Rising insurance premiums challenge dealers

Insurance costs exceed truck lease payments, some dealers report

The rising cost of truck insurance is pushing some smaller fleet managers to brace themselves for financial instability and has prompted drivers to reconsider financing their vehicles.

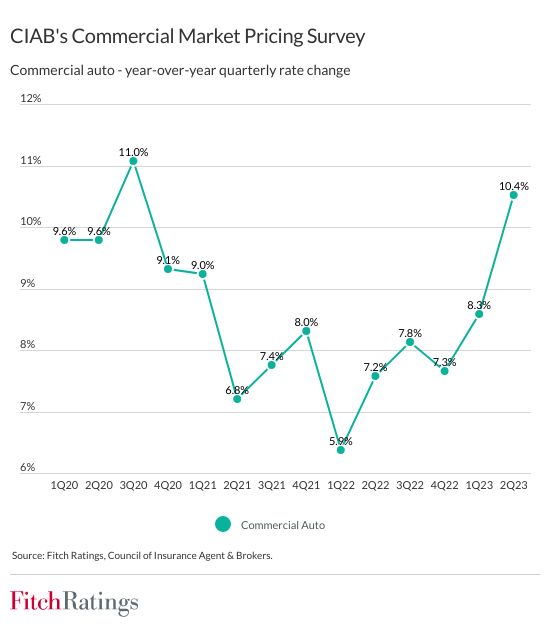

Auto insurance rates are rising across the board, but some commercial truckers are finding the costs increasingly difficult to justify. The rise in rates is driven by “less favorable underwriting experience, continuing rising loss severity and heightened claims litigation activity,” Jim Auden, managing director at analyst firm Fitch Ratings, told Equipment Finance News.

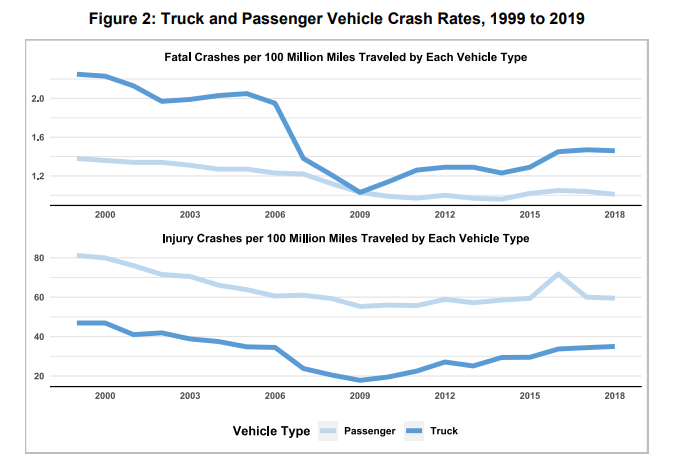

While the Federal Motor Carrier Safety Administration reported large truck crashes declined 2.5% from 2021 to 2022, the American Transportation Research Institute (ATRI) reported it expects commercial auto liability premiums to increase in the next several years “due to rising costs and poor performance in the previous policy year.”

The rate of insurance coverage is not rising completely in tandem with crashes: ATRI reported in a 2022 survey of 82 national carriers that the “rate of insurance costs during 2009-2018 far exceeds the nominal rate increase in crashes … from the previous year and earlier.”

Overall, the insurance premium cost per mile for truckers has nearly doubled in the last decade – up 47% to 8.7 cents, the ATRI said, spurred by not just safety but also economic conditions, increased litigation costs and persisting underwriting losses.

Insurance hampers financing

While smaller operators have the most difficulty shouldering growing insurance rates, larger operators are likely to experience more legal complications.

“Generally, the claims severity and litigation issues mentioned are more pronounced as vehicle and fleet size increases,” Auden said. “Insurers face more challenges with larger commercial auto accounts, so rate increases and underwriting changes [are] more likely to continue at a similar pace here in 2024.”

But costs are rising across the board.

“Freight is down, fuel is up and insurance is double,” Jason Spates, chief executive of Truck Lenders USA, told EFN. Truck Lenders USA finances in 48 states, and Spates said he has heard from truckers nationwide that their incomes are down.

“Even in recent weeks, we’ve approved people for financing and they have not taken the financing because the insurance cost is actually higher than the truck payment,” Spates said, adding that he hasn’t seen that happen in about 20 years of business.

“Also, insurance companies are not covering the insured values of the trucks,” he said, adding that trucks purchased during the pandemic, particularly two years ago, are now worth 25% to 50-25% of their value at auction. Meaning, the equipment depreciates fast and within a couple years of purchase is worth half its original price.

“So, if an operator is in an accident, and they owe the bank $60,000 to $80,000 on their unit, the insurance companies are coming in at $30,000 to $40,000, so there’s an automatic deficiency,” Spates said.

Insurance rates remain top of mind for drivers, said Sean Walsh, vice president of finance at Baltimore-based Peterbilt retailer The Pete Store. Walsh said that while he’s heard ample concerns from customers about rising rates, he wasn’t sure if he’s heard of insurance surpassing payments on vehicles.

He did add that to offer better value for his customers, The Pete Store works exclusively with a lender that “has started an insurance arm of their business in order to try to curb some of that frustration of potential customers.”

More trucks means more liability

Walsh added that owners of smaller fleets are the most concerned. “It’s certainly more impactful on the smaller, three-to-five truck fleets than it is to the 500–truck fleets,” he said.

Insurance premiums have been on the rise for years and that’s partly because the value of long-haul rigs is rising, said Hadley Benton, sales executive at fleet management firm Fleet Advantage.

“It’s hard to think about times when people were experiencing any sort of relief from the insurance side of things,” Benton said. “The equipment is a lot more expensive, there’s a lot more technology on it. They’re obviously a lot safer, but at the same time all that increased cost adds to those [insurance] premiums.”

He doesn’t expect there will be any “near-term” relief from insurance prices, he added.

Rates climb after pandemic lull

Insurance rates more than doubled in the 2010s, and they’re expected to continue rising as more freight is moved after the pandemic lull, according to ATRI. The institute’s 2022 study on trucking operations costs found that low traffic during the pandemic caused premiums to sink and provided “record profits in the auto insurance sector.”

Specialized carriers with smaller operations are often the hardest hit by rising rates. The American Transportation Research Institute found in a 2022 study that while the average commercial auto liability insurance went up 2 cents per mile year over year to 8.8 cents in 2022, smaller carriers paid about 1 to 4 cents more per mile on average than larger ones.

But sometimes, preemptive accounting can push costs up for large operators as well. The ATRI’s report found that very large fleets have higher out-of-pocket costs because they utilize self-insurance retentions, reserves of cash that operators put aside to pay for claims in advance of an insurance policy responding to a loss in an attempt to “reduce their reliance on the insurance market.”