Equipment finance industry confidence rises in June

67% of survey respondents expect economy to stay the same

Equipment finance industry confidence improved on an annual basis in June as stress persists despite increased optimism.

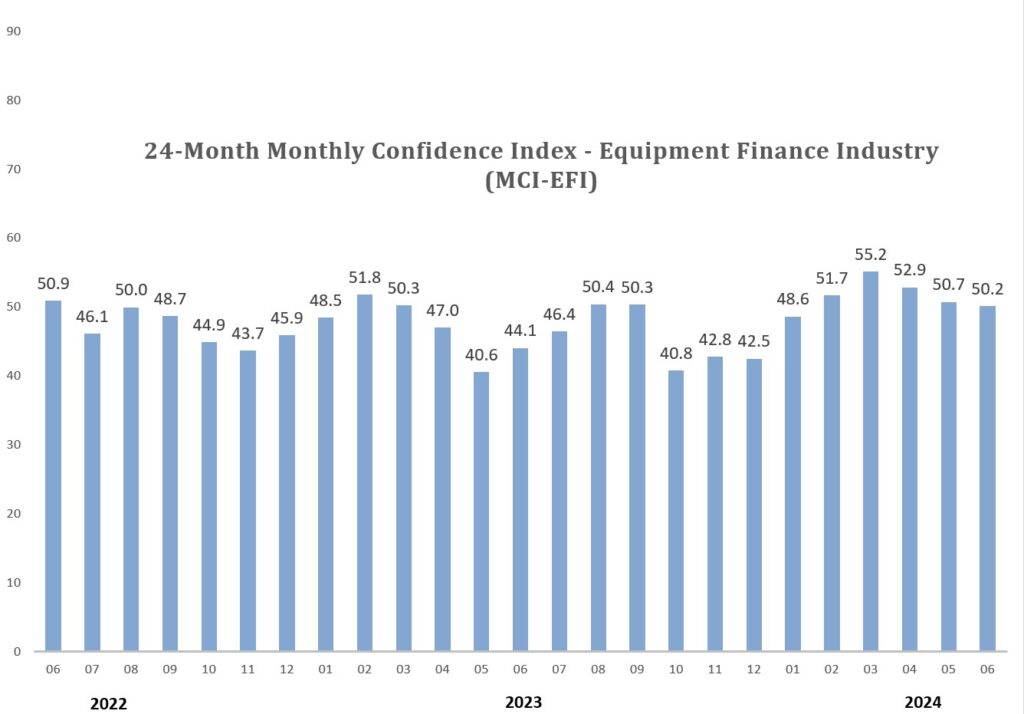

Equipment finance industry confidence landed at 50.2 in June, down from 50.7 in May but up compared with 44.1 in June 2023, according to the Monthly Confidence Index published by the Equipment Leasing and Finance Foundation (ELFF). The June reading marks the second-lowest confidence index value this year — but is still higher than the confidence values in all but four months of 2023.

ELFF is the foundational arm of the Equipment Leasing and Finance Association (ELFA).

Some 3.9% of equipment finance leaders rated the economy as excellent last month, up from zero respondents in May. Meanwhile, 76.9% of respondents viewed the economy as fair, down 8.3 percentage points month over month. The remaining 19.2% of respondents viewed the economy as poor, up 4.4 percentage points compared with May.

The current macroeconomic conditions continue to create difficulties in lending, David Normandin, president and chief executive officer of Wintrust Specialty Finance, said in the ELFF’s release today.

“The stress the industry is experiencing in small business lending continues with elevated bankruptcy, delinquency and a softening of credit quality,” he said. “Our industry is well positioned to help continue the success of these businesses, as well as help those struggling through a rough time in the economy.”

The scale and diversity of products in the equipment finance industry provides lenders with opportunities, even in less favorable economic conditions, Brian Scott, managing director of Alerus Financial Corp.’s equipment finance team, told Equipment Finance News.

“There’s so many industries embedded in [equipment finance], so when trucking would have its downturn, manufacturing was kind of going up,” he said. “There’s never a lack of opportunity.”

Equipment finance economic outlook

Fewer equipment finance executives maintained a neutral economic outlook in June, with 48.2% expecting the United States economy to stay the same for the next six months, dropping 14.8 percentage points MoM. In contrast, 14.8% expect U.S. economic conditions to get better, up double compared with 7.4% in May, and 37% expect economic conditions to worsen, up 7.4 percentage points MoM.

The Federal Reserve projects one interest rate cut in 2024, but that can be an opportunity for equipment finance, Scott said.

“From the rate perspective, that affects all the industries, not just commercial equipment finance,” he said. “What happened last March with the liquidity crisis within the regional banks, equipment finance became even more important because if you’re looking to grow your C&I business, there’s not a better tip of the spear than equipment finance.”

The current economic conditions provide the opportunity for growth and acquisition, as well as closures and consolidation, so well-managed businesses have reason for optimism, Normandin said.

“It is important to remember during these times that well-positioned businesses actually grow, take share of wallet, and expand,” he said. “I am optimistic that in a couple of years we will look back and recognize the positive impact we were able to have on the economy and the small business community.”