After Fed rate cut, Powell says jobs market no longer very solid

FOMC voted 11-1 to cut the federal funds rate to 4%-4.25%

Federal Reserve officials lowered their benchmark interest rate by a quarter percentage point and penciled in two more reductions this year following months of intense pressure from the White House to slash borrowing costs.

Chair Jerome Powell pointed to growing signs of weakness in the labor market to explain why officials decided it was time to cut rates after holding them steady since December amid concerns over tariff-driven inflation.

“Labor demand has softened, and the recent pace of job creation appears to be running below the break-even rate needed to hold the unemployment rate constant,” Powell told reporters in his post-meeting press conference. He added, “I can no longer say” the labor market is “very solid.”

The decision comes at an extraordinary moment for the Fed. President Donald Trump, who has demanded drastic rate reductions and sought to exert more control over the US central bank, continued his legal battle this week to remove one official from the Fed board and install his own top economic adviser ahead of the highly anticipated gathering.

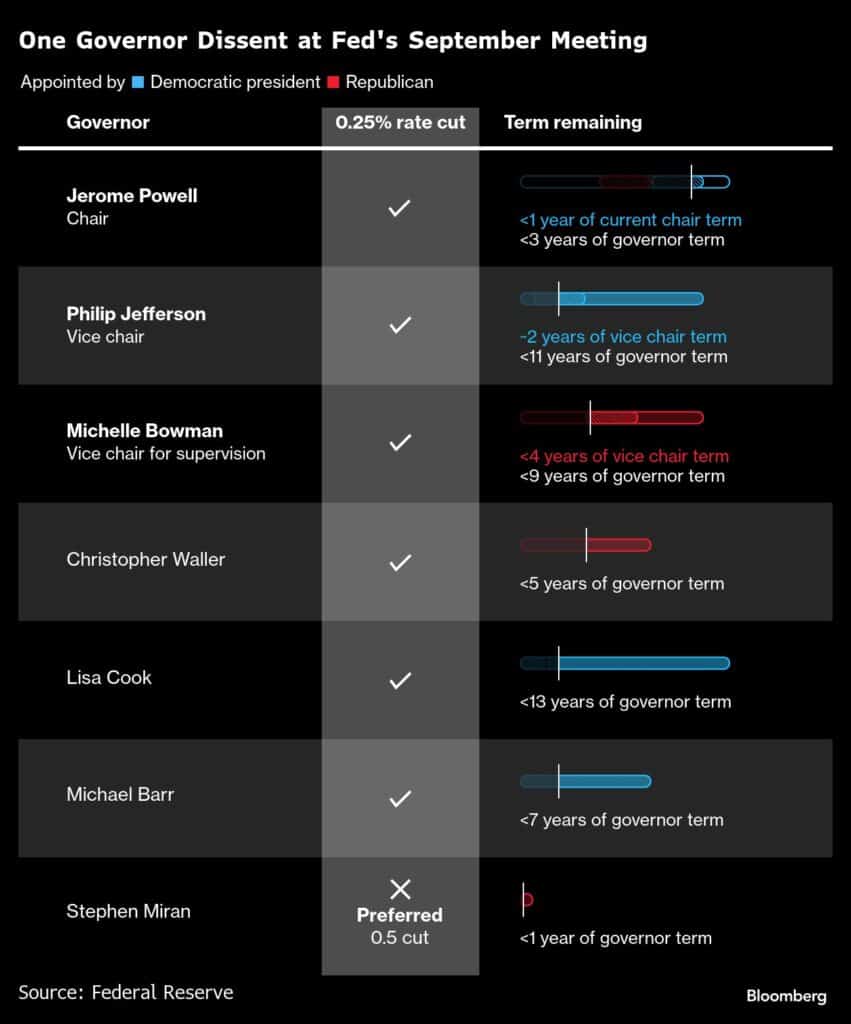

Fed Governor Lisa Cook and newly-sworn-in Governor Stephen Miran, who is on a temporary leave from his role as chair of the White House Council of Economic Advisers, both attended the meeting.

The Federal Open Market Committee voted 11-1 on Wednesday to cut the target range for the federal funds rate to 4%-4.25%, after holding rates steady for five straight meetings this year.

Miran was the only official to dissent, preferring a larger, half-point cut.

Powell also signaled ongoing concern over inflation pressures resulting from tariffs. “Our obligation is to ensure that a one-time increase in the price level does not become an ongoing inflation problem,” he said.

Looking ahead at the outlook for additional rate moves, Powell was cautious, saying the Fed was now in a “meeting-by-meeting situation.”

In their post-meeting statement, policymakers acknowledged that inflation has “moved up and remains somewhat elevated,” but also pointed to worries over jobs. Officials said the unemployment rate had “edged up,” and the “downside risks to employment have risen.”

The US dollar erased losses as Powell began speaking and described Wednesday’s decision as “a risk-management cut.” Treasury yields rose, led by the five-year yield up 6 basis points to 3.65%.

The cut was widely expected amid signs the central bank’s concerns are shifting toward employment and away from inflation, following a sharp slowdown in hiring over the last several months.

Policymakers also updated their economic projections at this meeting and now see two additional quarter-point cuts this year. That’s one more than projected in June. They foresee one quarter-point cut in 2026 and one in 2027.

One Fed official projected the policy rate would drop by another one and a quarter percentage point by December.

In their economic forecast, policymakers slightly upgraded their median outlook for growth in 2026. They also forecast modestly higher inflation next year.

Jackson Hole

Powell signaled the Fed could lower rates this month in a speech at the central bank’s annual Jackson Hole conference in August. After detailing the conflicting developments on each side of the Fed’s dual mandate, Powell said that “the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

A report released earlier this month showed hiring continued to slow in August, and the unemployment rate rose to 4.3%, the highest in almost four years.

But inflation has also accelerated in the past few months as companies increasingly passed tariffs on to consumers. The Fed’s preferred gauge of prices rose 2.6% in the year through July, and analysts expect the August reading due later this month to show another uptick, according to a Bloomberg survey.

While the impact of import duties has been more muted than many expected, some Fed officials remain concerned the tariffs haven’t fully worked through the economy, and could still generate a persistent impact on inflation, rather than represent a one-off adjustment. That has contributed to the central bank’s cautious approach toward rate cuts this year.

Others like Governors Christopher Waller and Michelle Bowman, both of whom were appointed by Trump in his first term, see the likely impact as temporary and have argued the Fed should lower rates more quickly to a neutral level, where they are neither weighing on nor stimulating the economy.

— By Catarina Saraiva (Bloomberg)