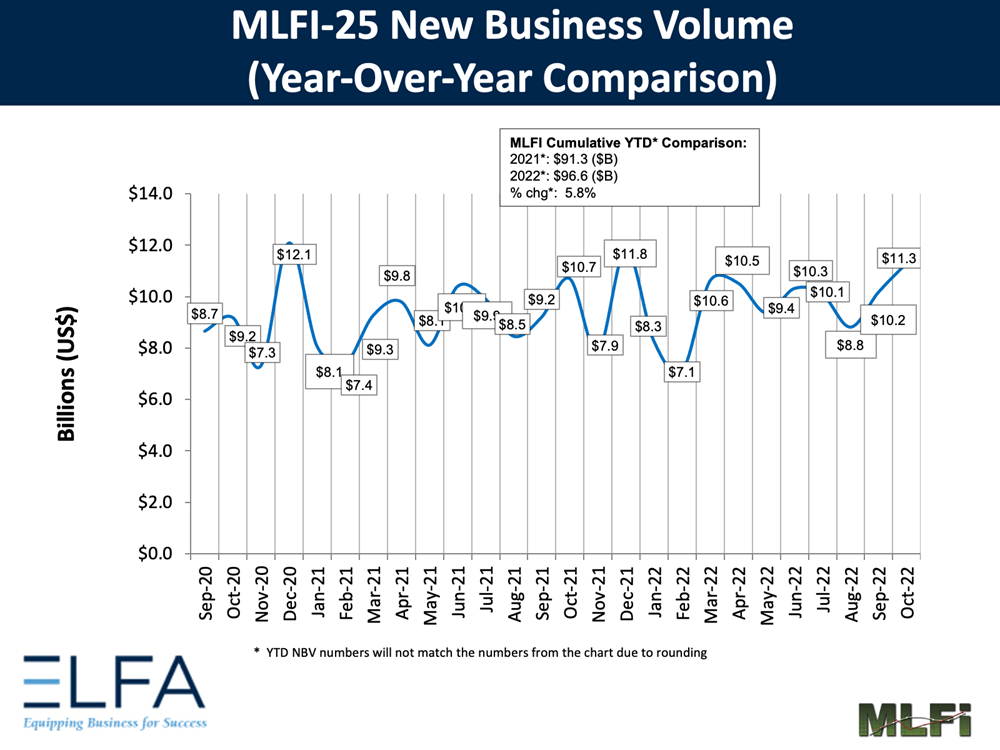

Overall new business volume in the equipment finance sector in October jumped 6% year over year and 11% month over month to $11.3 billion despite rising interest rates and the expectation of a forthcoming recession.

Year to date, cumulative new business volume in October was up nearly 6% compared with 2021, according to the Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Financing Index released Tuesday.

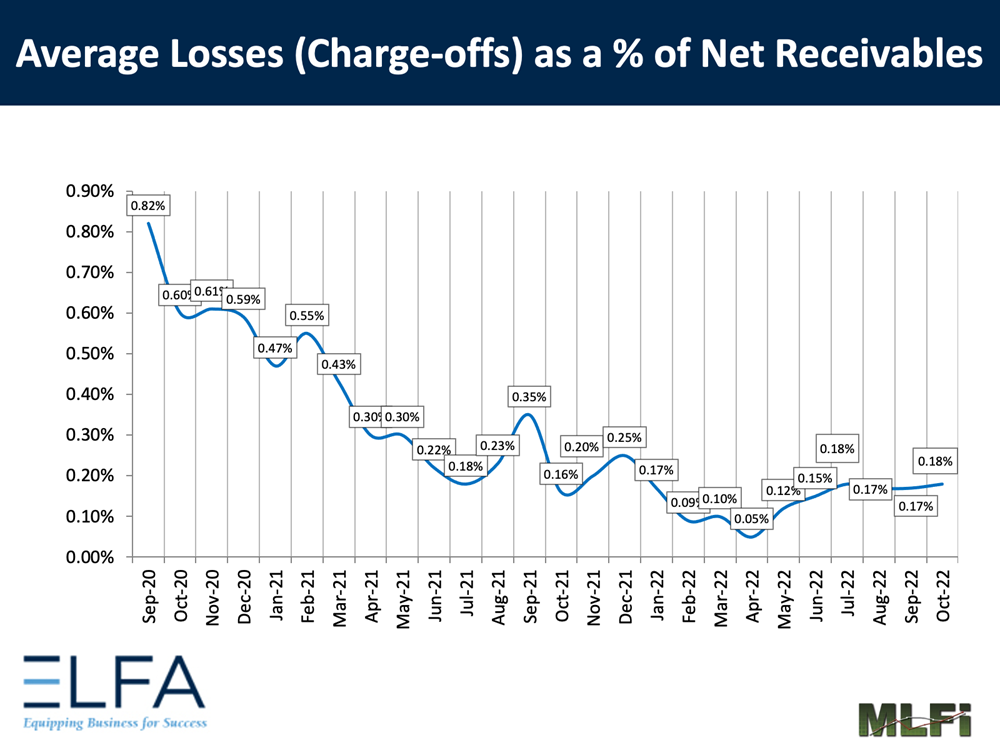

Meanwhile, receivables over 30 days in October clocked in at 1.7%, up from 1.5% in September but flat YoY. Net charge-offs inched up 1 basis point (bps) from September and 2 bps YoY to 0.18%.

Credit approvals as a percentage of all decisions submitted in October also inched down to 77% from 77.3% in September, according to ELFA.

Total headcount at equipment finance companies dropped 4.7% YoY.

“We see the economic tightening as an opportunity for carriers to get back on track with normal equipment replacement cycles that have been postponed and explore new verticals,” James Currier, USA chief revenue officer at lending platform Finloc, said in a statement. “Business reorganizations will require lenders to adapt to changing practices and operations. It will not be business as usual for the foreseeable future.”