AGCO maintains growth outlook in face of tariff expansion

S&P Global’s manufacturing index hits 39-month high

Agriculture equipment OEM AGCO maintains its growth outlook for fiscal year 2025 despite expanding tariff pressures, as overall business activity in the United States remains strong.

Much like fellow agriculture OEM CNH Industrial and material handling OEM Hyster-Yale, AGCO continues to monitor the evolving tariff environment across its service regions, the company said in a statement to Equipment Finance News.

“Our goal is to limit the impact on farmers by reducing our own cost structure, working with suppliers to mitigate cost and adjusting our supply chain where possible,” the statement reads. “We’ve built mitigation strategies into our outlook.”

While AGCO still raises prices on some products as part of its tariff mitigation strategy, it does not automatically pass tariff costs on to consumers, the company said.

“Instead, we manage pricing across our portfolio to maintain market balance and competitiveness,” according to the statement. “Despite near-term challenges, we remain confident in our strategy.”

AGCO raised its net sales outlook to $9.8 billion in its July 31 second-quarter earnings release, a 2.1% increase compared to its initial fiscal 2025 forecast released on Feb. 6.

Conditions improve, risks remain

AGCO and other OEMs have a reason to be optimistic in their outlook, as manufacturing and service activity in the United States increased in August due to stronger customer demand, Chris Williamson, chief business economist at S&P Global Market Intelligence, said in an Aug. 21 S&P Global release. Still, there also appears to be some cause for concern.

“Companies … are struggling to meet sales growth, causing backlogs of work to rise at a pace not seen since the pandemic-related capacity constraints recorded in early 2022,” he said.

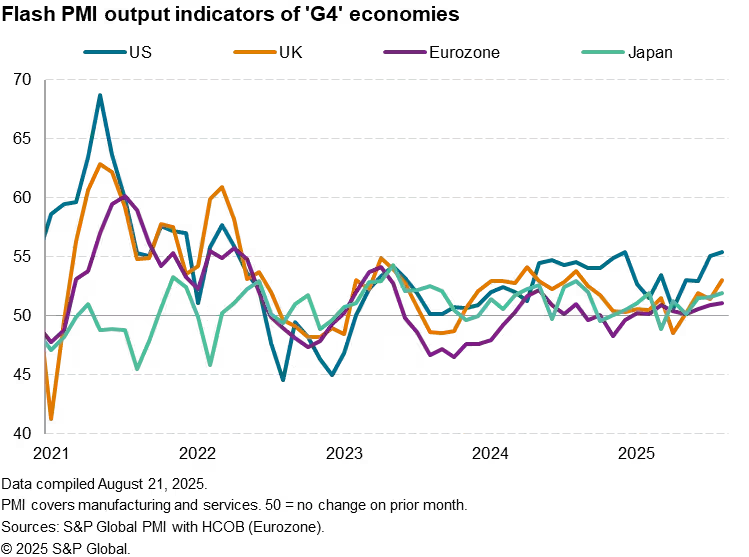

S&P Global’s Flash US Manufacturing Output Index landed at 55.2 in August, up 7.6% month over month, and 15.5% year over year, reaching a 39-month high, according to the release.

Meanwhile, S&P Global’s Flash US Composite PMI Output Index, which includes manufacturing and services production and surveys about 650 manufacturers and 500 service providers, reached an eight-month high of 55.4, a 0.5% MoM and 1.7% YoY increase.

The rising demand for manufactured goods and services has led firms to hire more while passing tariff-driven cost increases to customers, pushing inflation to a three-year high, Williamson said.

“The resulting rise in selling prices for goods and services suggests that consumer price inflation will rise further above the Fed’s 2% target in the coming months,” he said.

US, EU agree to trade framework

The United States and European Union this week reached a framework agreement on trade practices, aimed at resetting one of the world’s largest economic relationships and supporting reindustrialization, according to an Aug. 21 White House release. The pact addresses tariffs, investment, energy security, technology cooperation and standards alignment, while pledging to expand over time.

Critically, the two sides did not reach an agreement on Section 232 steel and aluminum tariffs, but agreed to explore action on both, as well as overcapacity, according to the release. Other key elements include easing financing conditions for equipment buyers and lessors by eliminating EU tariffs on U.S. industrial goods, capping Section 232 duties at 15% and reducing auto and parts tariffs.

The deal also streamlines auto standards and regulatory processes to speed cross-border equipment access, according to the release. In addition, the EU regulatory adjustments and joint supply chain measures enhance credit visibility for lenders and investors.

Check out our exclusive industry data here.