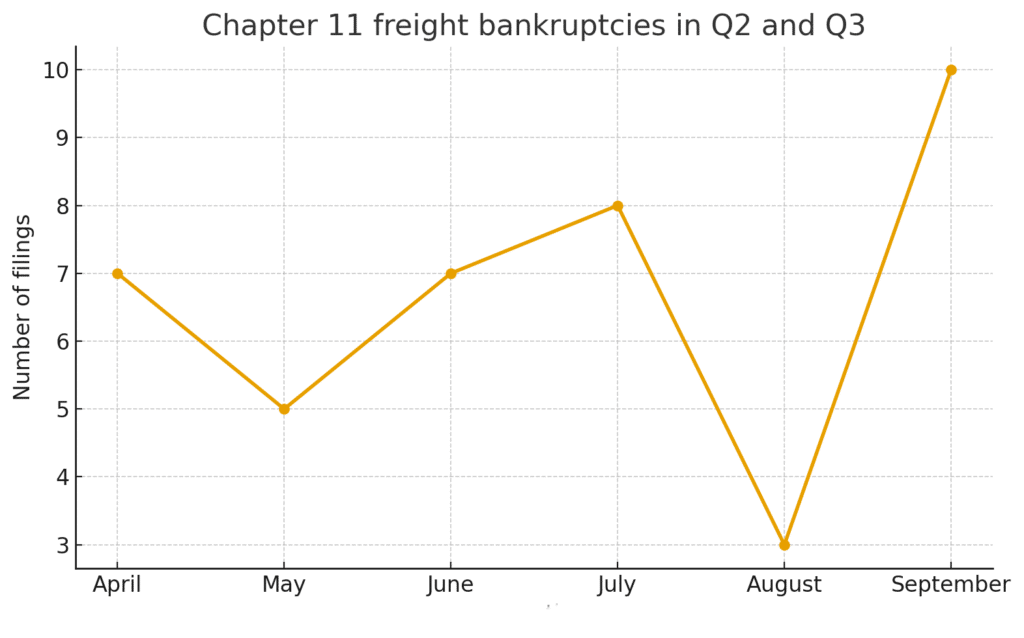

The 21 filings in Q3 follow 20 in Q2, highlighting the yearslong freight recession that’s been prolonged by tightened lending standards, rising operating costs and geopolitical uncertainty. September’s 10 filings were the most in a month since the start of Q2, followed by eight in July, seven in both April and June, five in May and three in August.

L.S. Trucking’s bankruptcy shows that even experienced operators are struggling to persevere through industry challenges. The company was founded in 1995 and specializes in hauling heavy equipment and construction materials, according to the company. It listed assets of $1 million to $10 million and liabilities of $1 million to $10 million, according to the filing.

Equipment lenders most affected by the L.S. Trucking bankruptcy include Commercial Credit Group, which is claiming nearly $762,000 in unsecured funds tied to eight dump trucks, two Peterbilt 365 vocational trucks and several other commercial vehicles. Japanese lender Sumitomo Mitsui Finance and Leasing Co. also has an unsecured claim of nearly $421,000 for six Peterbilt 579 Class 8 tractors.

Truck lenders with the largest unsecured claims in Q2 and Q3 include:

- Stoughton Trailers Acceptance, claiming $4.7 million in the July 4 filing by MG Logistics;

- Daimler Truck Financial Services, claiming nearly $2.2 million in the MG Logistics filing; and

- Starion Bank, claiming more than $1.4 million in the Sept. 16 filing by H5 Transport.

Keys to survival

Persistent market challenges have made trucking “a game of survival” for many small fleets and owner-operators, Dean Croke, principal analyst at DAT Freight and Analytics, a service provider and truck marketplace, told Equipment Finance News. Freight carriers that survive 2025 could be in “a really good position next year,” he said, noting that the industry is expected to begin recovering in Q2 of 2026.

Small fleet operators can take various measures to stay afloat this year, Croke said, including:

- Using technology to track loads and strengthen broker relationships;

- Strategic partnerships;

- Driving slower to lower fuel costs; and

- Being selective about where to operate and who to work for.

Carefully selecting where to operate is important because “terrain, fuel economy, wind direction, traffic density and delays” all come into play, he said.

Register here for the free Equipment Finance News webinar “High-priced used equipment inventory: The no-man’s land of equipment finance” set for Tuesday, Oct. 21, at 11 a.m. ET.