Used construction equipment market stabilizing

Heavy-duty construction inventory fell 2.5% YoY in May

Asking and auction values for used construction equipment and lifts fell slightly in May despite increased optimism that the market may be stabilizing.

Construction equipment dealers continued to face lower year-over-year asking values and auction values in May as inventory increased, according to Sandhills Global’s June 4 report on used equipment trends. Still, the relative stability of the construction equipment market is leading to dealer optimism, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

“The whole talk right now on the construction side is the rental side, so that’s going to be the key,” he said. “The used equipment market, we’re in a decent spot there, and we’ve been pretty steady, but that whole rental side is going to be what to keep an eye on for the next year.”

Continued pressure on the market from tariffs remains a key indicator for the used construction equipment market, Ryan said.

“The tariff side is going to impact a lot of the import stuff and export stuff, which is very large on the construction side,” he said. “Some of that does play into effect, but to what level, [we’ll] come to find out through the rest of the year.”

Over the past four to five years, the industry has faced different challenges, Terry Dolan, head of CNH Construction North America, told EFN. From the pandemic to supply chain disruptions, the industry continues to show strength and resilience, thanks in part to government investment.

“The federal, local and state governments, there’s a lot of dollars going into investment, and that’ll continue,” he said. “You’ll see the market up and down a little bit from year to year, but nothing dramatic.”

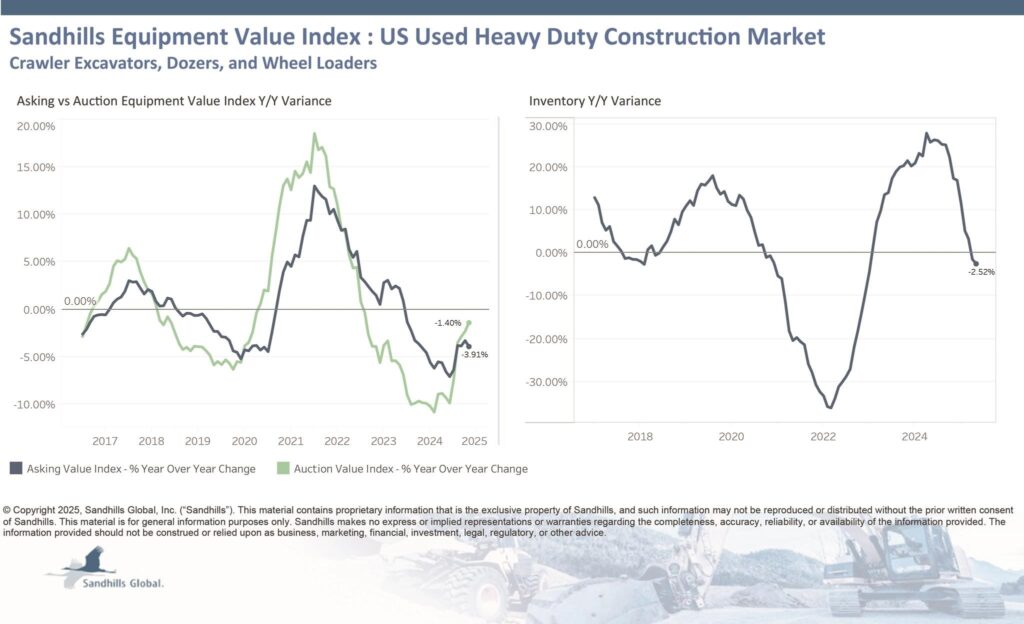

Used heavy-duty equipment

- Inventory fell 2.5% YoY despite a 1.2% month-over-month increase;

- Asking values fell 3.9% YoY and 1.9% MoM; and

- Auction values decreased 1.4% YoY and 0.7% MoM.

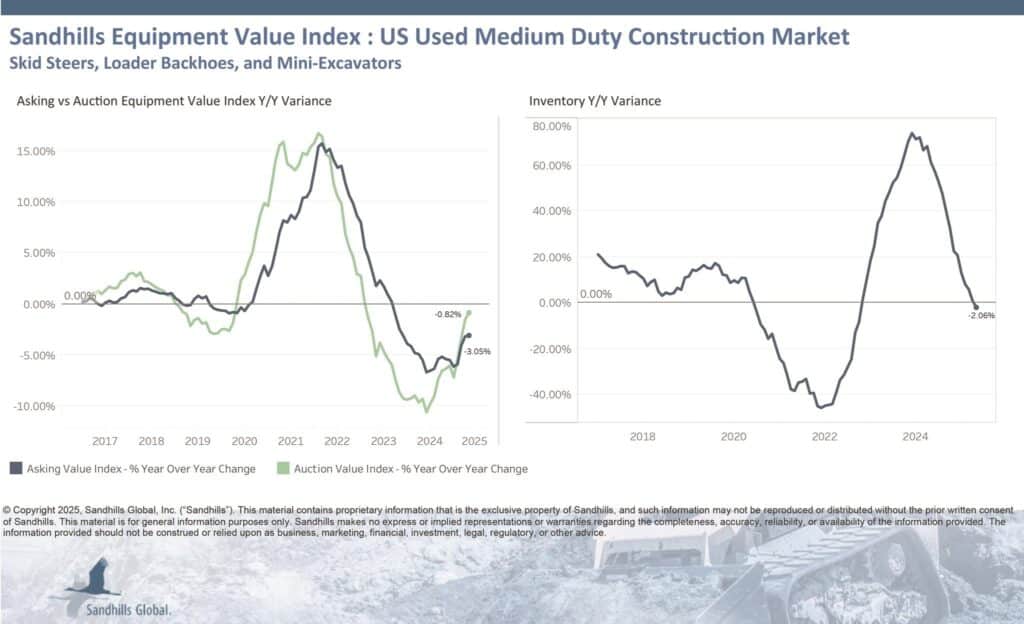

Used medium-duty equipment

- Inventory fell 2.1% YoY, but rose 0.5% MoM;

- Asking values fell 3.1% YoY and 0.9% MoM; and

- Auction values slipped 0.8% YoY and MoM.

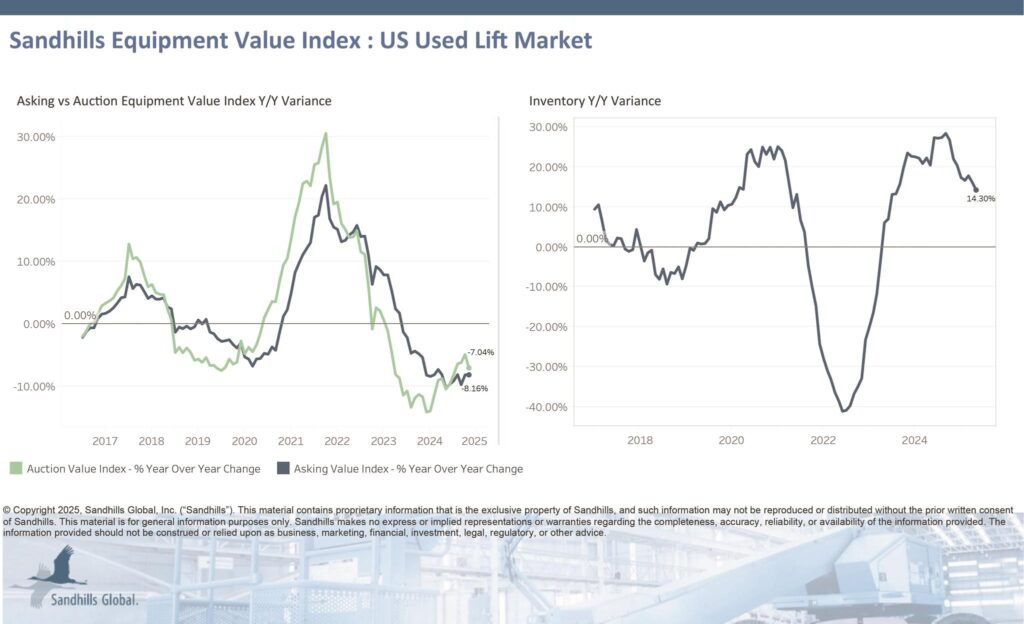

U.S. used lifts

- Inventory increased 14.3% YoY despite a 0.5% dip MoM;

- Asking values dropped 8.2% YoY and 1% MoM; and

- Auction values declined 7% YoY and 3.5% MoM.

Register here for the free Equipment Finance News webinar “Technologies to Advance Your Equipment Financing Business” set for Thursday, July 17, at 11 a.m. ET.