Tariffs are casting a dark cloud over the industry as equipment lenders prepare for short-term challenges while holding out hope that strong demand in some segments nullifies trepidation.

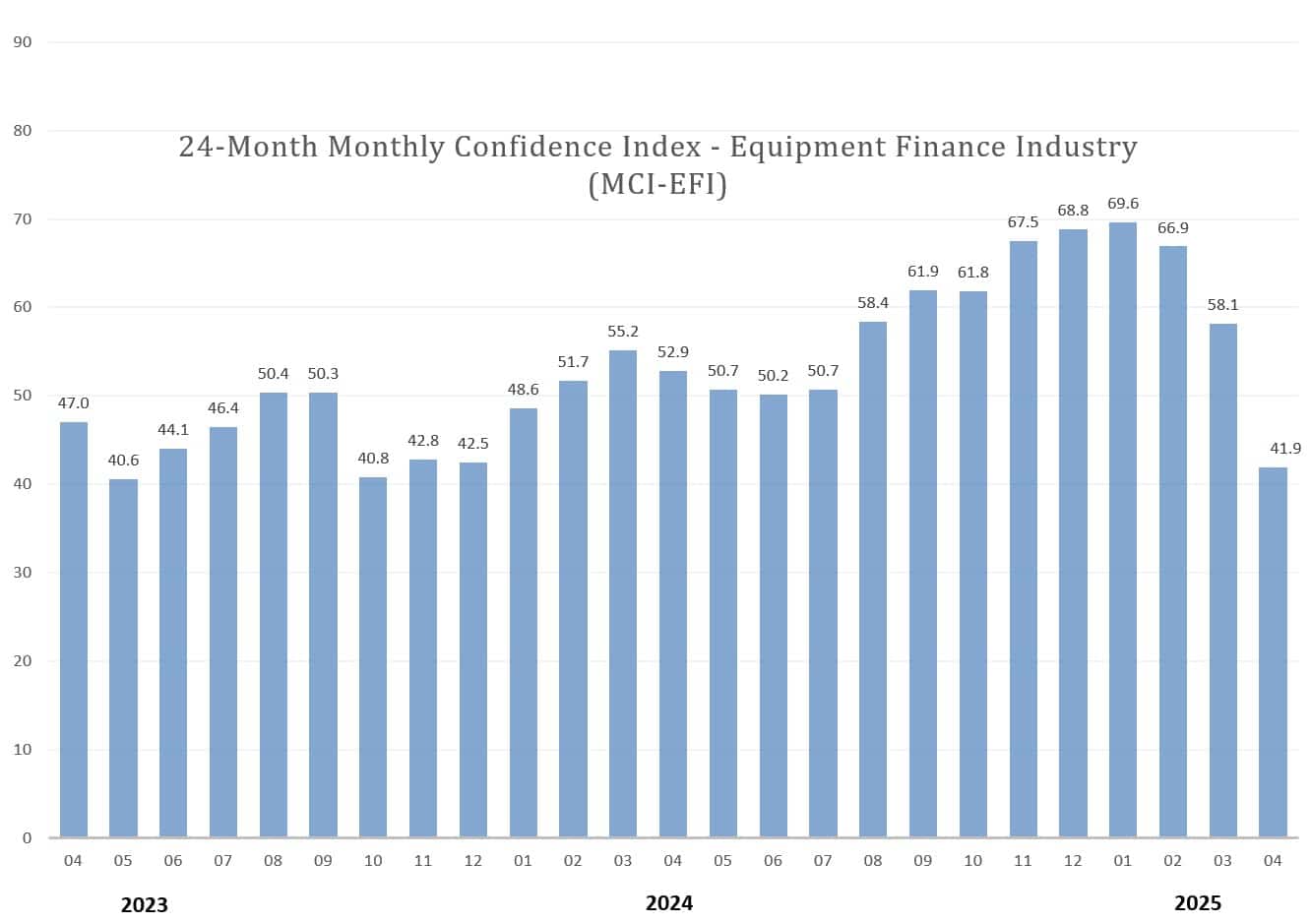

The Equipment Leasing and Finance Foundation’s (ELFF) Monthly Confidence Index fell to 41.9 in April from 58.1 in March. It was the lowest mark since October 2023 and the largest month-over-month drop in the past two years, according to an April 17 ELFF report. The report comprised responses from roughly 30 executives representing banks, independents and captives.

The decrease came despite half of the responses coming before President Donald Trump’s April 2 announcement of a universal 10% tariff. As tariffs shake the industry, lenders are experiencing “doom and gloom mixed with increased opportunities,” Charles Jones, senior vice president and equipment credit officer of Exeter, Pa.-based 1st Equipment Finance, stated in the report.

“Tariffs could lead to higher prices for parts and equipment,” he said. “They also will result in creative financing opportunities to help borrowers protect cash flow and offset higher prices for goods.”

“Once you get past the fear, it’s an exciting time to be in equipment finance.”

— Charles Jones, 1st Equipment Finance

Still, overall uncertainty is “not helping the economy in the near term,” Global Finance and Leasing Services’ Chief Executive James D. Jenks stated.

Just 7.7% of equipment lenders expect increased access to capital over the next four months, down from 21.4% in March, according to the ELFF report. About 15% anticipate business conditions to improve over the next four months, down from 28.6% in March. The number of lenders who expect increased loan and lease demand over the next four months fell to 11.5% from 32.1%.

Finding pockets of growth

As tariffs hinder equipment purchasing to some degree, targeting strong market segments and specific geographies is crucial for lenders. In North Texas, for instance, a slew of construction projects are boosting equipment sales despite tariff concerns, Matthew Isgrig, a sales representative at Landmark Equipment in Fort Worth, told Equipment Finance News.

“Of course, everybody wants to ask you about the tariffs,” he said. “But we’re busy. There’s projects going on everywhere. … You never know how things are going to go. I mean, no one could have ever predicted COVID. But I can tell you, it’s going to be busy here a long time.”

If tariffs yield higher new-equipment prices or disrupt supply chains, that could also drive up used-equipment demand and create opportunities for lenders, Paul Fogle, managing director at Carmel, Ind.-based Quality Equipment Finance, told EFN.

“New equipment could get more expensive or it could get more scarce, which obviously helps the used market,” he said. “I think that’s an opportunity for the existing inventory out there.”

The third annual Equipment Finance Connect at the JW Marriott Nashville on May 14-15, 2025, is the only event for both equipment dealers and finance providers. Learn more and register here.