Farm financial performance sinks, bankruptcies on the rise

Farm debt expected to hit record $562B in 2025

Decreased crop prices and minimal exports are dealing added blows to the agriculture sector, leading to a rise in financial stress and prolonging an equipment sales slump.

Purdue University’s Ag Economy Barometer, released today, dropped 11 points in July to 135, following a 10-point decline in June. Roughly 400 farmers were surveyed from July 7 to July 11 for the index, which measures farmer sentiment and overall industry conditions.

In addition, the Farm Financial Performance Index fell 14 points to 90, and the Index of Current Conditions dropped 17 points to 127. The Capital Investment Index dipped seven points to 53, reflecting an ongoing slowdown of agriculture equipment sales.

Weakened financial performance and current conditions were attributed to lower corn and soybean prices — down 7% and 3% month over month, respectively — as well as subdued exports amid global trade tensions, Michael Langemeier, associate director at the Center for Commercial Agriculture at Purdue University, told Equipment Finance News.

There are “a lot of worries right now about soybean exports to China,” he said. “Usually, they have more commitments or there’s more discussion that they’re going to buy soybeans when we harvest them, and they’ve been keeping fairly quiet. And that’s really concerning because… about 40% of soybeans are exported, and about half of that is exported to China.”

Meanwhile, equipment lenders are wary of the agriculture sector because of “softening commodity prices,” Mark French, president of Atlanta-based Crest Capital, told EFN.

Distress on horizon

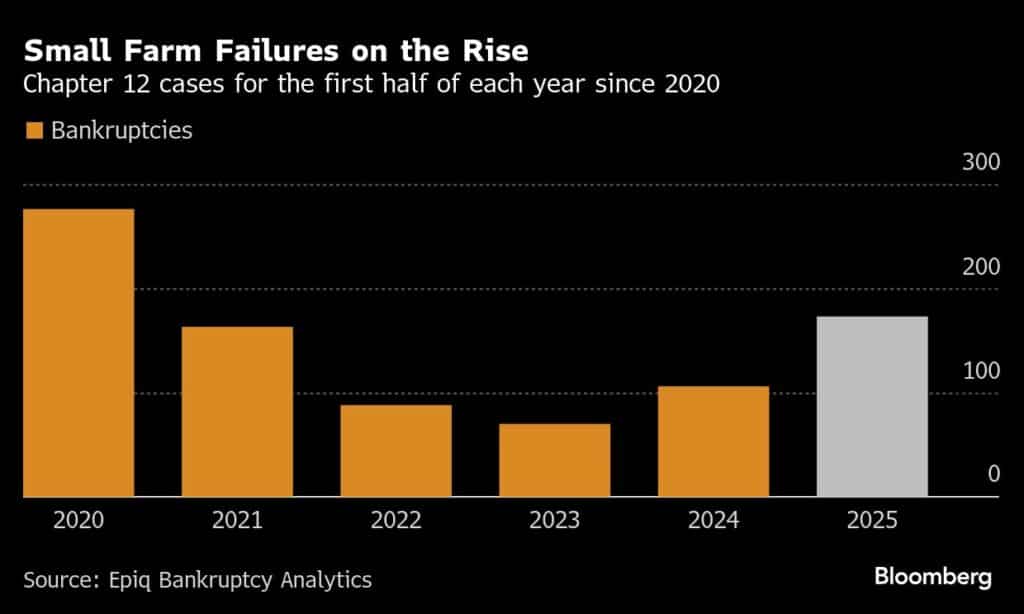

Bankruptcies filed by small farms and fishermen reached nearly 200 in the first half of 2025, their highest level since 2020. Farm debt is projected to hit a record $561.8 billion this year, according to the U.S. Department of Agriculture.

While larger farms are better positioned to use land equity to withstand financial challenges, bankruptcies and distress among small farms will likely continue to rise, Langemeier said.

“Input costs and break-even prices are still relatively high, so we’re going to see more bankruptcies,” he said. “Smaller farms, beginning farms, particularly if they’re not tied to an older generation, are very susceptible in the current environment because they don’t tend to have the equity that they need to withstand these low net returns.”

Langemeier said he expects 2025 to be worse for the agriculture industry than 2024 and the downturn to continue in 2026, signaling “an uptick of those that struggle repaying their loans.”

Glimmers of hope

Despite the slew of challenges facing farmers, 74% of respondents believe the U.S. is generally headed in the right direction, according to the Purdue report.

This long-term optimism is largely due to expected farm subsidies under President Donald Trump, like his first term, Langemeier said. A larger safety net stemming from increased reference prices and 2025 Farm Bill funding are also providing reasons for optimism, he said.

Plus, agriculture OEMs CNH Industrial and Agco are working to help the industry recover as they prioritize reducing dealer inventories.

CNH, for one, is offering tailored financing programs for new and used equipment, Chief Executive Gerrit Marx said during the company’s Aug. 1 earnings call.

“We have programmed our retail plans with financial services, in partnership with the dealers,” he said. “That’s of utmost importance and focus in our dialogues that we have with our dealers.”

Check out our exclusive industry data here.