The number of commercial trucks available for sale dropped in February as prices for new and used trucks also declined.

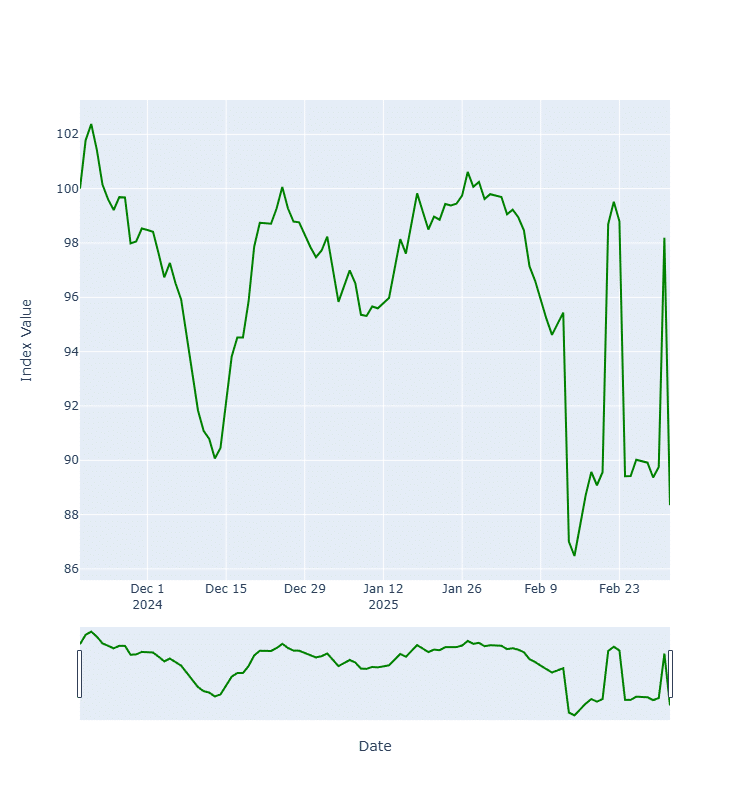

Equipment Finance News’ Index of Commercial Trucks and Trailers Available for Sale and Lease, which is based on data collected by EFN since November 2024, landed at 88.3 today, down 11% month over month. The interactive index is updated daily and is designed to serve as a reference point for truck-supply trends.

Index of Commercial Trucks & Trailers Available for Sale & Lease

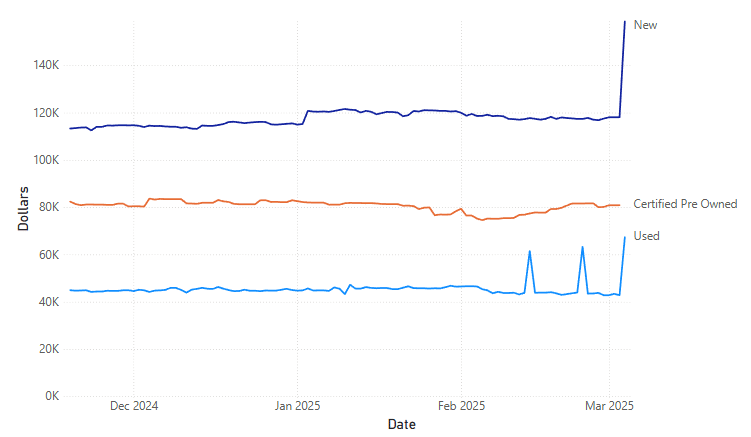

Meanwhile, new and used commercial truck prices declined over the past month while prices for certified pre-owned trucks increased, according to EFN’s new Average Pricing of Commercial Trucks and Trailers by Condition dataset. The interactive data, which also goes back to November 2024, is also updated daily and identifies pricing trends in the trucking industry.

Average Pricing of Commercial Trucks & Trailers by Condition

New commercial truck prices reached $118,088.59 as of March 3, down 1.5% MoM. Meanwhile, used truck prices fell 8.2% MoM to $42,811.66, while certified pre-owned prices rose 0.4% MoM to $80,877.02.

Pandemic-era supply issues have started to normalize, with medium and heavy-duty inventories also normalizing, Chief Executive W.M. “Rusty” Rush said during Rush Enterprise’s Feb. 18 earnings call.

“When we had supply issues in 2022 and 2023, because manufacturers that built both medium and heavy chose to take componentry and put it toward heavy because they make more money on it,” he said. “Once Class 8 slowed down last year, they shoot out the medium duty backlog, so medium duty right now is just like Class 8.”

The truck market also continues to feel the pinch of the freight recession, Richard Shearing, chief operating officer of North America at commercial truck dealer Penske Automotive Group, said during Penske’s Feb. 13 earnings call.

“Typically, when you have a freight recession, the capacity comes out fairly quickly, you have a big reduction in used truck pricing, and then you get to a new state of equilibrium where the capacity and the trucks available meet the loads that are there, and that’s not the case at the moment,” he said. “With the used trucks that were sold at very high prices in the 2021, 2022 time frame, we’re not seeing those carriers come out of the market as fast as they did in the past, and so that’s adding to the length of the freight recession.”

The third annual Equipment Finance Connect at the JW Marriott Nashville on May 14-15, 2025, is the only event for both equipment dealers and finance providers. Learn more and register here.