Equipment loan delinquencies fall to 17-month low

Originations rose 4.2% YoY in November

Momentum continues to build in the equipment finance industry as originations increased in November while delinquencies fell.

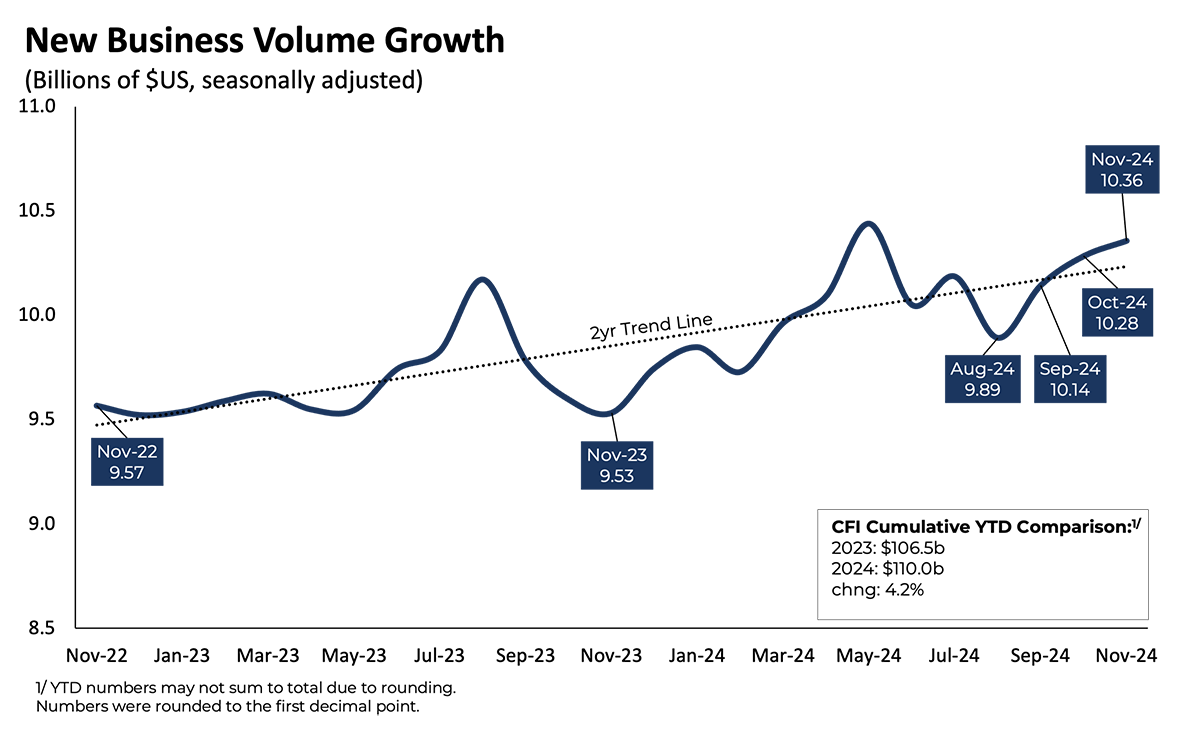

New business volume rose 0.7% in November to nearly $10.4 billion, marking a third straight month of equipment finance growth, according to the Equipment Leasing and Finance Association’s (ELFA) CapEx Index for November, released Dec. 23. New business volume totaled $110 billion for the year through November, up 4.2% year over year.

Delinquencies of 30 days or more dropped 30 basis points (bps) to 1.9%, their lowest since June 2023. Stronger balance sheets signal that the industry is poised for continued growth, even if Federal Reserve interest rate cuts slow in 2025, ELFA President and Chief Executive Leigh Lytle stated in the report.

“While challenges like a potential trade war could pose headwinds, easing regulations could spur equipment demand,” she said. “Looking ahead, I foresee technological innovations by both lenders and end-users driving productivity and transforming the sector over the coming decade.”

While charge-offs rose 30 basis points to 0.6% in November after falling to a nearly two-year low in October, the drop in delinquencies could indicate a one-time occurrence rather than broader financial stress, according to the report. Credit approvals decreased one percentage point to 74% and hovered around 75% for most of 2024.

Construction segment bounces back

Construction spending is projected to rise 3.8% in 2025 to more than $2.1 trillion, according to the Associated Builders and Contractors trade group.

The equipment finance sector should continue to benefit from “expected investments in infrastructure” and “pent-up demand” after recent interest rate cuts, Verdant Commercial Capital Chief Financial Officer Robert Moskovitz stated in the release.

An uptick in construction permitting following November’s presidential election is another positive trend for the construction equipment industry, Rob Jackson, sales and rental director at Raleigh, N.C.-based Gregory Poole Equipment, told Equipment Finance News.

“There was a lot of uncertainty and hesitancy, but the combination of permits letting loose, rates showing some signs of decline and some steadiness around the election has definitely helped,” he said.

Building permits increased 6.1% in November to more than 1.5 million, according to the U.S. Census Bureau.

The third annual Equipment Finance Connect at the JW Marriott Nashville in Nashville, Tenn., on May 14-15, 2025, is the only event that brings together equipment dealers and lenders to share insights, attend discussions on crucial industry topics and network with peers. Learn more about the event and register here.