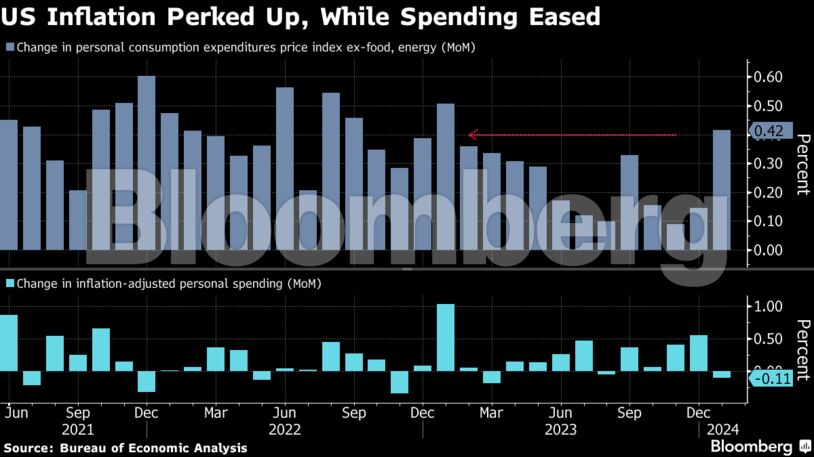

The Federal Reserve’s preferred gauge of underlying inflation rose in January at the fastest pace in nearly a year, helping explain policymakers’ patient approach to start cutting interest rates.

The so-called core personal consumption expenditures price index, which strips out the volatile food and energy components, increased 0.4% from December, data out Thursday showed. From a year ago, it advanced 2.8%. Economists consider this to be a better gauge of underlying inflation than the overall index.

Inflation-adjusted consumer spending dropped for the first time in five months after a robust holiday shopping season, according to the report from the Bureau of Economic Analysis. Real disposable income, the main supporter of spending, was little changed.

Fed officials have repeatedly said they have yet to reach a level of confidence that inflation is sustainably cooling, and Thursday’s report likely reinforces that view in the near term. Policymakers insist it’s too soon to start cutting interest rates, and they’ll continue to monitor incoming data to guide policy.

The core PCE data, on a six-month annualized basis, registered at 2.5% in January, rebounding above the Fed’s 2% target after briefly trailing it in the prior two months.

| Metric | Actual | Estimate |

|---|---|---|

| Real consumer spending (MoM) | -0.1% | -0.1% |

| PCE price index (MoM) | +0.3% | +0.3% |

| Core PCE price index (MoM) | +0.4% | +0.4% |

| PCE price index (YoY) | +2.4% | +2.4% |

| Core PCE price index (YoY) | +2.8% | +2.8% |

Policymakers pay close attention to services inflation excluding housing and energy, which tends to be more sticky. That metric increased 0.6% from a month ago, the most since March 2022. Costs for portfolio management — which climbed by the most in three years — and accommodation led the advance.

This is the last PCE report Fed officials will have access to before they meet March 19-20. Chair Jerome Powell and his colleagues have effectively ruled out a rate cut at that gathering, and investors are now leaning toward June as the most likely start time.

Stock futures climbed, Treasuries pared losses while the dollar weakened following the data.

While a still-robust labor market has so far supported consumer spending, the combination of high borrowing costs, fewer job postings and persistent inflation is taking a toll on spending.

Thursday’s report showed real spending in January was restrained by the biggest decline in outlays for goods in over a year. That was led by the largest drop in purchases of motor vehicles since mid-2021.

Services spending continued to climb, reflecting a steep increase in housing and utilities, as well as financial services and health care. Outlays for recreation fell, while purchases at restaurants and hotels rose only somewhat.

What Bloomberg Economics Says…

“We think a lot of one-off factors are at work – residual seasonality and portfolio management affecting the inflation data, cost-of-living adjustments driving income gains, and weather effects driving weak spending.”

— Anna Wong and Estelle Ou.

Separate data out Wednesday showed consumer spending was revised higher at the end of 2023, providing strong momentum into the new year. Fourth-quarter PCE inflation was also marked up slightly in that report.

Wages and salaries advanced 0.4%. Without adjusting for prices, incomes climbed by the most in a year, reflecting an increase in Social Security payments given the January cost-of-living-adjustment. The saving rate edged up.

Separate data out Thursday showed applications for unemployment benefits climbed by the most in a month, while continuing claims rose to the highest level since November.

— By Augusta Saraiva (Bloomberg)