Equipment lender confidence steady amid interest-rate optimism

38% of lenders expect improved economic conditions within 6 months

Equipment lender sentiment is holding steady as financiers look to capitalize on lower interest rates, pent-up demand and new tax breaks.

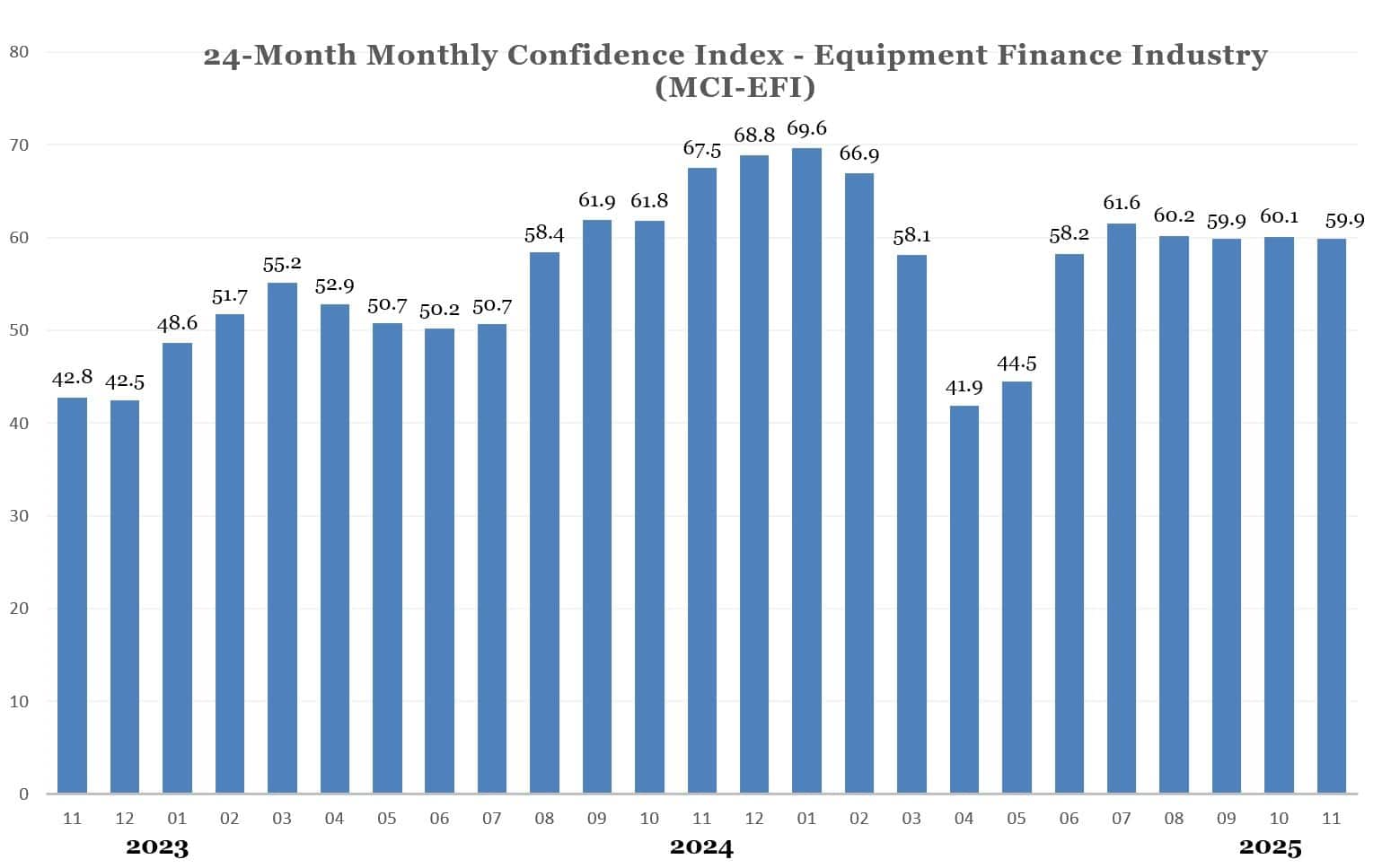

The Equipment Leasing and Finance Foundation’s Monthly Confidence Index, released Nov. 20, ticked down to 59.9 in November from 60.1 in October, but the index has remained mostly flat since June.

While lender confidence doesn’t reflect a potential yearend surge driven by restored full bonus depreciation, the index signals market stability despite tariff uncertainty and financial stress in some equipment sectors.

Interest rate impact

Lenders are already reaping the benefits of recent Federal Reserve interest rate cuts, Freddy Jalilvand, program manager at Atlanta-based Ameris Bank Equipment Finance, told Equipment Finance News.

“The Fed lowering rates and defaults tapering off are huge. It’s boosting confidence across the board — equipment buyers and funding sources both — so that’s fueling the growth right now.”

— Freddy Jalilvand, program manager, Ameris Bank Equipment Finance

With originations picking up while portfolio performance improves for some lenders, “banks have more deposits with rates down, and that’s all freeing up capital,” Jalilvand said.

For dealers, continued interest-rate reductions would significantly boost consumer sentiment, Ernie DeWinne, president of San Antonio-based DeWinne Equipment, told EFN.

“If we can get a consistent drop and get those rates down, there’ll be a lot more purchases at that point because [customers] are looking at monthly payments,” he said.

Lower rates, pent-up demand and depreciation advantages are all driving “renewed momentum,” Jim DeFrank, executive vice president and chief operating officer at Isuzu Finance of America, stated in the ELFF report.

Preparing for market swings

Meanwhile, 25% of roughly 30 equipment financiers expect business conditions to improve over the next four months, down from 37.5% in October, according to ELFF. Nearly 21% anticipate increased loan and lease demand over that stretch, down from 37.5% in October.

However, the number of lenders expecting greater access to capital over the next four months rose to 29.2% from 25%. Nearly 38% anticipate improved economic conditions over the next six months, up from 30.4%.

Regardless of what happens in the coming months, the equipment finance industry “is well positioned for a downturn or an economic boom,” Jeffry Elliott, chief executive of Elevex Capital, stated in the release.

“The sector, by nature, finances equipment that is new during boom times and used during downturns, so we have a game plan in either situation,” he said. “Equipment finance industry participants that have strong asset management capabilities will perform better in the downturns versus others that do not invest in that capability and talent.”

Register here for the free Equipment Finance News webinar “Tech-driven risk management: How innovation is reshaping equipment finance” set for Tuesday, Dec. 9, at 11 a.m. ET.