Concerns over delinquencies and credit quality curtailed equipment lenders’ confidence this month, but optimism persists amid lower interest rates and gradual economic improvements.

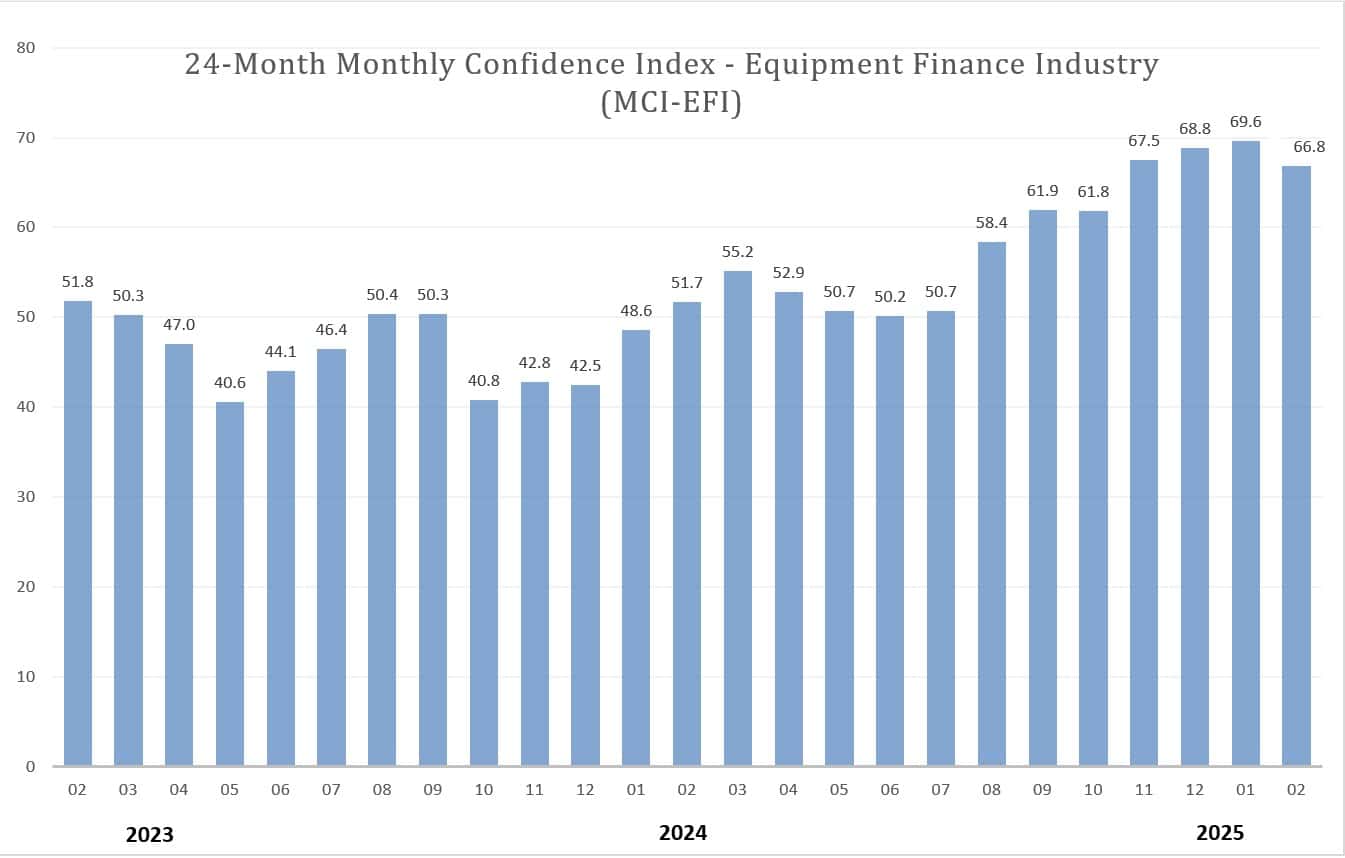

The Equipment Leasing and Finance Foundation’s (ELFF) monthly confidence index fell to 66.8 in February, down from January’s 30-month high of 69.6, according to a Feb. 21 report. February marked the first decline since October and the second since June.

Equipment lenders are detecting relatively strong confidence among businesses, and inflation, while still higher than desired, is “a marked improvement from the recent past,” Wintrust Specialty Finance President and Chief Executive David Normandin stated in the report.

“With that said, delinquency and credit quality remain a challenge with bankruptcy rates continuing to rise and stress in consumer auto and credit card debt,” he said. “2025 may not be an easy year, but there will be opportunities to leverage if you are nimble and creative in solving challenges.”

Of roughly 30 equipment financiers representing banks, independents and captives, 53.6% expect business conditions to improve over the next four months, down from 57.1% in January, according to the ELFF report.

Just more than 46% of respondents believe demand for loans and leases will increase over the next four months, down from 47.6%. The number of lenders expecting greater access to capital in that time dropped to 25% in February from 28.6%.

Despite some concerns over President Donald Trump’s tariff proposals, the “business climate should be stronger” under the new administration, with expectations of loosened regulations and lower borrowing costs, Jay Darden, regional sales manager for the East Coast at McLean, Va.-based Farm Credit Express, told Equipment Finance News. Lower rates could also spur an uptick in refinancing deals, he said.

Working through pricing discrepancies

While the used-equipment market seems to be stabilizing, large pricing gaps between new, late-model and old equipment can pose challenges to lenders when trying to determine the value of an asset, Darden said.

To work through this challenge, lenders should lean “heavily” on credible dealers for accurate appraisals, he said.

“We do periodically bounce things off of [online marketplaces] TractorHouse or Tractor Zoom to make sure that things aren’t way out of whack,” he said. “But for the most part, we lean heavy on the reputable dealer and the reputable farm.”

The third annual Equipment Finance Connect at the JW Marriott Nashville on May 14-15, 2025, is the only event for both equipment dealers and finance providers. Learn more and register here.