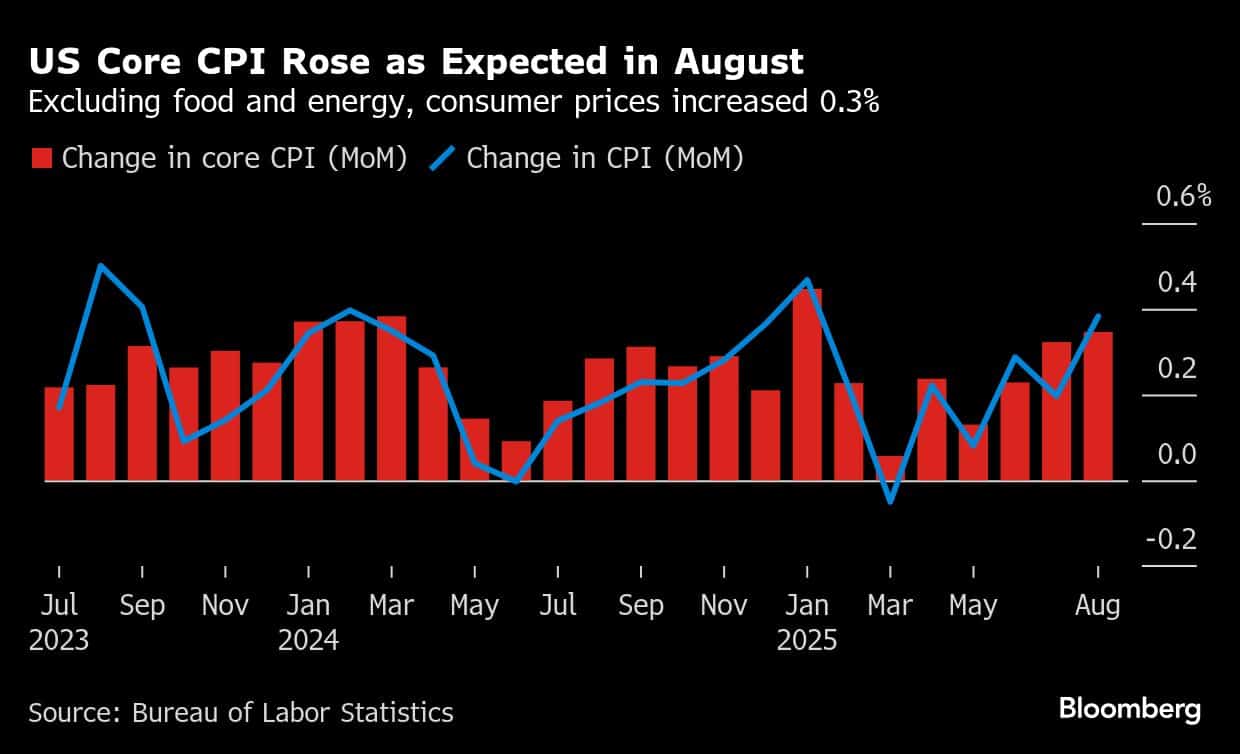

US core CPI rises as expected, keeping Fed on track for rate cut

CPI rose 0.4% in August, largest increase this year

Underlying US inflation rose as expected in August, keeping the Federal Reserve on track to cut interest rates next week.

The core consumer price index, excluding the often volatile food and energy categories, increased 0.3% from July, according to Bureau of Labor Statistics data out Thursday. When incorporating those components, the overall CPI rose 0.4%, the most since the start of the year.

Goods prices, excluding food and energy, accelerated 0.3%, matching the biggest climb since May 2023. That reflected increases in new and used cars, apparel and appliances, which some economists pointed out as possible impacts of tariffs. But analysts were generally divided as to how much of a role the duties played in the report, with others more focused on surges in travel-related services like airfares and hotel stays.

Several household expenses also picked up, including groceries, gasoline, electricity and car repairs.

Taken together, the report suggests inflation continues to linger. President Donald Trump’s global tariffs are impacting prices of some goods, while ongoing increases in services costs may present a more persistent pressure to overall inflation.

Even so, Fed officials are widely expected to cut interest rates for the first time this year at their meeting next week after a series of weak employment data. But firm inflation, if sustained, may complicate the path for additional reductions at subsequent meetings.

“I don’t see anything in this report that’ll stop the Fed from at least initially restarting the process of easing,” said Scott Anderson, chief US economist at BMO Capital Markets. “But I don’t think this inflation story’s over.”

Another release Thursday showed initial applications for US unemployment benefits jumped last week to the highest level in almost four years. Weekly filings can be volatile around holidays, and the week’s figures included Labor Day.

The S&P 500 opened higher and Treasuries rallied. Policymakers will see the latest data on consumer sentiment and retail sales before their Sept. 16-17 meeting. Traders expect the Fed to also cut rates two more times this year after that.

| Metric | Actual | Estimate |

|---|---|---|

| CPI MoM | +0.4% | +0.3% |

| Core CPI MoM | +0.3% | +0.3% |

| CPI YoY | +2.9% | +2.9% |

| Core CPI YoY | +3.1% | +3.1% |

One of the key drivers of inflation in recent years has been housing costs — the largest category within services. Shelter prices picked up 0.4%, the most since the start of the year and reflecting advances in both rents and the largest jump in hotel stays since November.

Another services gauge closely tracked by the Fed, which strips out housing and energy costs, stepped down somewhat, helped by declines in medical care, recreation and car rentals. While central bankers have stressed the importance of looking at such a metric when assessing the overall inflation trajectory, they compute it based on a separate index.

That measure — known as the personal consumption expenditures price index — doesn’t put as much weight on shelter as the CPI. The PCE draws from the CPI as well as another release on producer prices, which showed categories that feed into the PCE were mixed.

What Bloomberg Economics Says…

“The CPI suggests the Fed’s concerns about a weakening economy may be overdone, as inflation in airfares and hotels doesn’t typically accelerate in a floundering economy. We see inflation prints marching higher in coming months — especially if the Fed proceeds with a series of rate cuts.”

— Anna Wong and Chris G. Collins. To read the full note, click here

The watchdog for the Labor Department, which oversees the BLS, said Wednesday it was initiating a review of the agency’s challenges in collecting and reporting key economic data. In recent months, BLS has had to suspend CPI data collection in several US metro areas and increasingly rely on a technique to fill in the gaps. The review will also examine BLS’s revisions to jobs data, which have garnered more widespread criticism, particularly from the White House.

Central bankers also pay close attention to wage growth because it can help inform expectations for consumer spending — the main engine of the economy. A separate report Thursday that combines the inflation figures with recent wage data showed that real average hourly earnings climbed 0.7% from the year before, the weakest in over a year.