Rising mortgage rates, construction costs and inflation continue to stymy the new-home housing market, leading to the longest-running decline in confidence among homebuilders since the mid-1980s.

Housing starts — a leading economic indicator — remain sidelined as consumers pull back on purchases, according to the U.S. Census Bureau, which reported Tuesday that filings for building permits tumbled 22.4% from a year ago, and new housing starts dropped 16.4% as would-be buyers waited for mortgage rates to fall.

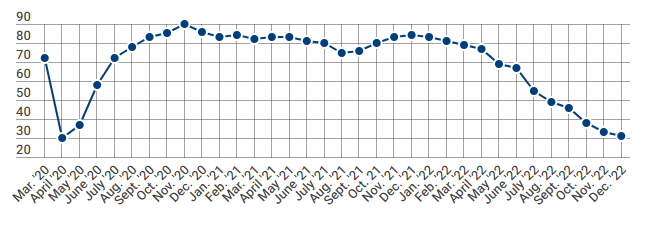

Among single-family homebuilders, confidence dropped in December for a record 12th consecutive month — the lowest since the onset of the COVID-19 pandemic in spring 2020, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index. Homebuilder’s sentiment is in contrast with the wider Equipment Finance Confidence Index, which rebounded from a two-year low in December.

“This proves that the new-home market is sensitive to interest rates,” Paul Emrath, vice president for survey and housing policy research at the NAHB, told Royal Media. “When interest rates go up, confidence goes down.”

The seasonally adjusted index, which measures perceptions of current home sales and expectations for the next six months on a 1-to-100 scale, dropped two points in December to 31. number above 50 is an indication that builders view conditions as favorable rather than poor. The index has held below 50 since July, when the Federal Reserve began to raise interest rates steadily.

Labor and supply shortages hammered the market for the first six months of the year, Emrath said.

While homebuilder confidence in December took a hit, the index reflects a kernel of optimism with builders registering a slight uptick in future sales expectations for the first time in eight months.