Core capital goods improve amid growing equipment investment

New durable goods orders rose 9% MoM, transportation orders spike

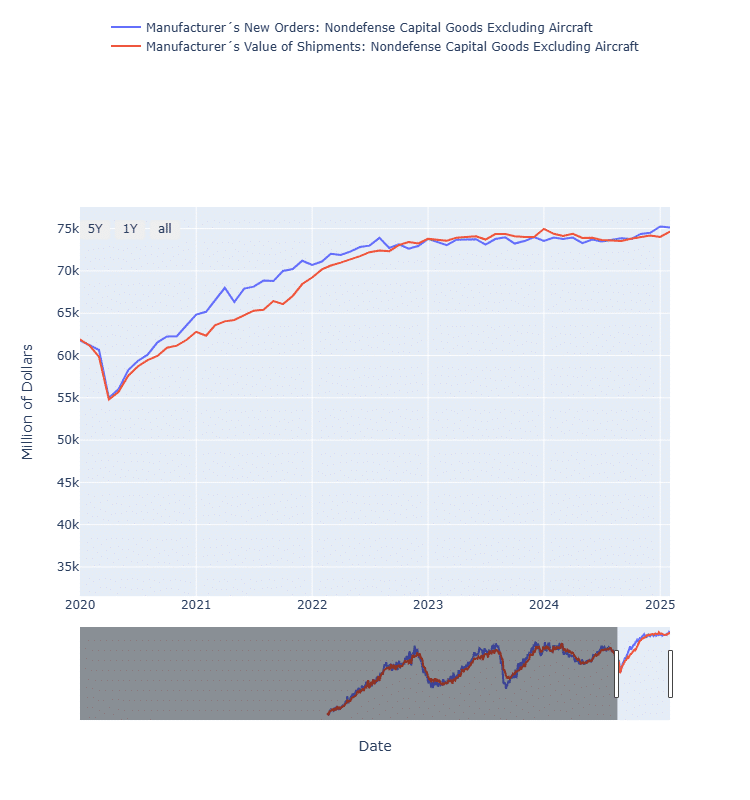

Core capital goods new orders, shipments, total inventory and unfilled orders inched up in March, as equipment investment increased during the first quarter.

March’s seasonally adjusted value of core capital goods orders, excluding aircraft and defense equipment, was $75.1 billion, up 0.1% month over month following a February decrease of 0.3%, according to the Monthly Advance Report on Durable Goods Manufacturers’ Shipments Inventories and Orders, released by the U.S. Census Bureau today. Seasonally adjusted shipments for core capital goods totaled $74.7 billion in March, up 0.3% MoM after a revised 0.7% increase in February.

Consecutive months of growth for core capital goods shipments indicates some equipment investment in Q1, according to a Wells Fargo research note.

“Since the shipments data feed into the BEA [Bureau of Economic Activity]’s calculation for equipment investment, the March report still suggests real equipment investment grew at a solid clip in the first quarter,” the Wells Fargo note stated. “Our latest estimate was for equipment to advance at a 16% annualized rate and this still feels like a reasonable estimate in the wake of the March data.”

Seasonally adjusted new orders for durable goods landed at $315.7 billion in March, up 9.2% MoM after a 0.9% rise in February, due in part to a 27% increase in new transportation equipment orders. Meanwhile, seasonally adjusted shipments for durable goods were $293 billion, up 0.1% MoM following a revised 1.3% increase in February.

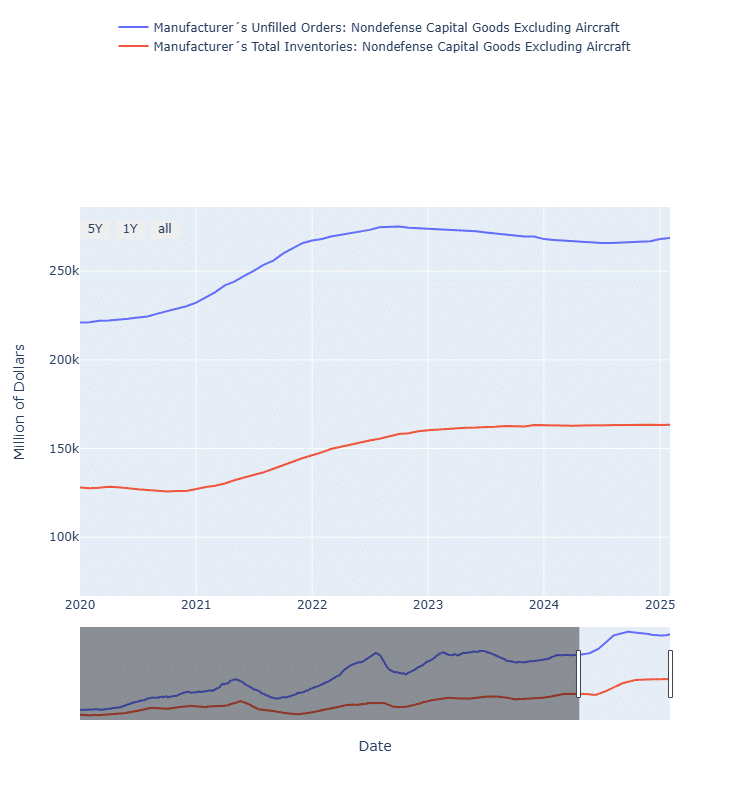

Unfilled orders, total inventories

Seasonally adjusted unfilled orders for core capital goods reached $269 billion in March, up 10 basis points (bps) from February, following a 20-bps revised increase in February by the Census Bureau. Seasonally adjusted total inventories for core capital goods hit $163.7 billion in March, up 20 bps after February was revised to a 10-bps increase.

Seasonally adjusted unfilled orders for durable goods totaled $1.4 trillion in March, up 2% MoM after a 0.1% rise in February, according to the report. Seasonally adjusted total inventories for durable goods finished at $533.3 billion in March, down 10 bps compared with the previous month following a revised 2-bps decrease in February.

While the good results in durable goods and core capital goods create anticipation for solid Q1 investment reports, underlying demand still fails to fuel a broad and sustained recovery in CapEx spending, according to the Wells Fargo research note.

“Borrowing costs remain elevated and tariff uncertainty leaves businesses in a holding pattern,” according to the note. “Small business intentions around capital spending remain historically low as many businesses, like the [Federal Reserve], are sitting and waiting for confidence around tariff policy.”

The third annual Equipment Finance Connect at the JW Marriott Nashville on May 14-15, 2025, is the only event for both equipment dealers and finance providers. Learn more and register here.