Trimble weaves tech integration into dealer ops

Construction telematics market could surpass $4.5B by 2034

Equipment dealers are making technology a larger part of their sales and service operations, and tech providers are on the front lines with them.

Murphy Tractor, for example, was recently recognized as the first John Deere dealer to become a Trimble outlet, according to a May 1 Trimble release. Construction dealer Kirby-Smith Machinery, with 13 locations across the Midwest and Southwest, became the first Trimble outlet in the U.S. in March.

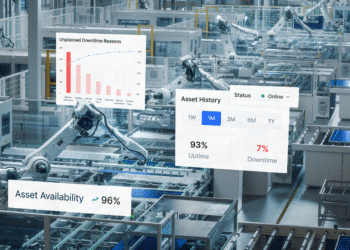

Trimble sells a range of equipment technologies, including grade control systems, autonomous solutions, global navigation satellite systems, telematics systems and other data collection software.

Whether it’s selling the technology itself or tech-driven equipment, Trimble dealers are adjusting sales and service operations to accommodate new products and evolving customer demands, Luke Kurth, director of machine technology at Park City, Kan.-based Murphy Tractor, told Equipment Finance News.

“It’s a product line that changes super-fast,” he said. “Lots of upside, but you really have to figure out how to manage it. Our strategy — we’re fully integrated with the iron folks, but we have dedicated sales specialists. They do nothing but live and breathe technology, so they can walk onto a job site with a customer and say, ‘Hey, this is what we can do… and we can help save you money or speed up projects.’”

Murphy Tractor has added specialists in addition to training existing employees while working to unite sales and service departments, Kurth said.

“If you can’t support this stuff, you’re never going to sell it again anyway,” he said. “So, we are very, very heavy on the support side.”

Assessing, educating dealer partners

The global construction equipment telematics market was valued at $1.5 billion in 2024 and is projected to more than triple to $4.7 billion by 2034, according to Global Market Insights.

As Trimble grows its dealer network, it’s important “to assess where [dealers] are on their technology journey,” Chris Shepard, vice president of channel development at Trimble, told EFN.

Trimble representatives typically work with new dealer partners for three or fourth months to ensure they’re educated and confident, Shepard said, noting the complexity of continued customer support.

“There are many components that interact in the field,” he said. “When an operator is using the machine and the grade control that can go wrong, you have to be able to diagnose it to keep them up and running, because the last thing they need is to be down.”

Quantifying return on investment is also crucial for strong dealer sales and customer satisfaction, Scott Crozier, vice president of civil construction at Trimble, told EFN.

“If we can start to understand how a machine works on a project, and we’re tracking the data compared to what we thought that machine was going to do, now we can optimize how we utilize the assets across multiple projects or a single project,” he said.

Analysis of multiple white papers, internal data and customer feedback determined that operators that use Trimble technologies can enhance productivity by 25% to 50%, Crozier said.

Financing opportunities arise

As equipment becomes increasingly tech-driven, dealers are seeing more financing opportunities, Derek Weaver, sales manager at Leola, Pa.-based Agriteer, which sells Trimble products, told EFN.

“A guy might spend $50,000 or $80,000 on technology for his planter, and not many are able to just write a check for that,” he said. “So, to offer that financing is important.”

Dealers are also seeing more financing options for new technologies and high-tech machines as their lender partners grow more confident, Murphy Tractor’s Kurth said.

“In a lot of cases, both the OEM on the machine side can offer financing that includes some of these systems that go on the aftermarket, or we have individual financing sources from Topcon or from Trimble,” he said. “Each of them kind of has their recommended institutions, recommended programs that we tap into.”