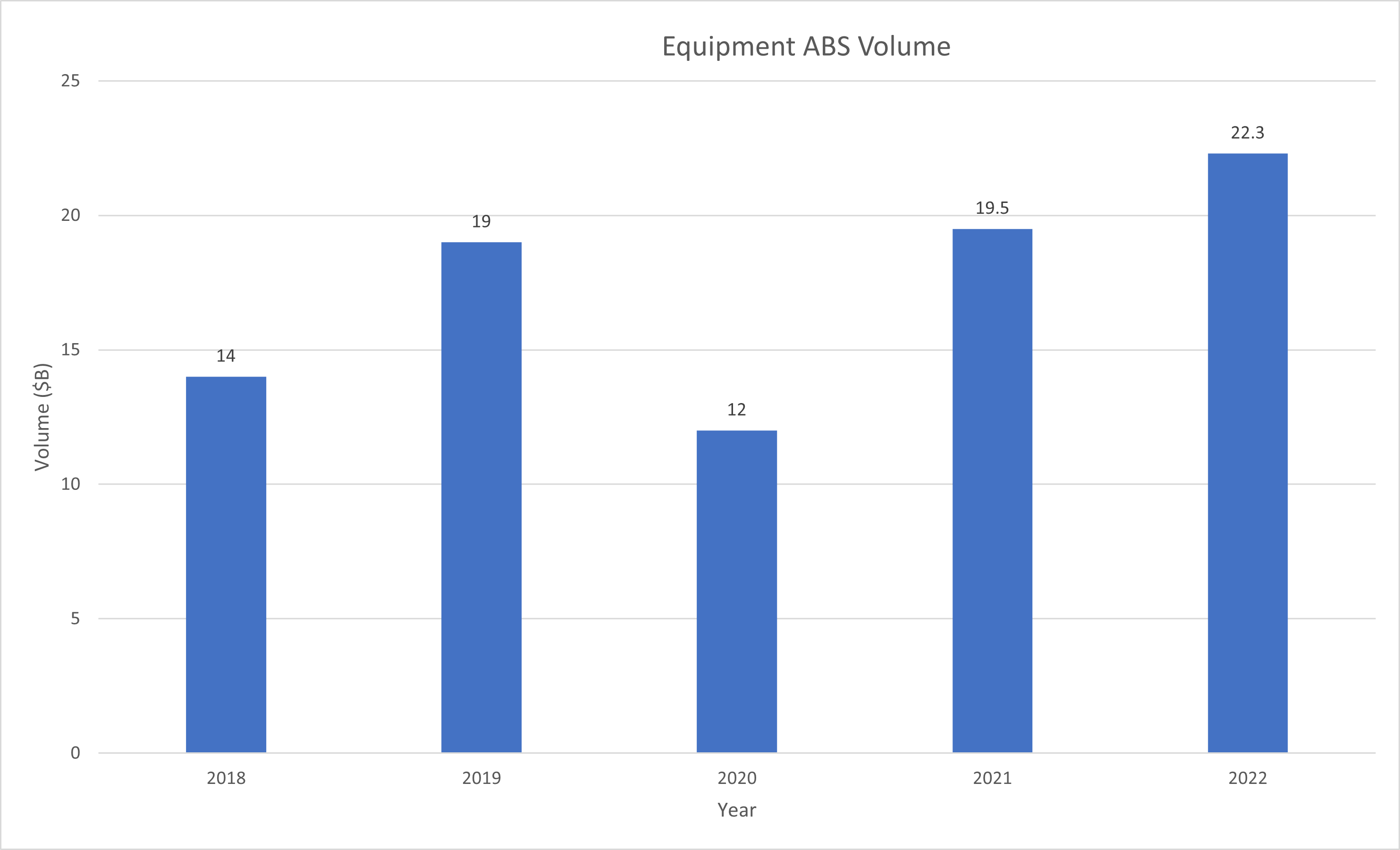

Equipment asset-backed securities issuance volume in 2022 outpaced the last three years as the structured finance segment continues its growth trajectory.

Equipment ABS volume landed at $22.3 billion, an increase of 14% YoY, according to JPMorgan Securities. By comparison, volumes landed at $13 billion, $19 billion and $14 billion in 2020, 2019 and 2018, respectively.

Small- and medium-ticket issuances accounted for $12.1 billion of issuances on the year, and agriculture and construction issuances accounted for $8.6 billion, according to Finsight, which monitors securities. Large-ticket ABS deals accounted for $1.6 billion.

John Deere was the industry’s largest issuer by volume, with three deals clocking in at a combined $3.7 billion. CNH Capital, meanwhile, executed three deals amounting to $2.5 billion, and Hewlett Packard finalized three deals totaling $1.8 billion.

Dell Technologies and Massachusetts Mutual Life Insurance rounded out the top five issuers with two deals each, totaling $2.2 billion and $1.8 billion, respectively.