The threat of price hikes sparked by tariffs is causing a temporary boost in used-truck demand, necessitating flexible financing as small fleet owners grapple with financial challenges.

Used Class 8 truck sales at dealerships jumped 23% year over year and 9% month over month in April, according to a May 16 report by ACT Research. That followed increases of 27% YoY and 17% MoM in March.

Tariff uncertainty and rising new-truck prices are driving the surge, with dealers observing a shift in behavior among typical new-truck buyers, ACT Research Vice President Steve Tam told Equipment Finance News.

“A lot of our dealer contacts have confirmed that there are some traditional new-truck buyers who are looking to the secondary market, looking at late-model, low-mileage equipment as a substitute for new,” he said. Manufacturers have “been reducing production on the new side, particularly in Class 8. … New trucks are expensive, and they’re going to get more expensive.”

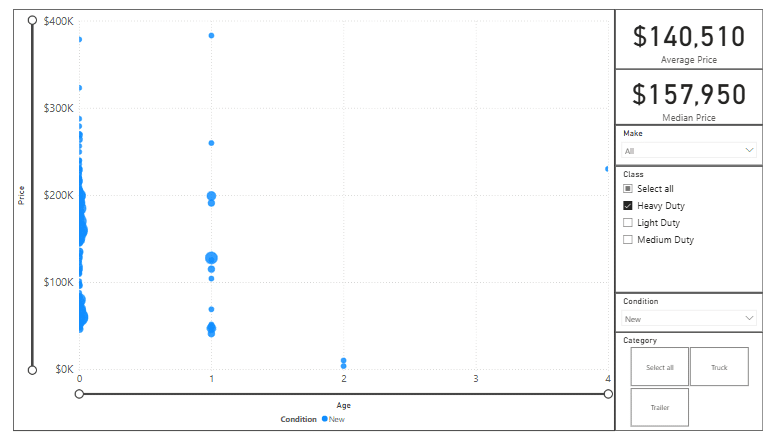

The average price of a new heavy-duty truck is about $140,000, compared with an average of roughly $47,000 for used, according to Equipment Finance News’ Current Truck Pricing Distribution dataset.

The increase in used-truck sales also hints that businesses may be entering the freight industry as distributors stockpile inventory ahead of potential surcharges or supply chain disruptions, Tam said, noting the possible drawbacks of this “miniature pull forward.”

“As tariffs disrupt the actual flow of goods, we’re going to have this air pocket where there’s not going to be freight, or not as much. And potentially, folks who just came into the business might be really second-guessing their decisions.”

— Steve Tam, vice president, ACT Research

However, Tam said he expects market dynamics to rebalance once economic uncertainty eases.

Lenders stress caution, flexibility

The trucking industry continues to grapple with lingering effects of a yearslong freight recession triggered by oversaturation and inflated used-truck prices, which began to bottom out earlier this year.

As used-truck demand picks up, lenders must be cautious in their underwriting and also advise caution to prospective borrowers, especially small businesses and owner-operators with credit blemishes, Chris Grivas, president of Chadds Ford, Pa.-based CAG Truck Capital, told EFN.

Lenders can mitigate risks for themselves and borrowers by guiding them in their search for quality used trucks, he said.

“Every day we help guide them to make the right decisions,” Grivas said. “And many times, it’s not what they want to hear. But we want to be trusted advisers. … We’ll say to them: ‘That truck is not best for what you’re trying to do, but you may want to explore something else, a different avenue.’”

CAG Truck Capital also assists borrowers looking for flexible financing solutions, Grivas said.

For example, “We’ve helped clients when they lose a contract,” he said. “So, if they have 18 remaining payments, maybe the next two will only be half the amount or one-third the amount just to help them get through that time period. … Other times, we’ll give them an extension because they had some mechanical catastrophe they weren’t ready for, or a significant engine failure.”

In addition, lenders can strike successful used-truck deals with small businesses by digging deeper to find creditworthiness, Grivas said.

“You may have somebody who made a bad business decision early on, but they’re coming to the table with a significant down payment,” he said. “We listen to the story.”