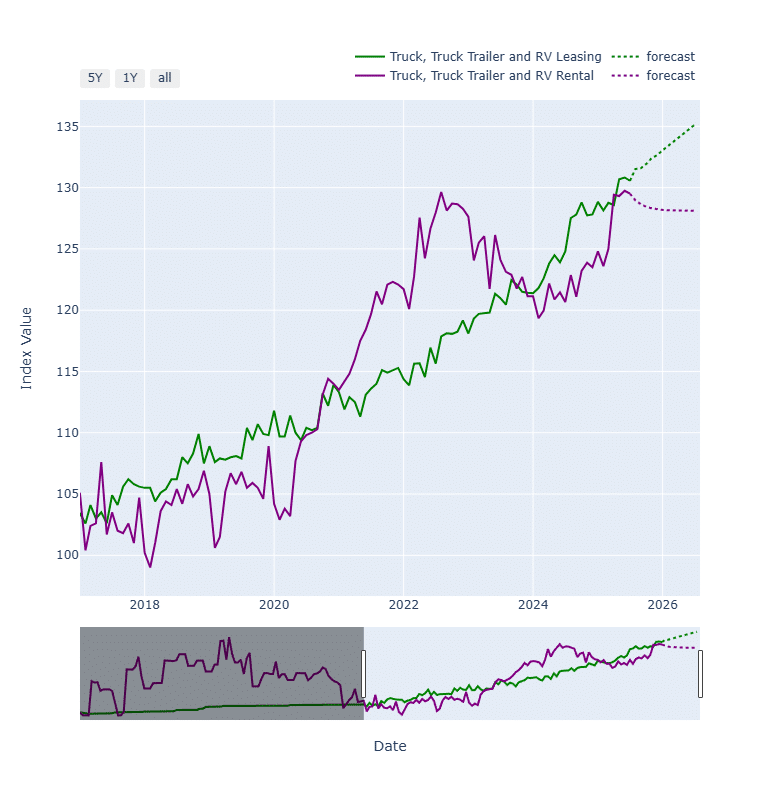

Truck, trailer, RV leasing price forecast rises 3.3%

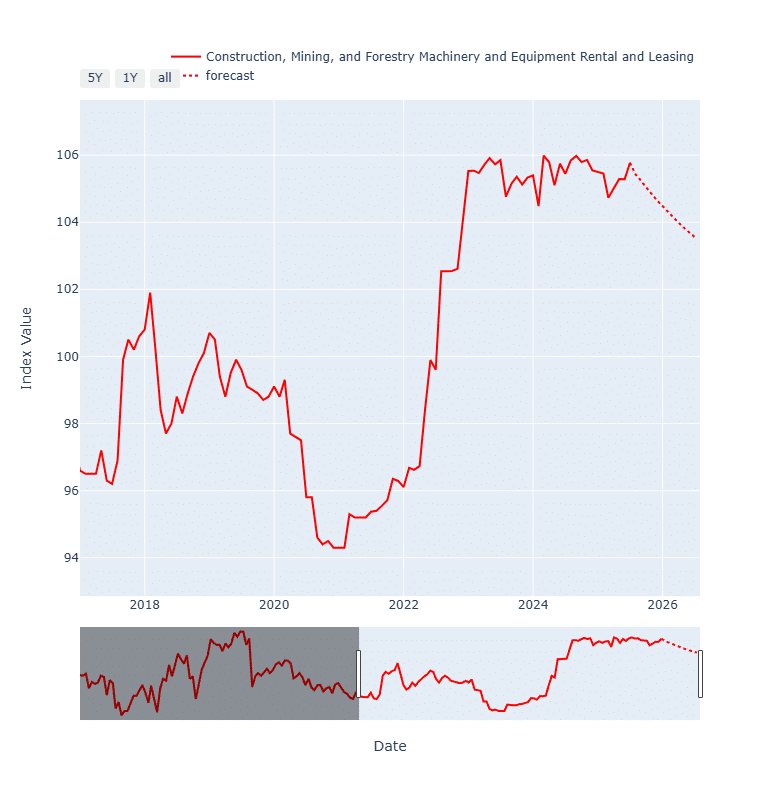

Rental, leasing prices for construction, mining, forestry expected to drop 1.6%

Truck, trailer and RV equipment leasing prices are forecast to increase in the first half of 2026, the result of higher tariffs and potential interest rate cuts by the Federal Reserve.

Leasing prices are expected to rise while rental prices are projected to decline slightly, according to Equipment Finance News’ Equipment Pricing Index and Forecast, based on data from the U.S. Bureau of Labor Statistics and the Chicago Mercantile Exchange. Truck, trailer and RV lease prices are forecast to be at 135.1 by June 2026, up 3.3% year over year, while the forecast rentals is 128.1 by June 2026, down 1.3% YoY.

New truck prices, which rose $10,000 to $15,000 due to advanced safety and emissions technologies, are leading to higher first-year costs and uncertain residual values that require conservative forecasting, Jennifer Sablowski, vice president of equipment finance at Chattanooga, Tenn.-based Transport Enterprise Leasing, previously told EFN.

The possibility of multiple Fed rate cuts through June 2026 — as soon as Sept. 17 — also creates a more favorable leasing environment for higher priced trucks.

Rental houses, on the other hand, face growth limitations, with rates in Sunbelt Rentals’ General Tool business still increasing. But with the revenue mix from megaprojects and larger customers creating headwinds in overall rate growth, Ashtead Group Chief Executive Brendan Horgan said during the company’s Sept. 3 fiscal 2026 first-quarter earnings call. Ashstead Group is Sunbelt’s parent company.

“From a megaproject standpoint … most often there’s an annual allowance for a price increase over the course of a project,” he said. “We don’t have the allowance within those agreements to increase rates as we go year in and year out.”

Construction, mining, forestry price forecast declines

Forecasted rates for rental and leasing of construction, mining and forestry equipment also appear to be dropping. The pricing index forecast landed at 103.6, a dip of 1.6% YoY, through June 2026, implying a weakening in that market following years of price increases due to the pandemic, according to the EFN data.

A price decrease can benefit the equipment industry, as increased prices can mask other industry concerns. For example, manufacturing activity for the region represented by the Federal Reserve Bank of Minneapolis contracted slightly in July, with mixed reports across its coverage area of Minnesota, Montana, North Dakota, South Dakota, the Upper Peninsula of Michigan and parts of Wisconsin, according to the Fed’s Sept. 3 Beige Book.

Higher prices in that region masked weaker equipment production volumes, an OEM there reported in the Beige Book.

“Our actual dollar sales volume is only down slightly from last year, but this is mostly due to the increased prices we are forced to charge,” the producer stated. “The actual volume of equipment made is down quite a bit.”

Check out our exclusive industry data here.