Equipment finance credit approvals highest since 2021

New business volume rose 2.8% in August to $10B

Equipment finance originations and credit approvals are on the upswing, signaling that the industry is poised to finish the year strong amid lower interest rates and new tax breaks.

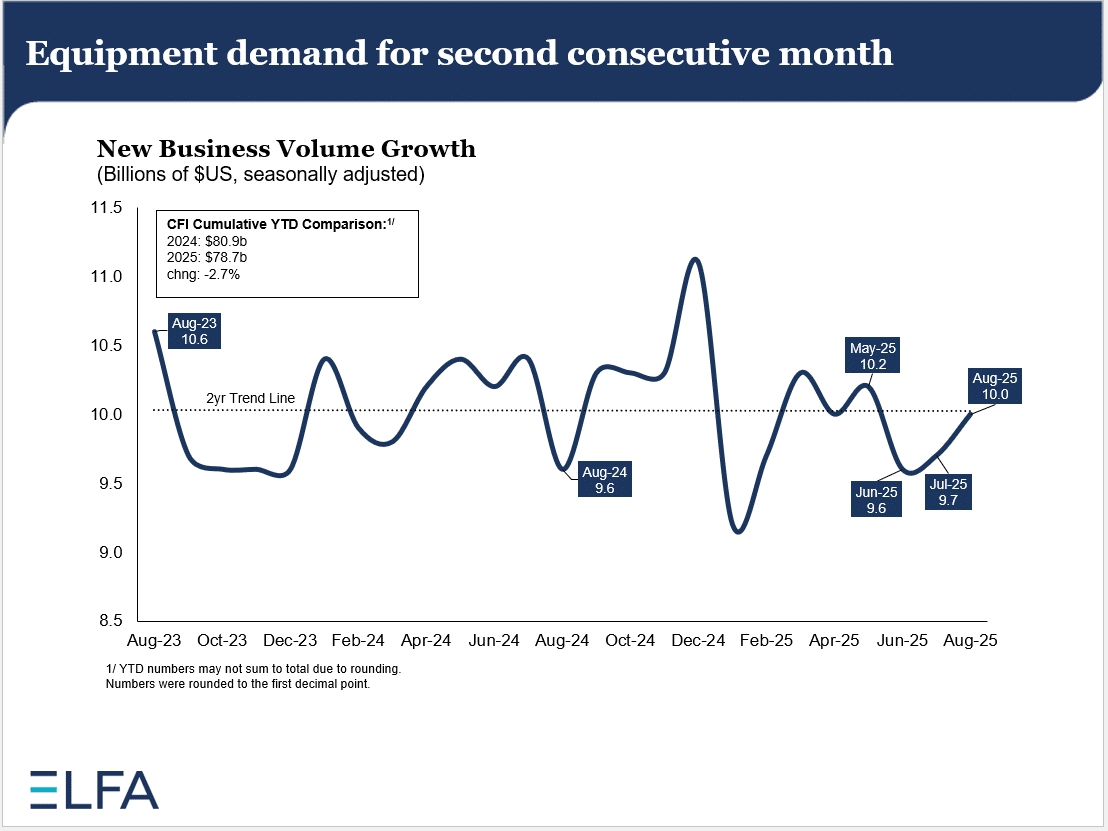

New business volume in equipment finance rose 2.8% month over month in August to $10 billion, following a 1.7% increase in July, according to the Equipment Leasing and Finance Association’s (ELFA) Capex Finance Index, released Sept. 24. New business volume totaled $80.9 billion through the first eight months of 2025, down 2.7% year over year.

Bank originations drove the August increase, up 5.6% MoM, while volume at captives and independents fell 3.6% and 4.8%, respectively. The average credit approval rate rose 50 basis points (bps) in August to 78.7%, its highest level since December 2021.

Overall delinquencies and charge-offs ticked up 10 bps to 2.1% and 0.6%, respectively, but consecutive increases in originations show that the “equipment finance sector is holding up well despite some choppiness,” ELFA President and Chief Executive Leigh Lytle stated in the report.

“I am not concerned about the modest rise in losses,” she said. “We have seen similar spikes followed by quick reversals. With lower interest rates now a reality, we should see an easier financial environment, which should help fuel growth in equipment and software demand over the next 12 to 18 months.”

Will lower rates be enough?

Dealers and lenders are hopeful that restored full bonus depreciation and the Federal Reserve’s Sept. 17 decision to lower its benchmark interest rate 25 bps will culminate in a strong fourth quarter despite ongoing tariff uncertainty.

Still, it’s unclear whether lower interest rates will be enough to offset higher new equipment prices, Marc Johnson, principal for equipment dealers at consulting firm Pinion Global, said during a Sept. 10 webinar in anticipation of the Fed’s rate cut.

“When we look at tariffs, 42% of manufacturers’ CFOs say that they’re going to eat the cost,” he said. But when OEMs make this assertion, it traditionally “means they’re going to put the cost into the price of the equipment.”

In the meantime, lenders must continue to seek the right balance between capitalizing on growth opportunities and managing risk, John Crum, head of Wells Fargo Specialty Equipment Finance and Leasing with a focus on transportation, told Equipment Finance News.

“In volatile economic times, and really in all economic times, it’s important not to get outside of your strike zone,” he said.

“If you get too focused on growth for growth’s sake and are not practicing the fundamentals of risk management, that’s when companies can tend to get in trouble. … Know what you can execute.”

— John Crum, Wells Fargo Specialty Equipment Finance and Leasing

No matter the economic conditions, “quality companies out there in the market attract quality capital,” Crum said.

“There’s still plenty of quality capital available out there to customers who are interested in acquiring it,” he said.

Check out our exclusive industry data here.