Compliance challenges dog equipment lenders, dealers

53% of technology leaders expect cloud adoption to up their compliance concerns

Equipment dealers and lenders are being dogged by compliance challenges even as the Consumer Financial Protection Bureau’s pullback on Section 1071 of the Dodd-Frank Act provides some relief.

Section 1071, which required some financial institutions to collect and report business and demographic information from small businesses to the CFPB, faced legal challenges from the day it was introduced.

Recent changes at the bureau effectively ended efforts to implement those requirements, Mehul Madia, special counsel with expertise in commercial lending and financial transactions at Sheppard, Mullin, Richter & Hampton, said at the recent Equipment Finance Connect 2025 event in Nashville, Tenn.

“As soon as it was introduced, there were a number of challenges [including] in Florida and in Texas,” he said. “Since the new administration has taken over, the CFPB has paused compliance deadlines related to the law and has indicated in these lawsuits that it wants to pursue and revisit the rulemaking here.”

Before the bureau can revisit rulemaking, other challenges must be addressed. For example, continued action related to Section 1071 is complicated by executive orders that conflict with small business data collection and the diversity, equity and inclusion policies of President Donald Trump‘s administration, Madia said. As a result, the CFPB might have to rework its approach.

Meanwhile, the agency also faces internal challenges, including proposed cuts that would take staff from 1,200 to 200 and House of Representative efforts to repeal Section 1071 entirely, Madia said. Some iteration of the rule could exist moving forward.

“For lenders, that means that there’s a wait-and-see approach to figure out what’s going to happen.” — Mehul Madia, special counsel, Sheppard, Mullin, Richter & Hampton

“The compliance dates are our pause, so there’s less of a rush, but just something to keep an eye on,” he added.

State disclosure laws

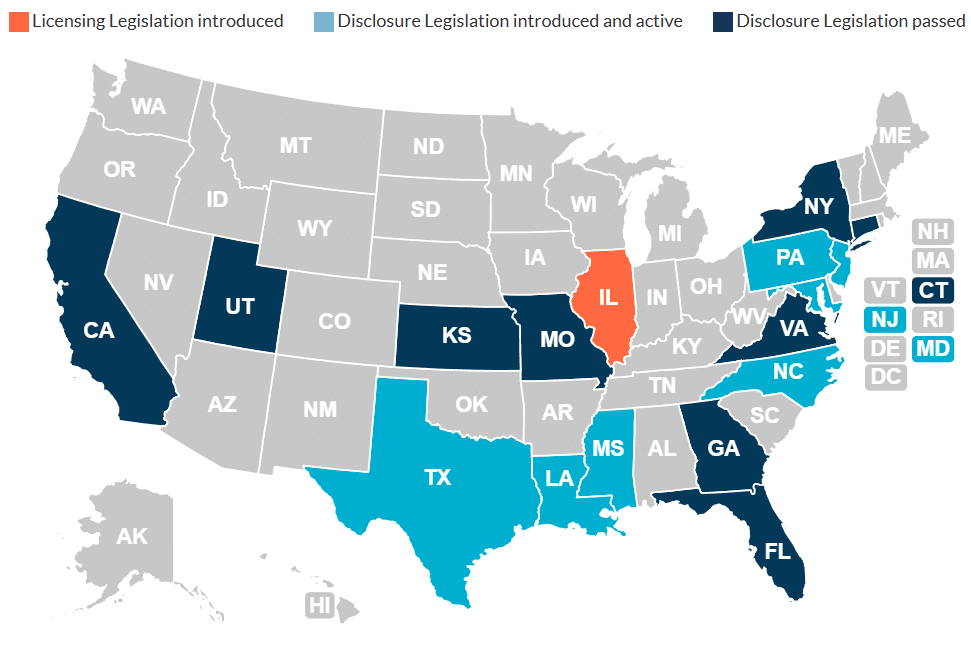

While federal disclosure laws take a back seat amid the CFPB changes, state disclosure laws are taking effect across the country, Madia said. Nine states have introduced commercial financing disclosure laws, with eight more in progress, signaling rapid developments on this front.

Navigating compliance across all 50 states is complex due to varying disclosure forms, transaction thresholds and pricing calculation methods, such as annual percentage rate in California or finance charges in New York, Madia said. Such variations make it difficult for lenders to develop a uniform system, particularly for products like merchant cash advances.

“Lender systems are built on the consumer side but are they really modified and ready to work on the commercial side because, when we talk about 50 states, document retention issues and various disclosure forms, it becomes very complicated” — Mehul Madia, special counsel, Sheppard, Mullin, Richter & Hampton

Groups like the Uniform Law Commission, for one, are working toward standardizing commercial finance disclosure laws, he said. “The hope is that [the commission] can get some kind of model set of rules in place before more states adopt [disclosure laws] because if you have 20 to 25, states that have adopted their own separate rules, then it really becomes difficult.”

FTC, UDAP, other compliance concerns

While the CFPB and Section 1071 have been the primary compliance concerns at the federal level during the past few years, equipment dealers and lenders are required to follow FTC regulations around:

- Unfair and deceptive acts and practices (UDAP);

- Privacy laws; and

- Data security laws.

Jean Noonan, partner at law firm Hudson Cook specializing in consumer financial services, fair lending, marketing, financial privacy, and consumer protection matters noted that for decades the FTC has brought cases against companies [that] engage in deception.

“We think that the new leadership is going to be active. In addition to UDAP, we have to be concerned about the whole range of other laws that the FTC enforces,” Noonan said at Equipment Finance Connect 2025.

Dealers and lenders also need to be careful with advertising rates, as certain transactions may be treated with the same scrutiny as consumer transactions, she added.

Even if a transaction isn’t technically subject to lending or credit advertising regulations, it’s wise to follow those rules anyway, since higher authorities have determined that disclosing these additional terms is necessary to avoid misleading consumers, Noonan said. “It’s likely that in a commercial transaction, a court or the entity would come out the same way.”

Risk in the digital age

Even as AI and automation gain ground in equipment finance, they come with their own compliance risks, Christopher Johanneson, former chief digital officer and executive vice president at Mitsubishi HC Capital America, said at Equipment Finance Connect 2025.

Many processes and procedures must be formally documented, and it’s important to do so correctly to ensure all necessary components remain in place for testing, avoiding any compliance or regulatory problems, he said. “There’s a variety of different compliance types of risks for … business, but also regulatory limits that are outside of that.”

As more tech moves to the cloud, pressure on compliance budgets is increasing. In a January survey on rising software compliance costs, 53% of technology leaders expected adoption of cloud technology to increase compliance concerns. The survey was conducted by Unisphere Research in partnership with software management firm License-Fortress.

Equipment Leasing and Finance Foundation (ELFF) found growth in technology equipment and software investment to be 10.6% YoY in May after growing by roughly 10% YoY in May 2024, according to the U.S. Equipment & Software Investment Momentum Monitor. Tech and software investment is forecast to grow 5.2% by yearend compared with 4.4% in Q4 2024, according to ELFF’s Q2 Industry Snapshot.

AI and compliance

As tech investment increases, compliance budgets and regulatory constraints can limit how much AI can be implemented and in what form, Daryn Lecy, chief operating officer and senior vice president of Oakmont Capital, said at the Equipment Finance Connect conference.

Lenders should be cautious with applying automation in credit processes because, while it can help speed decisions in certain cases, scaling it effectively across a larger operation can be challenging, he said. For large finance companies handling million-dollar deals with complete financial documentation, fully shifting to AI-driven financial analysis may be difficult and potentially unreliable.

Still, the benefits of using AI and customer data for insights warrant the risks that come with know your customer (KYC) compliance, Mitsubishi HC Capital America’s Johanneson said.

KYC is critical for any lender and, while these tools are becoming more advanced, real value lies in using data effectively to detect inconsistencies and unusual patterns, he said. Whether it’s inconsistent use of inventory across accounts or irregular application of identifiers, strong compliance and governance must be central when businesses implement new technologies and workflows.

“There’s a high degree of compliance [and] governance that needs to be part of the way that the business looks at the adoption of technology, processes and procedures,” Johanneson said.