Farm conditions worsen ahead of potential subsidy

Farmers expect $10B to $15B relief package in coming months

Low commodity prices and high input costs continue to strain farmers, but lower interest rates, possible federal subsidies and technology could provide some relief.

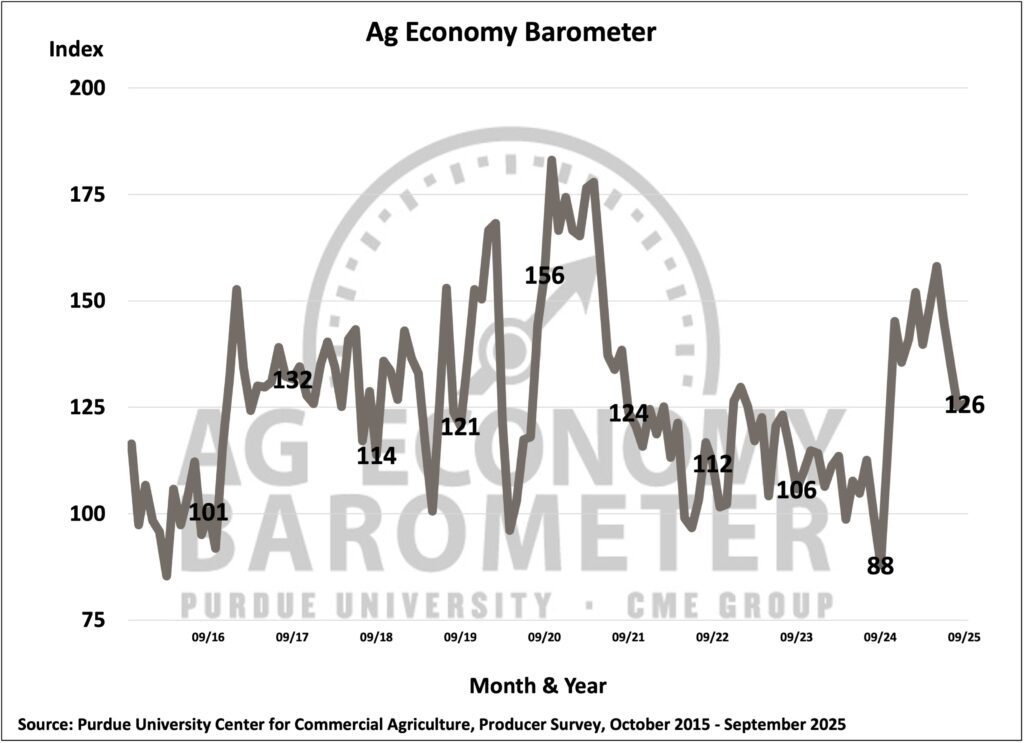

Purdue University’s Ag Economy Barometer, released Oct. 7, ticked up one point to 126 in September, following three straight months of decreases. About 400 farmers were surveyed from Sept. 15 to Sept. 19 for the index, which measures overall sentiment and economic conditions in the agriculture industry.

Meanwhile, the Index of Current Conditions fell seven points to 122, and the Farm Financial Performance Index dipped three points to 88.

The indices would be even lower without a strong performance in the livestock sector, Michael Langemeier, director at the Center for Commercial Agriculture at Purdue, told Equipment Finance News.

Despite persistent low commodity prices, corn and soybean farmers are expecting record yields, which would lower break-even prices and provide a boost to the crop sector, Langemeier said.

“If you can lower that [break even] to $4.75, compared to $5 with trend yields, that helps immensely,” he said.

Impact of subsidies, lower rates

Farm equipment sales remain muted despite relief funds and aggressive OEM incentives.

The remaining $2 billion of the U.S. Department of Agriculture’s Emergency Commodity Assistance Program will hardly move the needle for farmers’ cash flow, Langemeier said. But a separate $10 billion to $15 billion program that farmers are expecting soon could have a noticeable impact on financial performance and equipment sales, he said.

“It depends on how much they spread that out, and then also the [government] shutdown is probably impacting the timing,” he said. “But I do think there’s a wild card for the machinery industry if we start seeing some relatively large payments. That could spark some investment.”

Sixty-two percent of farmers surveyed said it’s very likely that they will receive subsidies like the 2019 Market Facilitation Program (MFP) if a trade war leads to lower prices for agricultural products, according to the Purdue report. The MFP was a federal package that allotted $14.5 billion in direct payments to farmers, according to the USDA.

Meanwhile, the September Federal Reserve interest rate cut will likely have a minimal impact on equipment sales, but lower rates would make it easier for farmers to pay off debts and alleviate financial stress for some, Langemeier said.

Embracing tech

About 75% of farmers in North America had adopted or were willing to adopt precision agriculture technology in 2025, according to an Oct. 2 study by the Equipment Leasing and Finance Foundation, citing consulting and research firm McKinsey & Co. The tech includes drones, automated steering systems, milking machines and yield monitors.

While some crop producers may be unable to invest in new technology, “now would be the time to invest” in those technologies for many livestock farmers, Langemeier said.

“That could be more sophisticated fencing,” he said. “It could be collars to kind of track the health of the animal. It could also be drones. … If there was ever a time to invest in some of that, it would be now.”

Register here for the free Equipment Finance News webinar “High-priced used equipment inventory: The no-man’s land of equipment finance” set for Tuesday, Oct. 21, at 11 a.m. ET.