Equipment financiers withstood a shaky political climate in February as they expanded their portfolios and cut back on delinquencies, potentially opening new financing avenues for dealers.

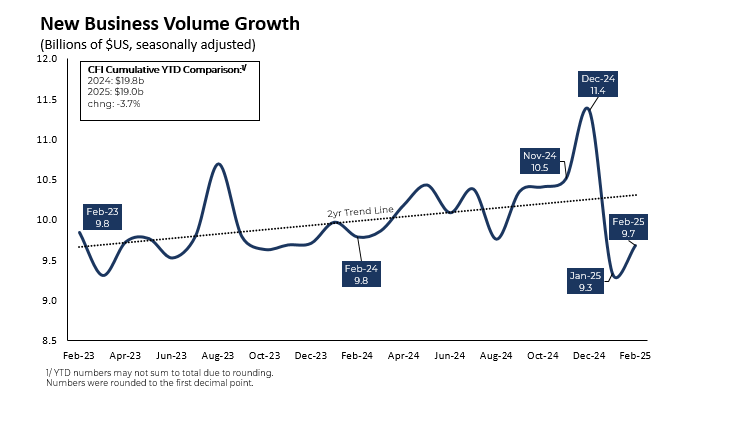

New business volume rose 3.7% month over month in February to $9.7 billion, according to the Equipment Leasing and Finance Association’s (ELFA) recently released CapEx Finance Index. That followed a 17.8% decrease in January, which was attributed to uncertainty surrounding tariffs and investments slowing after they surged in December as part of a seasonal boost.

Delinquencies of 30 days or more fell 20 basis points (bps) to 2% last month, and credit approvals continued to hover above 75%. Charge-offs rose 9 bps to 0.55% after declining in the previous two months.

Overall, credit quality “remains strong” in equipment finance, with many lenders expecting origination growth early in the second quarter, Daryn Lecy, chief operating officer at West Chester, Pa.-based Oakmont Capital Services, told Equipment Finance News.

“We have been fortunate to maintain steady growth in our originations and anticipate that to continue for the foreseeable future,” he said.

“Dealers will continue to be approached with potential new sources and many maintain multiple finance partners.”

— Daryn Lecy, COO, Oakmont Capital Services

Dealers planning to expand their lender network must “rely on the sources with a proven track record and demonstrated ability to make the financing possible,” Lecy said.

“We have seen in other cycles companies that enter the market as a shiny new object, but their staying power can be limited or they are unable to deliver on all the promises,” he said.

Weathering the storm

President Donald Trump’s tariffs — enacted and proposed — have marred equipment financiers’ short-term outlook, with economic uncertainty potentially curtailing capital investments.

While 2025 is shaping up to be bumpy, the industry has “weathered the storm” so far, ELFA President and Chief Executive Leigh Lytle stated in the report.

“We’re closely watching financial conditions for signs of erosion, but we expect the industry to have a solid year as long as the economy avoids a recession.”

— ELFA President Leigh Lytle

Improved credit quality and an abundance of capital should also support the industry as businesses look to upgrade their assets, Peter Bullen, executive vice president and group head at Superior, Colo.-based Key Equipment Finance, stated in the report.

“We are also encouraged to see a significant rebound from Key Equipment Finance clients in equipment financing demand compared to last year at this time,” he said. “At the same time, we remain vigilant of the potential impact of new tariffs and general economic uncertainty on capital spending.”

Early-bird pricing for the third annual Equipment Finance Connect ends March 28. Taking place at the JW Marriott Nashville on May 14-15, 2025, this is the only event for both equipment dealers and finance providers. Learn more and register here.