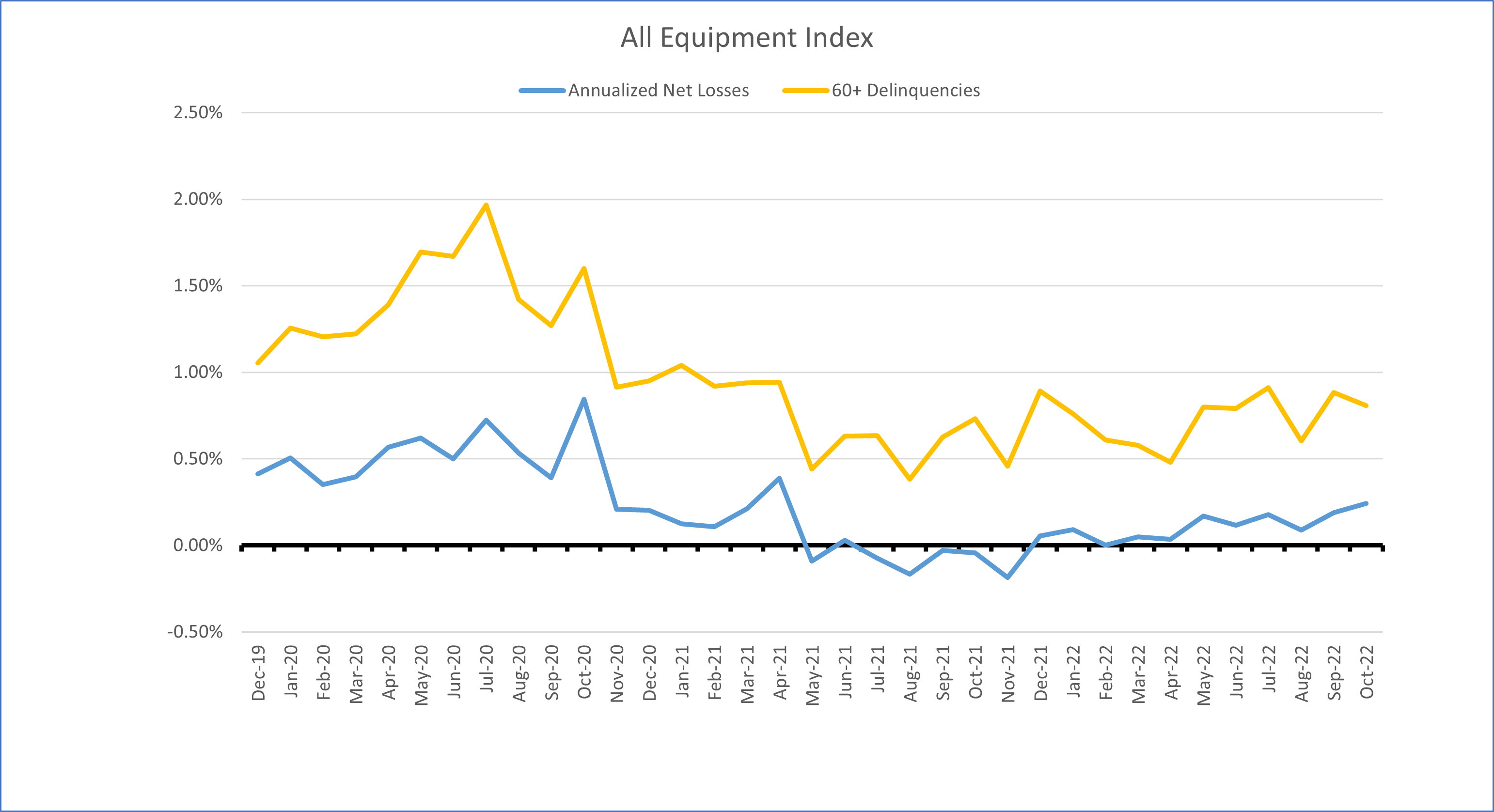

Credit performance in the equipment asset-backed securities (ABS) market was mixed in October as annualized net losses ticked up and 60-plus-days delinquencies dropped across all publicly rated equipment ABS deals.

Annualized net losses in Kroll Bond Rating Agency’s Equipment Loan & Lease Index for October rose 5 basis points (bps) month over month and 29 bps year over year to 0.24%. While the annualized net losses increased, the number of borrowers more than 60 days delinquent declined by 13 bps MoM and 21 bps YoY to 0.57%.

KBRA’s October equipment index observes 83 securitized equipment loan and lease pools with a collective collateral balance of $26.2 billion. The all-equipment index can be split into two sub-indices: the small-middle ticket index and the large ticket index.

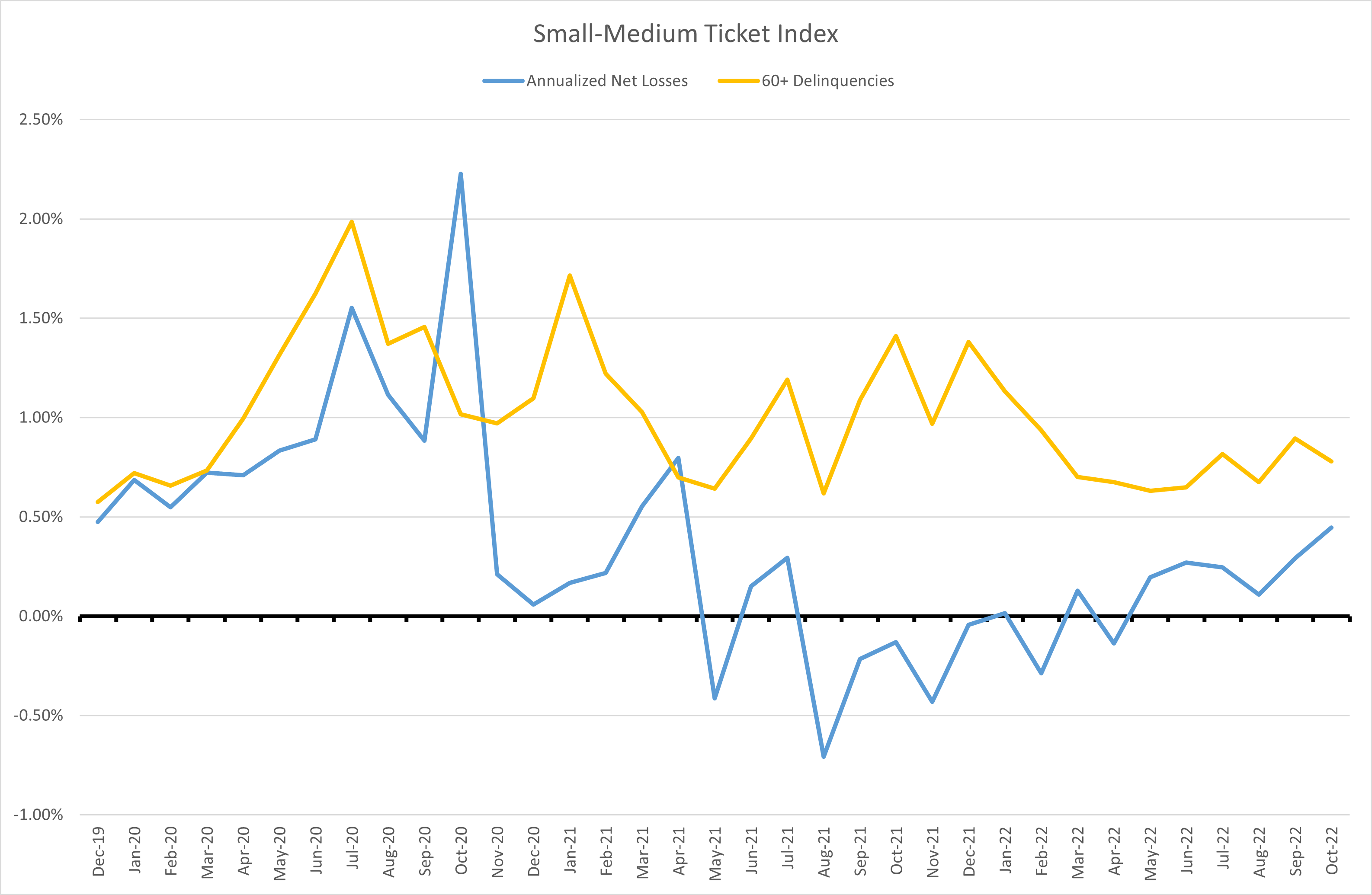

Small-medium ticket index

KBRA’s small-medium ticket index — which includes transactions under $500,000 — followed similar trends in October as the all-equipment index for annualized net losses, which increased 16 bps MoM and 58 bps YoY to 0.45%.

Delinquencies greater than 60 days on the small-medium ticket equipment loans and leases declined 12 bps MoM and 62 bps YoY to 0.79%.

KBRA’s small-medium ticket index contains securitized pools of light-duty equipment, primarily office equipment and computers. The October index contains observations from 32 small-medium ticket securitized equipment pools, which represents $9.9 billion outstanding.

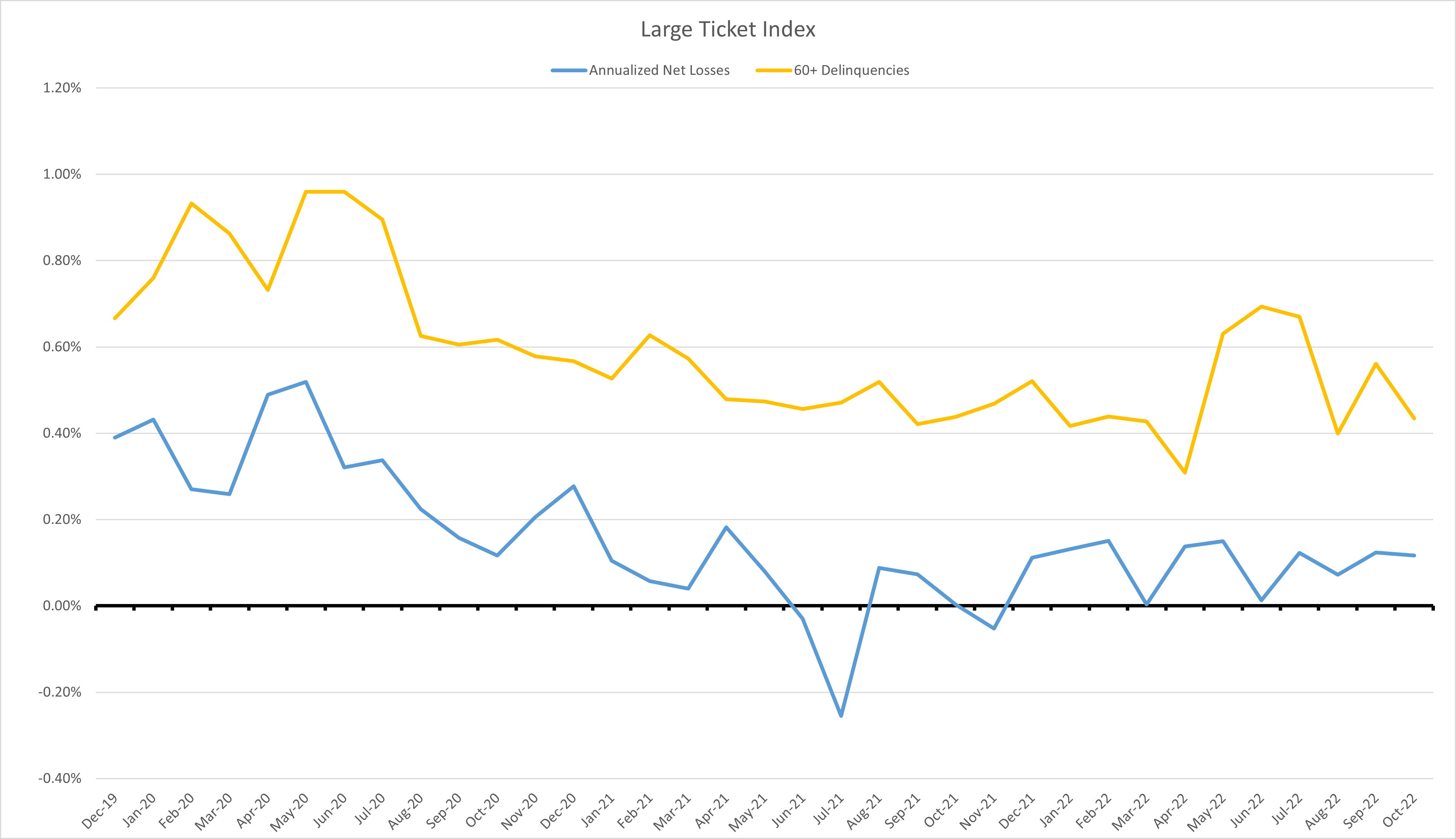

Large ticket index

Meanwhile, KBRA’s large ticket index — which includes transactions over $500,000 — for October bucked the trend, showing monthly improvement in both performance metrics. Annualized net losses fell by 1 bps to 0.12% and 60-plus-days delinquencies fell by 13 bps to 0.43%.

Still, year to date large ticket annualized net losses were up 11 bps. Year to date delinquency rates, on the other hand, remained virtually unchanged.

KBRA’s large ticket index is made up of securitized pools of heavy equipment, such as trucks and agricultural and construction equipment. The October edition of the index contains observations for 51 large ticket securitized equipment pools, which represents $16.3 billion outstanding.