The equipment finance sector was stuck in neutral last month as many businesses waited for the Federal Reserve’s decision on interest rates.

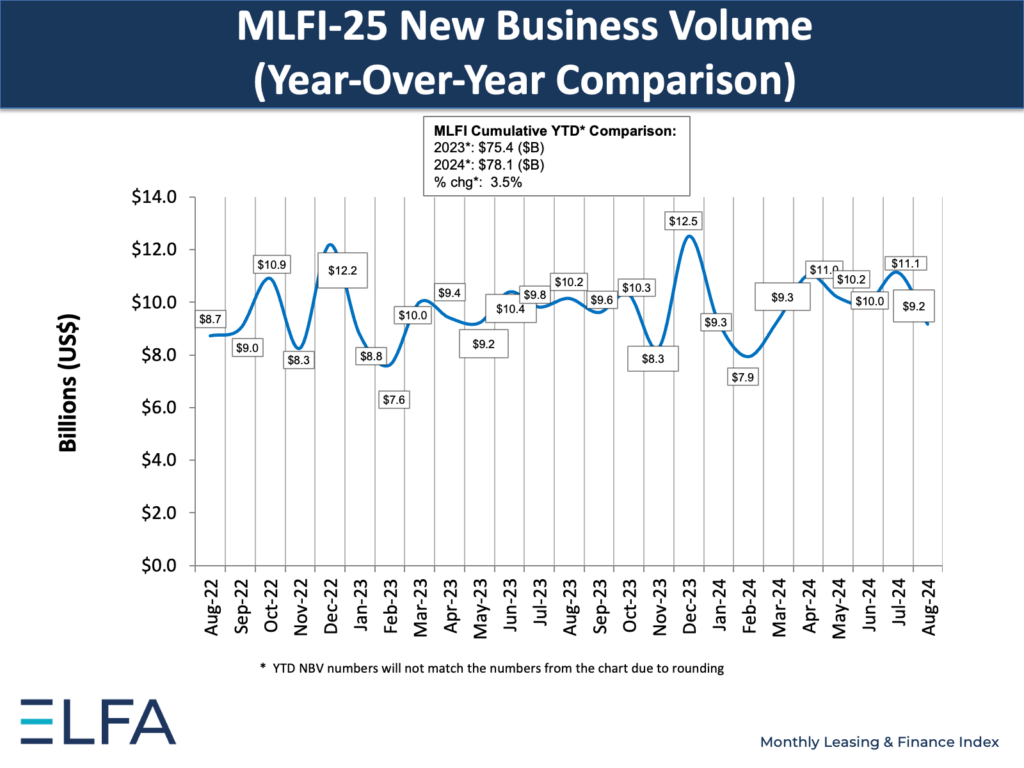

New business volume in the industry totaled $9.2 billion in August, down 10% year over year and 17% month over month, according to a monthly report from the Equipment Leasing and Finance Association, released today. That followed increases of 13% YoY and 11% MoM in July.

The credit approval rating in August was 76%, unchanged from the previous month. Receivables over 30 days stood at 2.2%, down 10 basis points YoY and 30 basis points MoM. Total headcount for equipment finance firms rose 1.2% YoY, according to the report.

The Fed’s decision last week to reduce its target federal funds rate by 50 basis points leaves the industry poised for an increase in heavy-equipment demand, ELFA President and Chief Executive Leigh Lytle stated in the report. However, a second rate cut later this year would especially move the needle as some businesses are still delaying their purchases, Luke Smith, a regional sales manager at Wells Fargo Equipment Finance, told Equipment Finance News.

“Even though the 50 basis points is good from a borrower standpoint, a lot of people are still waiting,” Smith said. “So, it hasn’t spurred a lot of immediate action because the anticipation of future rate cuts within the next few months could be an additional 25-50 basis points.”

Ag sector reeling

Of all the industries tied to heavy equipment, the agriculture sector may be struggling the most, evidenced by persisting inventory gains and record-high spreads between auction and asking values. Thus, lower rates could have little to no impact on the agriculture equipment finance sector, Jay Darden, regional sales manager at Mount Joy, Pa.-based Farm Credit Express, told EFN.

“A half point [reduction] is a positive thing, but it really pales in comparison to just the sheer overabundance of commodities, low commodity prices and, now, natural disasters,” he said.

Darden likewise said many businesses are waiting to see the results of the presidential election and whether rates will continue to drop before buying new equipment.

“Unless I had a piece of equipment that just went out of service or was technologically obsolete, I’m hanging on,” he said. “I would want to see what this harvest looks like, what this election looks like and what happens with these interest rates.”