Fifth Third to buy Comerica in the year’s biggest US bank deal

Deal creates ninth-largest US bank with about $288B in assets

Fifth Third Bancorp agreed to buy Comerica Inc. for about $10.9 billion in stock, the largest US bank deal this year and a sign that the logjam blocking big mergers in the industry may have broken under the Trump administration’s deregulation efforts.

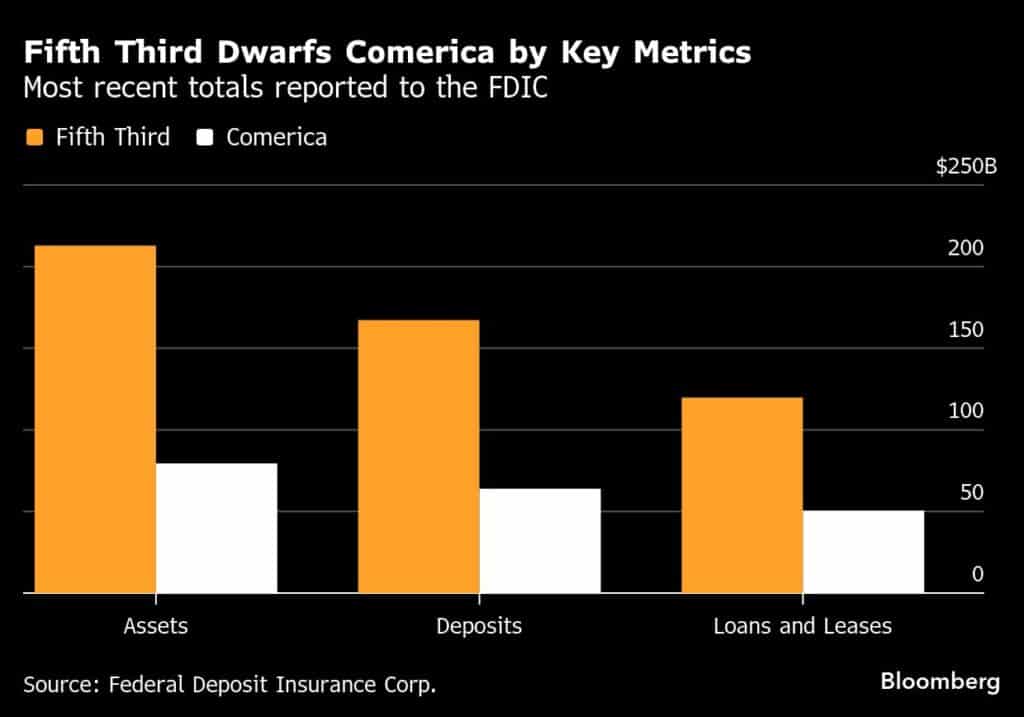

The deal will create the ninth-largest bank in the country, with about $288 billion in assets, the two companies said in a statement Monday. The per-share transaction value represents a 17% premium to Comerica’s closing share price Friday.

Regional lenders across the US are looking to take advantage of the new environment under President Donald Trump, who’s ushered in an era of financial deregulation that’s led many investment bankers to predict his administration will go easier on merger approvals. Smaller US banks are pursuing scale to cope with the heavy costs of technology upgrades and regulatory compliance.

Fifth Third, based in Cincinnati, has long been known for its reach across the Midwest, but it’s spent years trying to expand in the Southeast, where the deal with Dallas-based Comerica could help. Explosive growth in the region’s major metropolitan areas — including Atlanta, Nashville, Houston, Dallas and Charlotte, North Carolina — has expanded the Southeast’s population at an annual compound rate of roughly 1% since 2010, easily the fastest growth of any region in the country.

The deal was attractive for Fifth Third because of Comerica’s focus on commercial banking for middle-market companies, with the buyer seeking more businesses in the category to make it a larger contributor of revenue, Fifth Third Chief Executive Officer Tim Spence said in an interview. Comerica, meanwhile, didn’t have a large retail deposit base, which adds flexibility to funding sources at a time when interest-rate moves are becoming more volatile, he said.

“We’re going to be able to leverage Fifth Third’s retail discipline and proven de novo strategy to build out a leading position in the Texas market, where Comerica has a foothold, and be able to leverage Comerica’s incredible expertise and credit culture in the middle-market across the broader Fifth Third platform,” Spence said.

Comerica has been under pressure to sell to a large bank from an activist investor group. The company has been cutting expenses to improve earnings.

Among this year’s other large deals, PNC Financial Services Group Inc. announced it would take over FirstBank Holding Co. for about $4.1 billion, giving it $26.8 billion in assets and branches in Colorado and Arizona. Pinnacle Financial Partners Inc. agreed to combine with Synovus Financial Corp. in an all-stock transaction valued at $8.6 billion.

Comerica’s stockholders will receive 1.8663 Fifth Third shares for each Comerica share they hold, or about $82.88 per share based on the Oct. 3 closing price. When the deal is completed, Fifth Third shareholders will own roughly 73% of the combined company.

Shares of Fifth Third fell 4.3% at 7:40 a.m. in early New York trading, while Comerica climbed 11%.

Goldman Sachs Group Inc. was financial adviser to Fifth Third and Sullivan & Cromwell was legal adviser. JPMorgan Chase & Co. advised Comerica and Wachtell, Lipton, Rosen & Katz was legal adviser. Keefe, Bruyette & Woods also served as financial adviser to Comerica.

— By Yizhu Wang and Steve Dickson (Bloomberg)