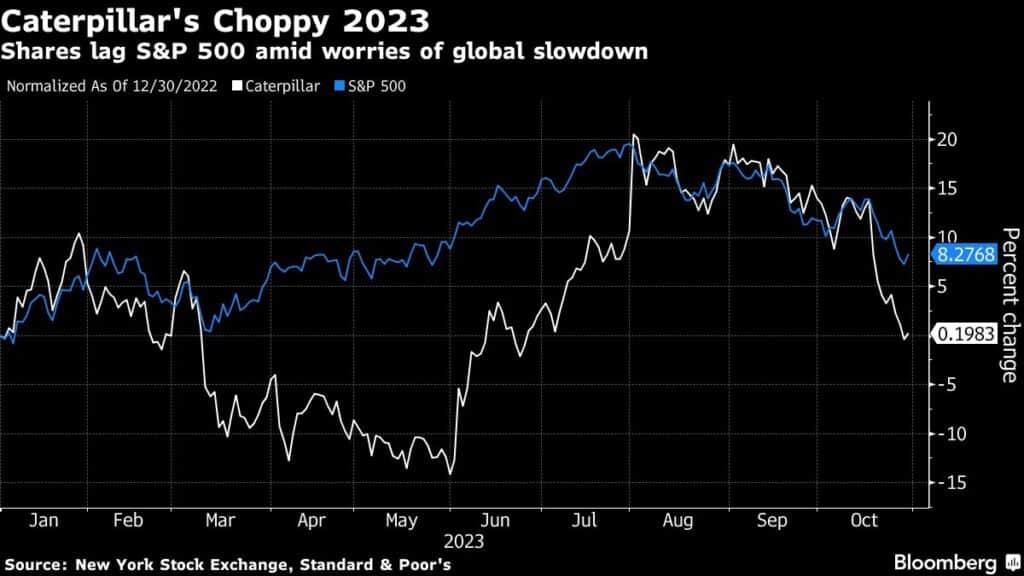

Caterpillar Inc.’s stock tumbled to the lowest price since early June after the company said its order backlog shrank in the third quarter, in a sign of slowing demand for its iconic yellow machinery.

The year-on-year decline of $1.9 billion is the first since the third quarter of 2020, when the Irving, Texas-based company was grappling with the effects of Covid-19 shutdowns on its sales, according to data compiled by Bloomberg.

The drop, even as Caterpillar reported earnings that beat analyst estimates thanks to higher prices and strong sales, will deepen concerns that economic headwinds are beginning to take hold after years of strong sales growth coming out of the pandemic. The company is viewed as an economic bellwether because its machines dot construction, mining and energy sites around the world, which means its order books are closely watched.

Caterpillar’s report showed dealer inventories have continued to grow while orders declined 15% year-on-year, analysts at Robert W. Baird & Co. wrote in a note to clients, adding that their modeling points to a slowdown in sales and earnings growth for the fourth quarter.

Shares fell 5.5% to $228.77 at 9:35 a.m. in New York, its lowest level since early June.

“Due to improving supply chain conditions, productivity and lead times have improved for many products,” Chief Executive Officer Jim Umpleby said in Tuesday’s earnings call. “Dealers and customers can wait longer to place orders, which has led to a moderation in order rates as expected.”

While the company posted better-than-expected revenue in its construction equipment business for the third quarter, sales from mining as well as its energy and transportation businesses were weaker than analysts’ anticipated. Caterpillar reported adjusted earnings of $5.52 a share, beating the $4.77 average estimate of 23 analysts polled by Bloomberg.

Bloomberg Intelligence analysts noted ahead of the earnings that the company’s third quarter may bring softening orders and inventory destocking among its dealers, which likely would exacerbate economic-slowdown concerns.

Relentless supply chain hangups and rising raw material costs have challenged the company in the years since the start of the pandemic, though Caterpillar’s operational flexibility and price hikes to consumers have more than offset such pressures.

Caterpillar also reiterated its expectation of $700 million in restructuring expenses for the full year.

–By Joe Deaux (Bloomberg)