Autonomous trucking success rests on public acceptance

13% of heavy-duty trucks in U.S. could be autonomous by 2035

The autonomous truck market is gaining traction as federal rules and financing models develop, but public acceptance is the golden ticket to widespread adoption.

Thirteen percent of heavy-duty, over-the-road trucks in the United States are projected to be autonomous by 2035, edging out China’s 11% as the fastest adoption rate globally, according to research and consulting firm McKinsey & Co. The global autonomous truck market is projected to more than quadruple to $1.5 trillion by 2034, according to Global Market Insights.

The proposed America Drives Act, introduced July 23 by California Rep. Vince Fong, signals that a federal framework is starting to take shape for autonomous trucks. The bill has been referred to the House Committee on Transportation and Infrastructure.

To finance autonomous trucks, lenders are exploring:

- Asset-backed loans;

- Usage-based financing; and

- Full-service leasing structures.

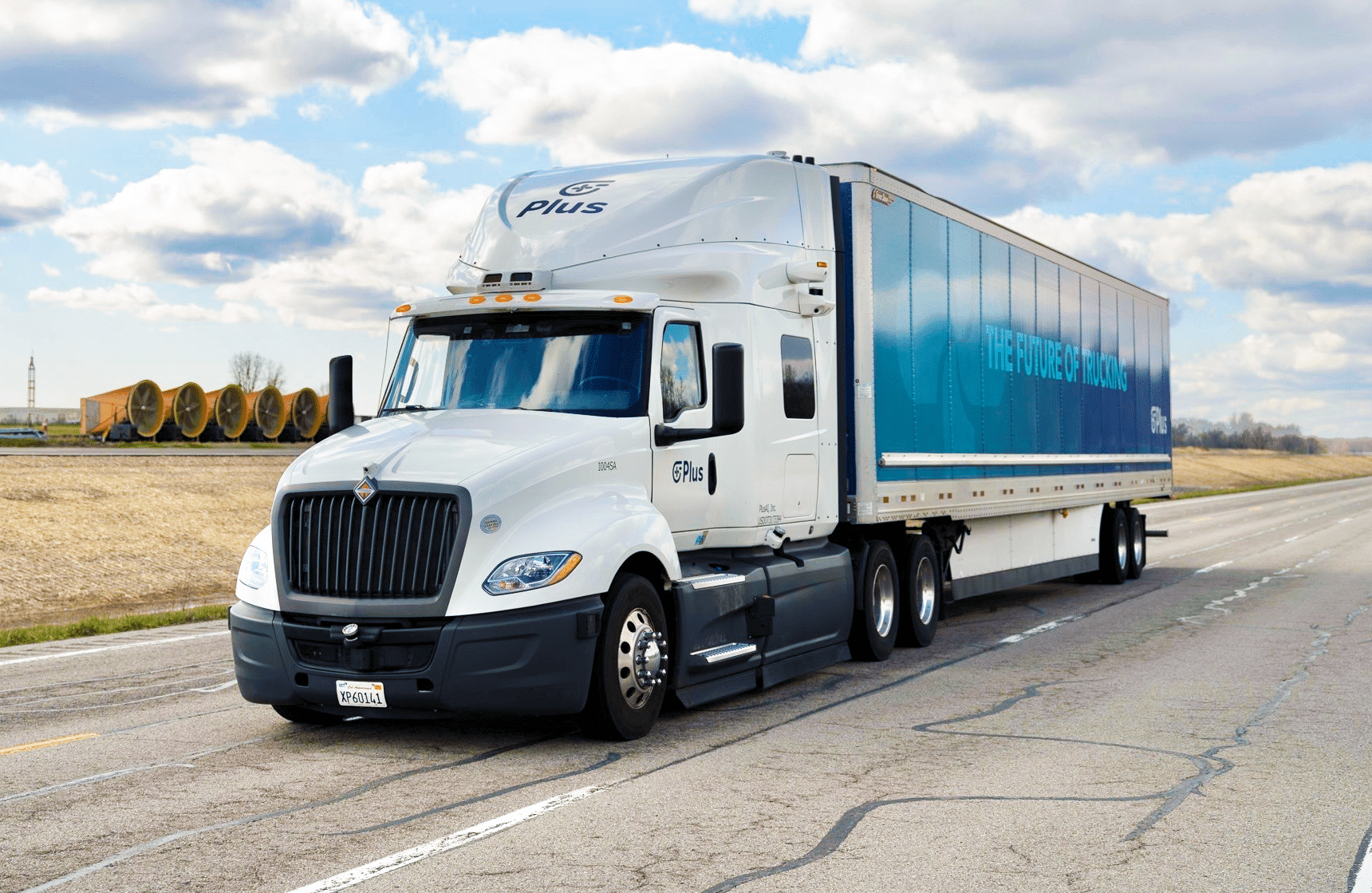

Despite recent momentum, earning the public’s trust is the primary hurdle that must be cleared, Earl Adams Jr., vice president of public policy and regulatory affairs at autonomous trucking technology company PlusAI, told Equipment Finance News.

“Ultimately, the threshold or challenge for the industry is not necessarily regulation. I actually think that it is public acceptance and the public being prepared to look up and see the 80,000-pound bullet driving down the highway without a driver. We need people to feel comfortable with that reality.”

— Earl Adams, VP of public policy and regulatory affairs, PlusAI

OEM partnerships crucial

Strong OEM partnerships are crucial to public acceptance, Adams said, noting that they’re important to “a lot of different stakeholders, not just regulators.”

“We believe that it is the strongest way of ensuring that there is comfort with the technology being on these trucks,” he said.

PlusAI has partnered with truck OEMs including Traton Group, Hyundai and IVECO. Autonomous technology provider Aurora Innovation has also partnered with industry giants Volvo and Paccar, and Torc Robotics is working with OEM Daimler Truck as an independent subsidiary.

These partnerships should also boost confidence among truck lenders and insurance providers, Adams said.

In fact, autonomous trucks’ ability to collect and transmit real-time data could yield lower insurance premiums, especially if it helps validate their safety, Eryn Brasovan, partner at national law firm Womble Bond Dickinson whose specialties include insurance, told EFN.

“The more data that the insurance companies can compile, especially if that data is favorable, the more likely you are to have reduced premiums. Whether it’s cameras inside the trucks or other ways of measuring data, positive results may make a company stand out from the industry as particularly safe or having low rates of accidents.”

— Eryn Brasovan, partner, Womble Bond Dickinson

Lower premiums would be a major win for the autonomous truck market given that truck insurance costs hit a record 10.2 cents per mile in 2024, according to the American Transportation Research Institute.

Regulatory, incentive roadmap

In addition to the America Drives Act, which would preempt state regulations for autonomous trucks while aligning these vehicles with broader industry standards, federal officials are taking other measures to propel the market, Adams said.

“You also have the bipartisan congressional autonomous vehicle caucus, which is actually putting together a proposal of their own,” he said.

U.S. Transportation Secretary Sean Duffy is also calling for an autonomous vehicle framework to strengthen safety standards, unleash innovation, encourage domestic production of AVs and enable commercial deployment, according to an April 24 release by the DOT.

It’s unclear if there will be state or federal incentives for AVs, similar to those for EVs enacted during former President Joe Biden’s term, Adams said. However, there might not be a need for significant incentives partly due to the potential for substantially lower ownership costs compared with conventional trucks, he said.

“There is going to be a reduction in the cost of moving those goods, which will increase margins in an industry where margins are very tight in general,” he said.

To this end, cost per mile (CPM) modeling shows that a “fleet of just 30 autonomous trucks can achieve break-even on specific, high-value freight lanes in just two years,” Xiaodi Hou, chief executive of Houston-based autonomous trucking Bot Auto, said in a July 28 blog post.

“To beat the average $2.25/mile CPM of a human-operated fleet, the number required is closer to 100 autonomous trucks, not thousands,” he said.

Check out our exclusive industry data here.