Farm equipment sales remain soft, drop in November

Compact and utility tractor values down 5% YoY

Farm equipment sales fell in November amid declining net farm income, all despite growing optimism in the sector.

Demand for farm equipment did not see a post-election boost, as sales of tractors and combines fell double-digits year over year for the month and year to date despite increased optimism among farmers, according to the November 2024 United States Ag Tractor and Combine report released by the Association of Equipment Manufacturers (AEM) on Dec. 11.

November sales for:

- Two-wheel-drive farm tractors finished at 10,836 units, down 14% YoY;

- Four-wheel-drive farm tractors landed at 167 units, down 40.8% YoY;

- Total farm tractors ended at 11,003 units, down 14.5% YoY;

- Self-prop combines were 145 units, down 46.7% YoY.

In addition, year-to-date sales for:

- Total two-wheel-drive farm tractors reached 196,137 units, down 13.6% YoY;

- Four-wheel-drive farm tractors finished at 4,001 units, down 1.6% YoY;

- Total farm tractors were 200,138 units, down 13.4% YoY;

- Self-prop combines ended at 5,120 units, down 24.1% YoY.

The decline in November sales continues a trend of softness in the sector, AEM Senior Vice President Curt Blades said in the AEM release.

“This slowdown in sales can be traced back to high interest rates and uncertainty in the overall ag economy,” he said in the release.

Equipment values, revenues decline

Meanwhile, on the used equipment and auction side, dealers continue to dump equipment as sales for new and used remain down, Jim Ryan, equipment lease and finance manager at Sandhills Global, which issues a monthly report on the state of the industry, told EFN.

“On the farm side this year, a lot of those dealers were dumping throughout the year, taking huge losses throughout the year, got to yearend, and we’re seeing some continue to dump,” he said. “We’re seeing some that are holding off until next year, but the ones that are holding off till next year are sharpening the pencils, as they’re fixing a lot of those asking values that they have on the retail side.”

By fixing their asking values, dealers aim to use their aggressiveness to move inventory, Ryan said.

West Fargo, N.D.-based equipment dealer Titan Machinery also experienced declining revenue due to agriculture sector softness, Chief Executive Bryan Knutson said during Titan’s Nov. 26 earnings call.

“The agriculture equipment industry is adjusting to the softening demand as agriculture fundamentals have materially weakened, driven by the anticipated decrease in net farm income and sustained higher interest rates,” he said. Inventory jump for high-HP tractors

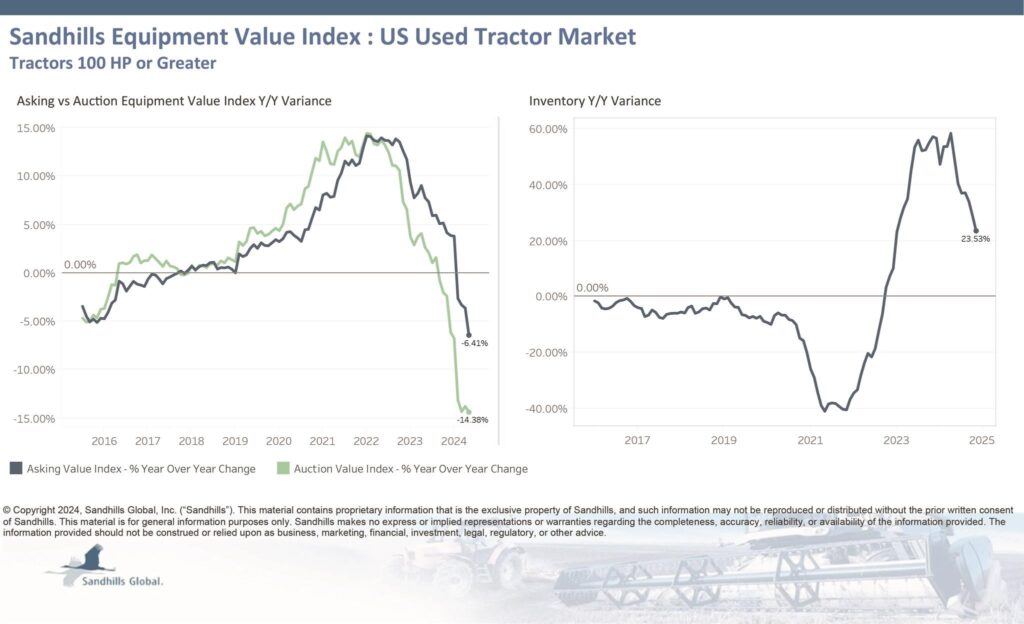

Inventory for high-horsepower tractors increased 0.8% month over month and 23.5% YoY in November and continues to trend upward, according to Sandhills Global data provided to EFN. Asking values, or retail values, for high-horsepower tractors fell 2.2% MoM and 6.4% YoY, while auction values rose 0.2% MoM but dropped 14.4% YoY in November.

Compact, utility tractor values fall

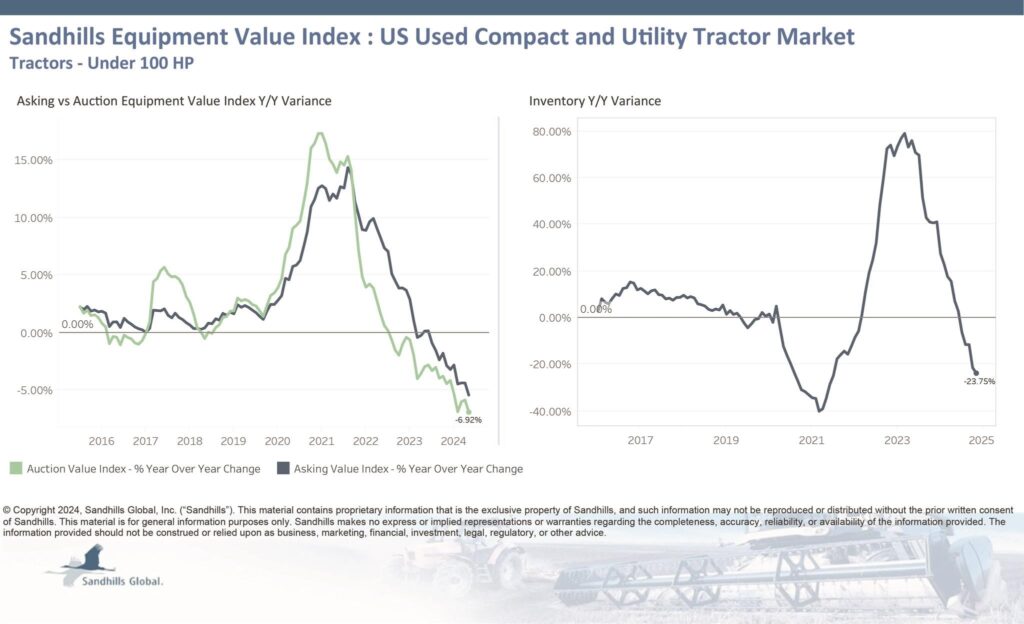

Retail values for used compact and utility tractors declined 0.8% MoM and 5.4% YoY, continuing an 11-month trend, according to Sandhills. Meanwhile, auction values also declined 0.8% MoM and 6.9% YoY in November, marking nine straight months of decline.

Inventory for compact and utility tractors, defined as tractors under 100 horsepower, fell 0.8% MoM and 23.8% YoY in November. For equipment under 40 horsepower, inventories fell 28.7% YoY, the most for any group.

The third annual Equipment Finance Connect at the JW Marriott Nashville in Nashville, Tenn., on May 14-15, 2025, is the only event that brings together equipment dealers and lenders to share insights, attend discussions on crucial industry topics and network with peers. Learn more about the event and register here.