Medium-duty auction values rise 3.1% YoY as market improves slightly

Heavy-duty construction inventory fell 9.1% YoY in August

Construction equipment auction values improved slightly in August, including medium-duty construction equipment values rising 3.1% year over year, as the rental market and infrastructure projects provided stability amid tariffs.

U.S. used construction equipment markets saw inventories trend down in August, while auction values rose modestly, led by crawler excavators and loader backhoes, according to Sandhills Global’s Sept. 5 report on used equipment trends.

While the Federal Reserve’s 25-basis point rate cut provided a short-term boost for rental companies and opened market opportunities, lasting growth in equipment sales depends on resolving tariff uncertainty, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

“The rate cut is obviously a shot in the arm, it may swing some people for sure,” he said. “But to see a long-term play, the tariff solution is going to have to get figured out before you’re going to see a real bump in buying on that side.”

Meanwhile, some construction inventory continues to shift into rental fleets as medium-duty construction and agriculture markets cycle back for yearend cash flow, Ryan said.

“Ideally, you see some of that inventory level drop on the retail side because of that,” he said. “Those mini axles and the skid steers do have a good cross market with the ag side, so that’s where I think a lot of that inventory really is.”

Tariffs and interest rate shifts continue to pressure OEMs, which plan to pass tariff-induced costs to equipment dealers’ prices, leaving dealers focused on margin protection despite steady rolling 12-month construction performance, Marc Johnson, principal for equipment dealers at consulting firm Pinion Global, said during a Sept. 10 webinar hosted by Associated Equipment Distributors.

“As I look at performance this year, we already have a margin problem. Whether you’re on the construction side or on the ag side, margins are tightening,” he said. “We’re flatlining on performance.”

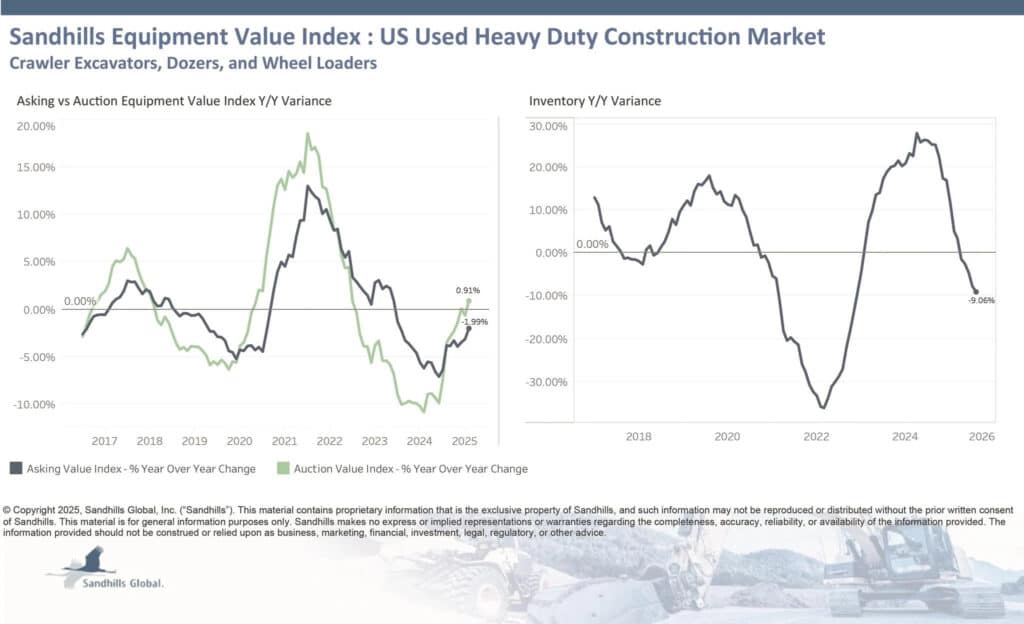

Used heavy-duty equipment

- Inventory declined 9.1% YoY despite a 0.2% month-over-month increase;

- Asking values fell 2% YoY but rose 0.1% MoM; and

- Auction values rose 0.9% YoY and 0.2% MoM.

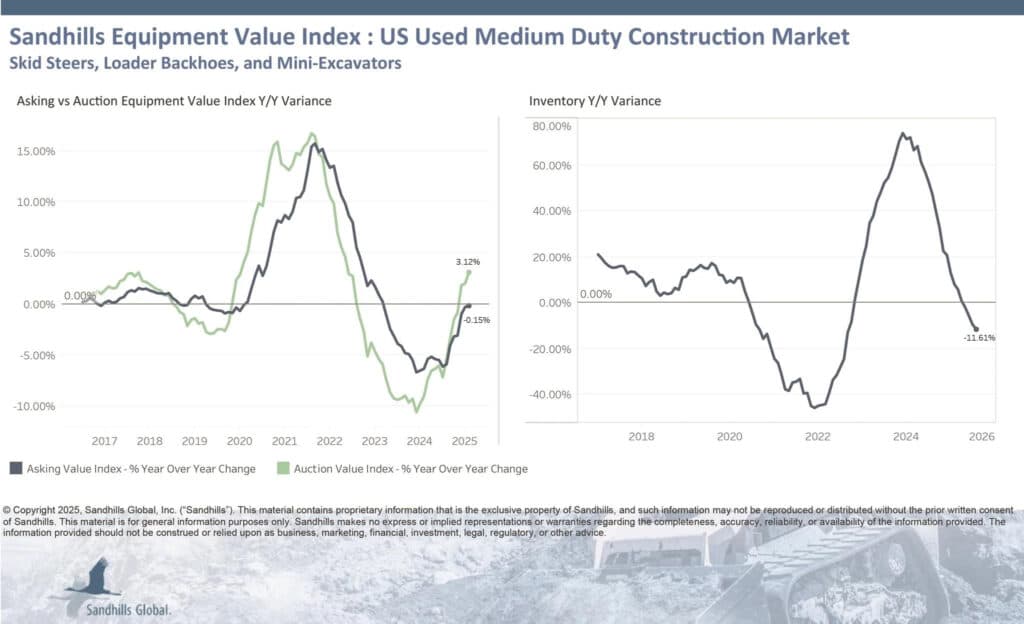

Used medium-duty equipment

- Inventory dropped 11.6% YoY and 0.2% MoM;

- Asking values fell 0.2% YoY and 0.5% MoM; and

- Auction values increased 3.1% YoY and 0.5% MoM.

Check out our exclusive industry data here.