Fake and missing addresses are creating hiccups in the collections process for equipment lenders as charge-offs increase and credit conditions tighten.

Missing or incorrect information can slow collections, Andrew Alper, vice president and shareholder at Frandzel, Robins, Bloom & Csato, a firm specializing in litigation services for financial institutions and businesses, said during a panel at National Equipment Finance Association’s Funding Symposium in San Antonio on Oct. 5.

“I’ve got a lot of cases where they come in, they seem to be in the $50,000 to $200,000 range, and we just don’t get good addresses,” he said. “We send [collections] out, they don’t get served and then we’re stuck. We prepare a lawsuit, the clients have been charged and now we’ve got a bunch of status conferences” and no defendants.

Using a people-verification system, sending demand letters through carriers with tracking systems and external collections agencies help facilitate collections and reduce costs when compared with the legal fees of collection lawyers, Alper said.

“The thing our office spends the most time on is the location,” Deborah Rubin, senior counsel at Taft Law, said during the panel. “I can’t tell you how many times somebody will send the files to me … I need to verify it prior to filing, and it’s a bad address.”

Companies can verify addresses before filing to save both time and money before having to take legal action, Rubin said. “We can do it, but these are cost-cutting things that the client can do before the file gets to our office,” she said.

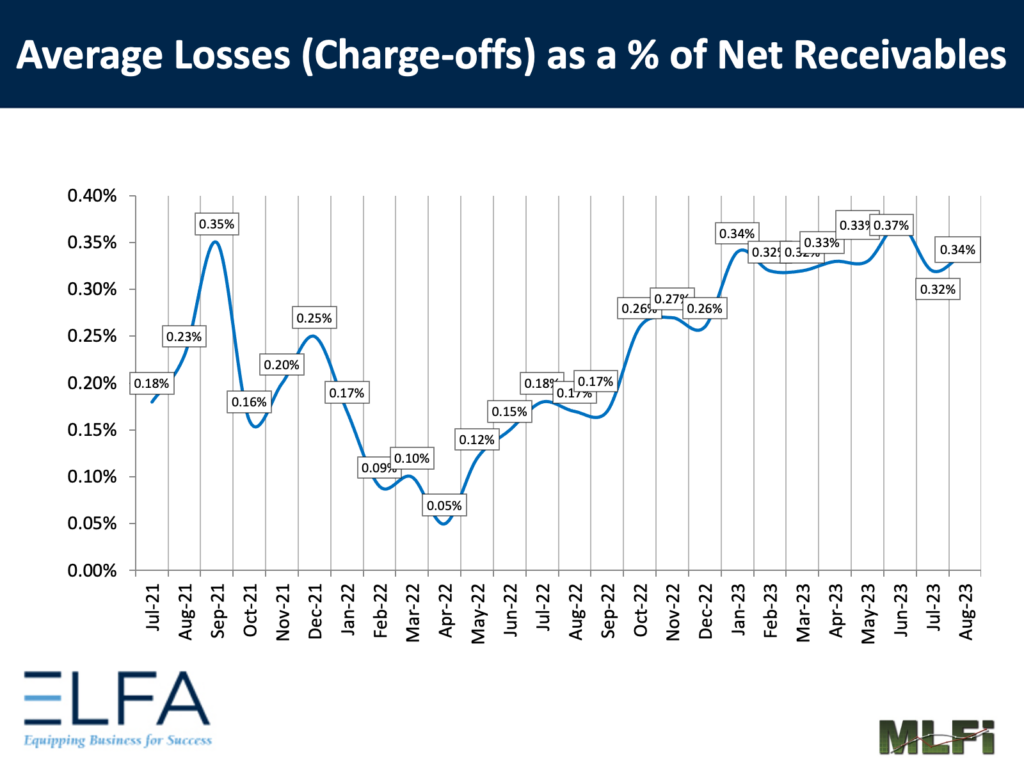

Charge-offs in the equipment finance industry were 0.34% in August, up 20 basis points sequentially, and have doubled year over year, according to the Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index.

As charge-offs increase and the courts become more jammed, it becomes harder for lenders and vendors to take legal action against buyers with falsified or missing information, Shawn Smith, chief executive of Dedicated Financial GBC, said during the panel.

“The industry tends to over-prioritize the front end so much until the back end is on fire,” he said.

GPS is another alternative to keeping track of locations and addresses ahead of collections, Kevin Carr, vice president of financial services at PassTime GPS, said during the panel.

Companies could use GPS systems to track the physical location of the equipment and see if it’s different than the given address of place of business or the previous storage location, he said. “[The vehicle’s] showing in Chicago, where it was in Atlanta before, and the borrower never told them about that, which goes back to how we serve them.”