OEMs are increasingly churning out autonomous farm equipment to address critical issues facing the agriculture industry, but widespread adoption rests on dealers as they work to educate users and arrange financing.

The autonomous farm equipment market is projected to nearly double to $122.7 billion by 2032 from $63.7 billion in 2023, according to research firm Global Market Insights. Industry heavyweights such as John Deere, Kubota, New Holland and Agco have launched or unveiled new autonomous equipment in the past year.

Autonomous machines already in the market include tractors, combine harvesters, sprayers, bale movers and crop dusters. Robots and drones are also increasingly common for monitoring crops, applying chemicals and collecting data. The boom is partly attributed to the emergence of AI and advancing technologies, according to research firm Astute Analytica.

For OEMs, however, autonomous innovation is aimed at addressing key challenges facing the agriculture industry, including a significant labor shortage and high labor costs, Ryan Schaefer, vice president of New Holland North America, told Equipment Finance News.

“It’s not as attractive of a career path for many young people today as it was once upon a time,” he said. “So, the labor pool that’s available for these labor-intense jobs … whether it’s crop production, the fresh pack vegetable and fruit industry, the dairy industry or the beef industry…

“… farmers are increasingly facing a cost structure where labor is becoming the majority cost for their operation.”

— Ryan Schaefer, vice president, New Holland North America

Downfall of family farming

Hired farm workers now account for less than 1% of all U.S. wage and salary workers, despite a 4% increase in employment from 2013 to 2023, according to a Jan. 8 report by the U.S. Department of Agriculture (USDA). But this is nothing new. The number of self-employed and family farm workers decreased 73% from 1950 to 2000, and the average annual employment of hired farm workers fell 52% during that stretch.

In 2022, 53% of farmers reported labor shortages, up from 41% in 2018 and 14% in 2014, according to a June 7 study by the International Fresh Produce Association.

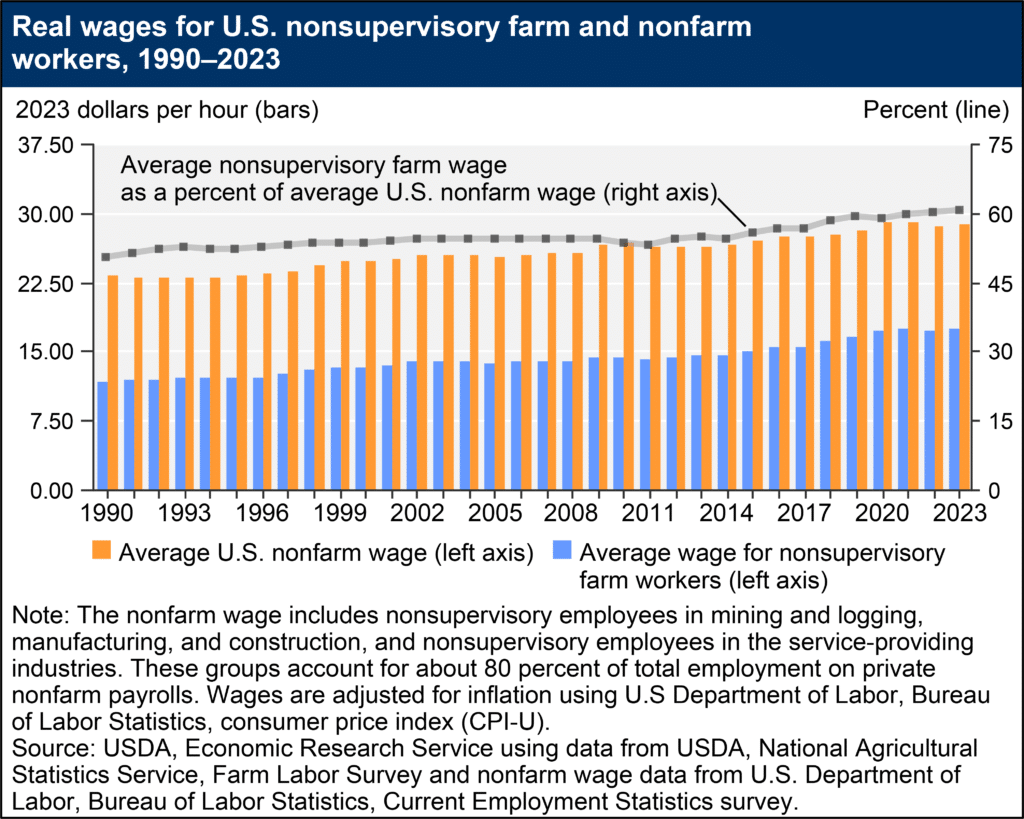

Farm wages rose 5.5% from 2022 to 2023, and they’ve increased 2.1% annually over the past five years, according to the USDA report. Farm income decreased roughly $6 billion, or 4.1% in 2024, according to USDA.

An absence of generational farming is perhaps the most glaring void in the agricultural labor pool that autonomous equipment can help fill, Chase Phelps, owner of Shawnee, Okla.-based dealership Phelps Equipment Group, told EFN.

“There used to be a lot more folks that grew up on a farm or had some type of agriculture input in their life that were available as teenagers or young adults to help a larger farm operate,” he said. “And I think those times are gone. I believe the autonomous equipment is really going to step up and kind of fill those roles.”

Innovation with a purpose

Fewer than 5% of farmers had adopted autonomous machinery by the end of 2022, according to consulting firm McKinsey and Co.

Higher upfront costs of autonomous equipment could be a cause for concern for end-users. For instance, a new John Deere 8R autonomous tractor costs around $500,000. The retail price of a Monarch Tractor MK-V model ranges from roughly $75,000 to $100,000.

Meanwhile, a traditional farm tractor typically costs between $25,000 and $50,000, and the price of a traditional compact tractor ranges from $10,000 to $30,000, according to online auction marketplace Municibid. Moreover, the average cost of an autonomous crop duster is about 43% more than a conventional model, according to online database ResearchGate.

Developing autonomous machinery to address specific solutions and practical applications is one way to drive up adoption rates, New Holland’s Schaefer said, emphasizing the importance of return on investment (ROI) for the farmer.

“We are focused highly on value-added product development,” he said. “Innovation with purpose, innovation that delivers ROI for a farmer. We try not to spend too much on innovation for innovation’s sake.”

Automating simple, repetitive tasks is crucial to delivering ROI, Kyle O’Brien, owner of Olivet, Mich.-based Michigan Dairy Tech, Indian Creek Ag and Amarillo, Texas-based Western Dairy Tech, told EFN. O’Brien’s companies offer a wide range of autonomous technologies and equipment.

“I think autonomy — and we are in its infancy of what is possible — is going to allow more accurate application of your technology, whether you’re planting or pushing up feed or milking cows,” he said.

“A machine is going to be more consistent in what it does than a human operator will be. Getting the people out of the equation not only solves the consistency part, but also the high-cost part. People are expensive. Training is expensive.”

— Kyle O’Brien, chief executive, Michigan Dairy Tech

In addition to reducing the need for manual labor, automating jobs such as planting, weeding, spraying and harvesting makes farming “more appealing by reducing the physical burden and attracting a new generation of tech-savvy individuals,” Saurabh Gupta, chief product officer at Livermore, Calif.-based Monarch Tractor, told EFN. Monarch makes fully autonomous and electric tractors.

Road to education goes through dealers

As more farmers explore autonomous solutions, education is key to widespread adoption.

Dealers must shoulder much of this responsibility, from becoming experts themselves to being hands-on with customers, Rich Wildman, managing member at Henrietta, N.Y.-based Ag To Go, told EFN. Ag To Go sells Monarch tractors, autonomous software and precision agriculture hardware.

“It’s a process for growers to first understand the potential that autonomy can bring to their business and how they could implement. And then supporting them through the implementation and guiding them through the evolution of their operations to be able to capture continual values from the autonomy. … It’s vital that we coach the farm in that process.”

— Rich Wildman, managing member, Ag To Go

It’s also imperative for dealers to be transparent about the limitations of certain autonomous equipment, Michigan Dairy Tech’s O’Brien said.

“A lot of these producers need to have patience for when it’s not right,” he said. “Everything will improve as our data sets improve. … And in time, things will get better, but it will still never be 100%. Customer education on that is very important.”

O’Brien said he encourages customers to ask about the weak points of an autonomous product before purchasing.

OEMs can support dealers in the education process by co-hosting product demonstrations that introduce farmers to the basics of autonomous technology, Monarch Tractor’s Gupta said.

“On-farm demonstrations can go a step further, allowing farmers to assess capabilities and ask questions in a practical setting,” he said. “Dealers are often the first point of contact for farmers. So, it is important for OEMS to invest in training dealers so that they can become experts in autonomous technology.”

Depreciation looms over financing landscape

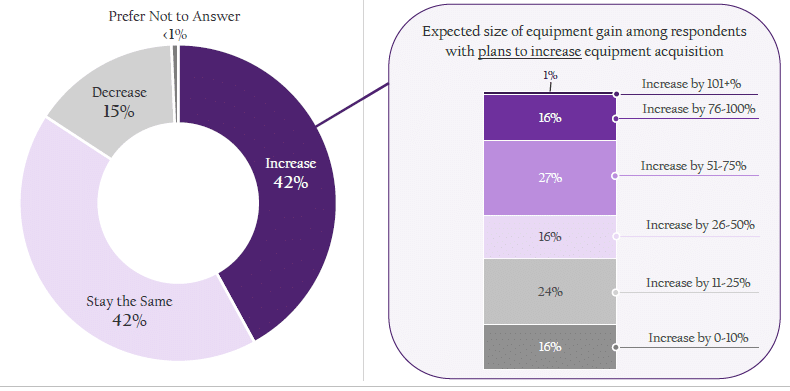

Of roughly 600 businesses in the heavy-equipment industry, 42% plan to increase their equipment and software acquisitions in 2025, according to an Oct. 28 survey by the Equipment Leasing and Finance Foundation (ELFF).

Anticipated changes of equipment and software acquisitions in 2025

While lenders are anticipating more opportunities to finance innovative equipment, rapid advancement of autonomous technology and “limited historical performance data equals residual-value uncertainty,” Mark French, president of Atlanta-based Crest Capital, told EFN.

“We’ll mitigate [this risk] by favoring shorter loan terms, enhanced portfolio monitoring and prioritizing deals with proven operators,” he said.

Dealer feedback will play a large role in autonomous equipment financing, Phelps Equipment Group’s Phelps said.

“I think if the dealer network is receptive, the financing network will be receptive, because obviously, worst comes to worst, the finance company has to resell it,” he said. “If you only have three dealers in the whole country that really want to deal with them, the resale value is just not there.”

Dealers can bolster the financing landscape for autonomous equipment by providing lenders “detailed utilization metrics and service records,” Crest Capital’s French said.

Lenders also may need to develop new financial models in which farmers are charged “based on autonomous usage rather than an upfront cost,” Gupta said. “This will allow for better alignment of incentives and accelerate the deployment of autonomous technologies.”

Leasing, rental opportunities

The most popular method for acquiring equipment and software in 2023 was leasing, which represented 26% of all transactions, according to ELFF.

Additionally, the equipment rental market is projected to grow 5.7% in 2025 to nearly $82.6 billion, topping last year’s record of $78.2 billion, according to the American Rental Association.

These growing markets present opportunities for dealers and OEMs because farmers may want to test certain autonomous applications before committing long-term, Schaefer said.

“We already have horsepower-for-rent models in many areas of agriculture,” he said. “… And I could easily see this scaling to support autonomy in other applications, definitely in those markets that have a hunger or existing appetite for autonomous solutions to address significant labor challenges.”

Michigan Dairy Tech’s O’Brien agreed.

“Everything is a lease, everything is a month-to-month payment,” he said. “All hardware is going to that too. So, like milking-parlor robots, those are going to lease and that way it’s not a capital expense that they have to amortize over years upon years.”

But ultimately, OEMs and autonomous innovators are “absolutely reliant on our network of independent dealers and the investment they make in their service and product-support organization,” Schaefer said.

“You will not see widespread adoption unless we have a network that proactively promotes autonomous solutions but also has the capability to stand behind them.”

The third annual Equipment Finance Connect at the JW Marriott Nashville on May 14-15, 2025, is the only event for both equipment dealers and finance providers. Learn more and register here.