Equipment finance originations sink 18%

Credit approvals spiked to nearly 76% in January

Equipment finance demand dropped in January amid political uncertainty, but credit approvals rose as lenders cut back on their losses while expanding their offerings.

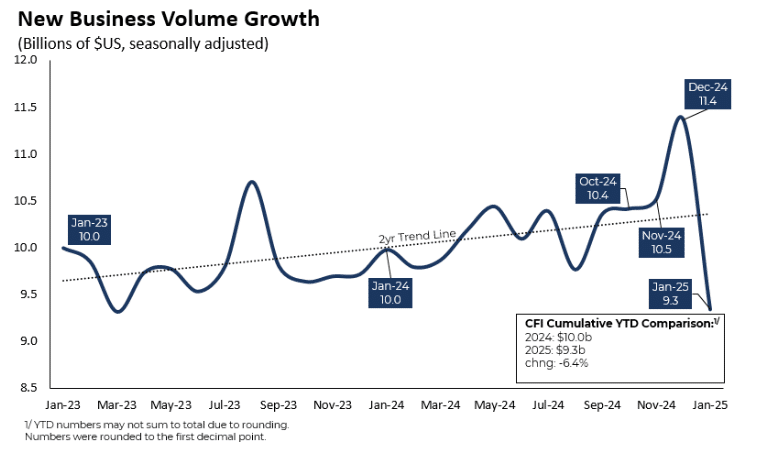

New business volume in the equipment finance industry totaled $9.3 billion in January, down 17.8% from December and ending four consecutive months of growth, according to the Equipment Leasing and Finance Association’s (ELFA) CapEx Finance Index, released Feb. 26. New business volume was down 7% year over year.

The decline, while substantial, was not unexpected given that new business volume surged 8.1% in December as part of a typical seasonal boost, driven by yearend tax breaks and expectations of bonus depreciation. The presidential election resolving in November also contributed to an especially large increase in December, an ELFA researcher previously told Equipment Finance News.

Bank originations fell more than 30% in January after a record increase of 36.2%, while independents bounced back with a 9% jump following a 5.3% decrease.

While the market is expected to normalize in the coming months, global economic and political uncertainty, such as the impact of tariffs, “could weigh on equipment demand later this year as businesses decide to pause investment until tensions subside,” ELFA President and Chief Executive Leigh Lytle stated in the report.

Nonetheless, the industry is “well prepared for an extended period of uncertainty, or whatever else may be thrown its way in 2025,” she said.

Financing climate loosens

Credit approvals rose 1.6 percentage points to 75.9% in January, marking the largest month-over-month increase since October 2023, according to the ELFA report. Banks, captives and independents all reported a higher approval rate.

Moreover, charge-offs dropped for a second straight month, down 6 basis points (bps) to 0.46%. Thirty-plus days delinquencies were up 20 bps to 2.2% and have been hovering around 2% since September.

Dealers are observing loosened lending standards among their captive finance partners, Derek Weaver, sales manager at Leola, Pa.-based Agriteer, told EFN. Agriteer mostly works with captives Agco Finance and Claas Financial Services.

“They really try to make sure financing is quick and seamless,” he said. “We’re getting quick approvals, sometimes automatic approvals if the guy has good credit. So, they’ve really done a good job streamlining finance.”

Offering flexible and frictionless financing is imperative to equipment finance growth in 2025, Mitch Rice, CEO of Lenexa, Kan.-based Commercial Capital Co., stated in the report.

“Recognizing this demand, the industry is undergoing a widespread focus on technological enhancement to deliver more efficient and effective solutions and services,” he said. “We’re embracing this shift when it comes to process automation and utilizing artificial intelligence.”

The third annual Equipment Finance Connect at the JW Marriott Nashville on May 14-15, 2025, is the only event for both equipment dealers and finance providers. Learn more and register here.