Lender and consumer roadblocks are negatively impacting the financing process for equipment dealers.

“One, the customer is declined by the primary lender, so we’ll take that as a workflow or a key question to evaluate,” Beckham Thomas, founder and chief executive of Trnsact, said Tuesday at Equipment Finance Connect in Charlotte. “No. 2, most customers are not accepting the offer that a dealer provides without any additional evaluation.”

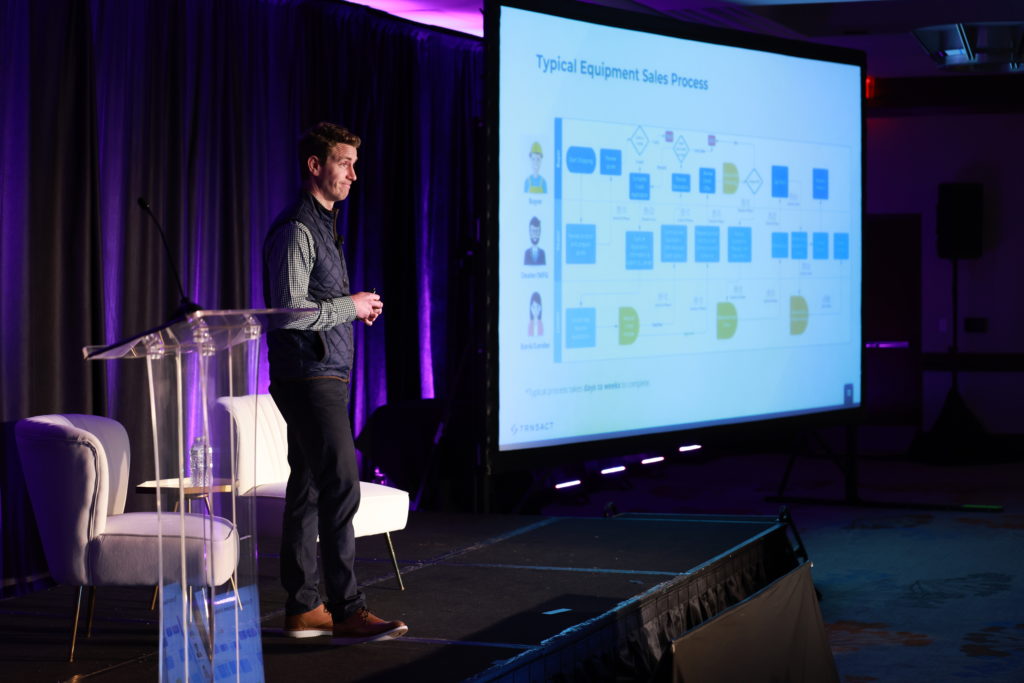

Managing the credit application process presents difficulties in lending for finance managers and salespeople, Thomas said.

“Most dealers have a process of submitting to individual lenders with unique processes,” he said. Finance managers or salespeople “have to track and manage that and even once they get an approval, it becomes quite challenging.”

Upward of 40% of all applications are declined by the first lender they are sent to, according to Trnsact’s research.

“The dealer or salesperson is often responsible to go out and find another lender,” Thomas said. “Each time that decline occurs, our research shows that the salesperson is less motivated to advance with that customer.”

Thirty-three percent of all buyers seek alternative financing offers before selecting what the dealer has offered, according to Trnsact.

“Additional evaluation takes time and jeopardizes the dealer’s sale because, ultimately, [consumers are] shopping elsewhere,” Thomas said.