The number of used compact and utility tractors at auction declined substantially in April as the inventory glut following the pandemic began to subside.

Elevated farm equipment inventories in 2024, created by supply chain normalization, created a significant backlog and a need for ag dealers to reduce inventory, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

“They were sitting on a boatload of inventory at the compact tractor side, so it took a good year plus to flush that to a certain extent. But we’re seeing the tail end of what we saw a year ago, when it was peaking,” he said. “Hopefully, depending on the economic issues and volatility, we get to this point next year, and we can start seeing that in some of the other markets as well.”

While 2023 was a good year for farmers, farm equipment and farm financing, farmers began to see a slide in 2024 that has continued into 2025, Jay Darden, program director at Farm Credit Express, said in a panel discussion at Equipment Finance Connect 2025 recently in Nashville, Tenn.

“Our customers began feeling some stress there, having trouble getting their operating lines for the next year, so we’ve got that stress, and our numbers are down a bit again,” he said. “We competed with cash in 2023, so we’re seeing a little depression in the eastern United States.”

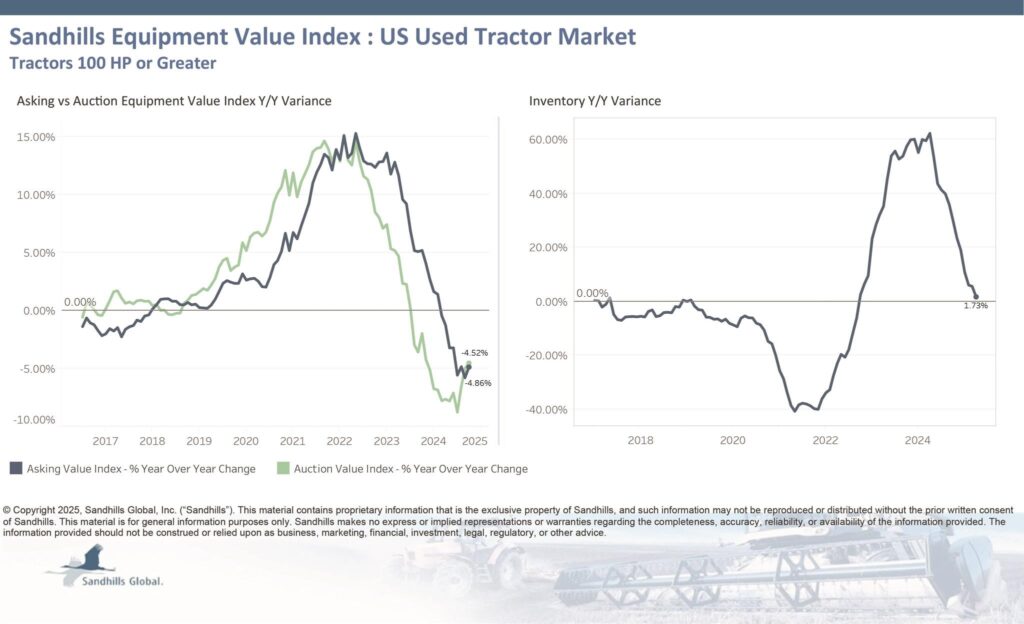

Used high-horsepower tractors, 100 horsepower or more

- Inventory rose 1.7% year over year despite falling 2.3% month over month;

- Asking values fell 4.9% YoY yet rose 0.7% MoM; and

- Auction values declined 4.5% YoY and less than 0.1% MoM.

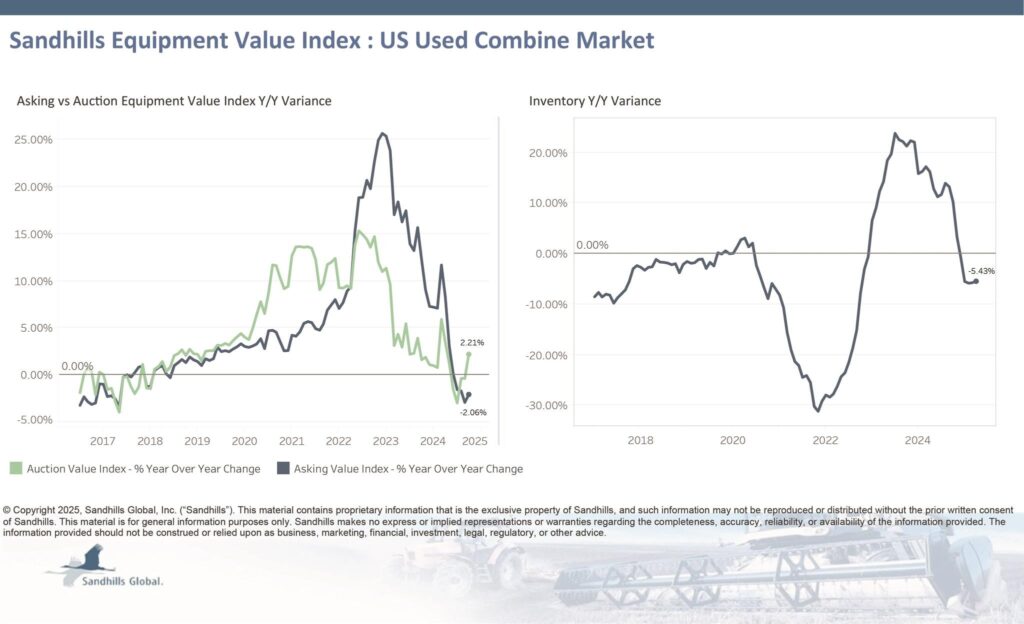

Used combines

- Inventory fell 5.4% YoY but rose 0.5% MoM;

- Asking values dropped 2.1% YoY but rose 0.2% MoM and are trending upward; and

- Auction values increased 2.2% YoY and 1.3% MoM.

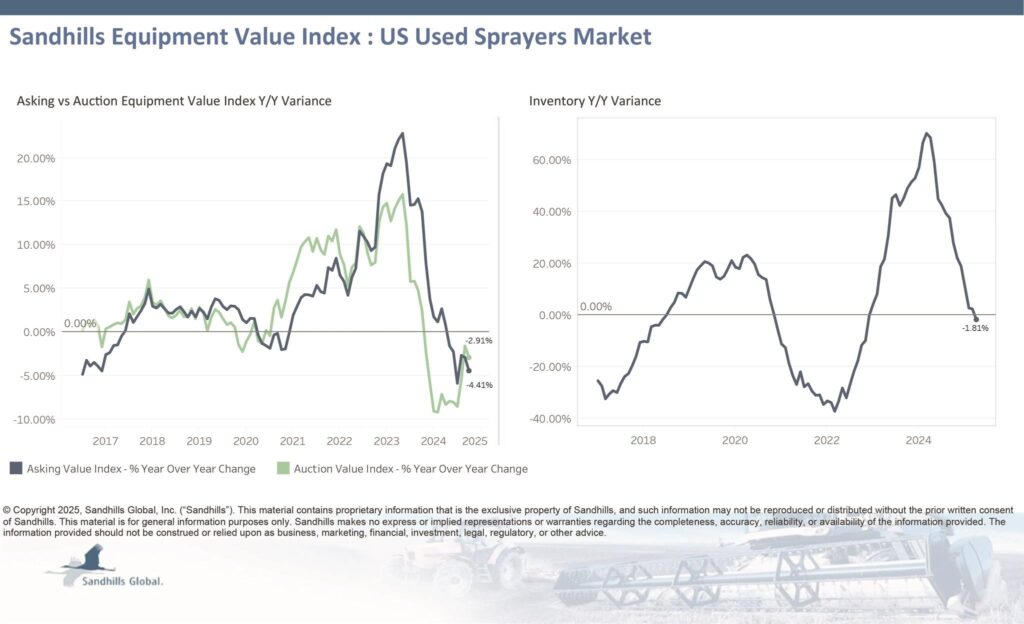

Used sprayers

- Inventory fell 3.7% YoY and 1.8% MoM and continue to trend down;

- Asking values fell 4.4% YoY and 1.9% MoM; and

- Auction values dropped 2.9% YoY and 3.7% MoM.

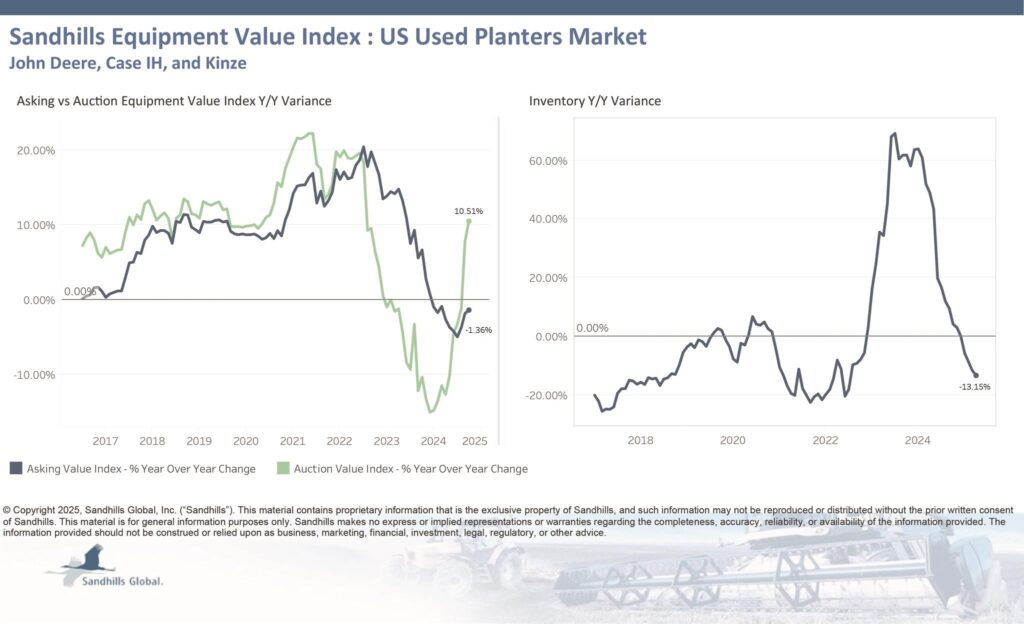

Used planters

- Inventory declined 13.2% YoY and 4.2% MoM;

- Asking values fell 1.3% YoY and 0.3% MoM; and

- Auction values rose 10.5% YoY and 1.2% MoM.

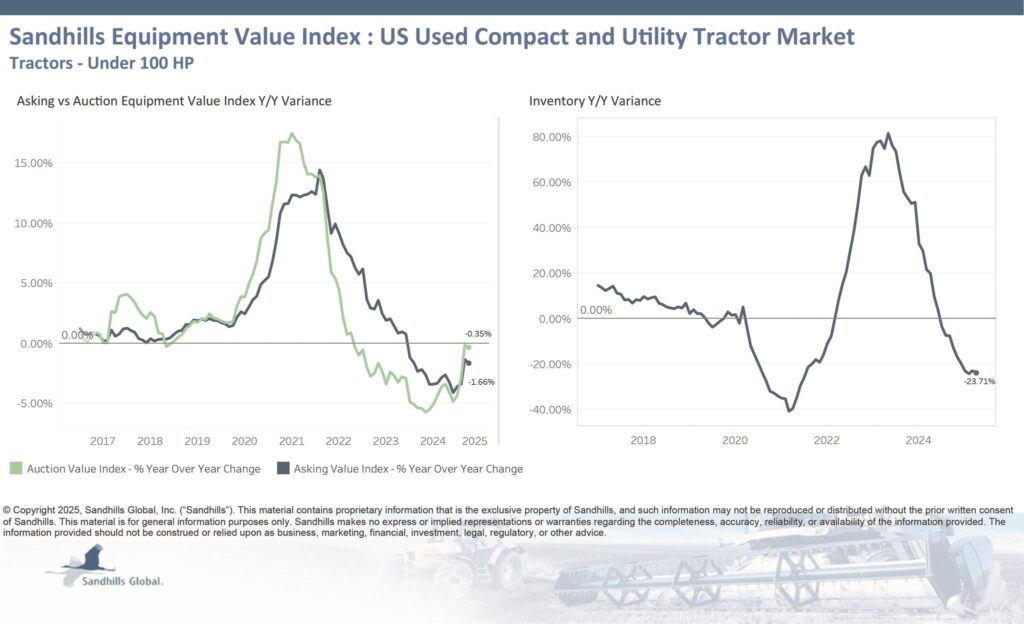

Used compact and utility tractors

- Inventory plummeted 23.7% YoY and 4.1% MoM;

- Asking values fell 1.7% YoY and 0.2% MoM; and

- Auction values were down 0.4% YoY and 0.3% MoM.