Trucking inventory levels, values split in February

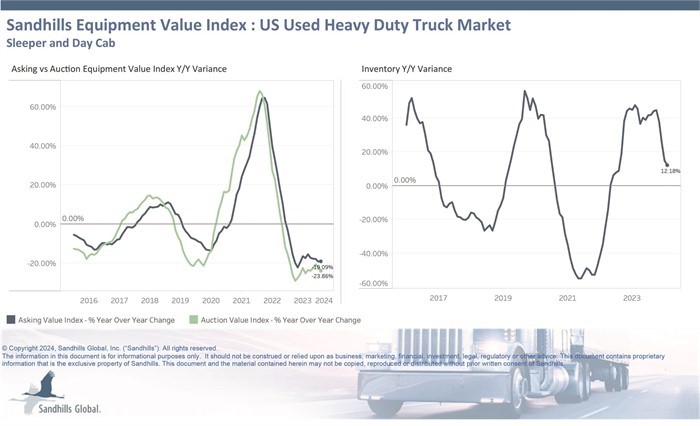

Heavy-duty truck asking values down 19% YoY

Inventory levels in the heavy-duty used-truck market decreased in February, while all other segments recorded increases.

Asking and auction values were down in February across the industry. Jim Ryan, equipment lease and finance manager at analyst firm Sandhills Global, told Equipment Finance News last month that the market is purging older units, which widens the gap between asking and auction prices.

The trucking industry is not inspiring lender confidence, as noted in the Equipment Leasing and Finance Association’s Equipment Market Forecast report published March 12. ELFA has reported this data for 34 years and noted that transportation fell nine places this year in the 13-place confidence ranking, the second-largest drop in the history of the survey.

Shipments are down and that affects demand, said Carl Chrappa, senior managing director of equipment advisory firm Alta Group’s asset management practice.

“Tonnage fell by 1.7% in 2023, and that was the worst year since 2020 during the pandemic, and that’s not a good thing,” Chrappa told EFN.

Chrappa said the numbers show “that this is clearly a service industry. If it was related to equipment moves and shipments, our GDP would be minus 10. It’d be pretty bad. The services are holding everything together and the employment rate is high because of services.” Services include consulting and ancillary support for the trucking industry, he said.

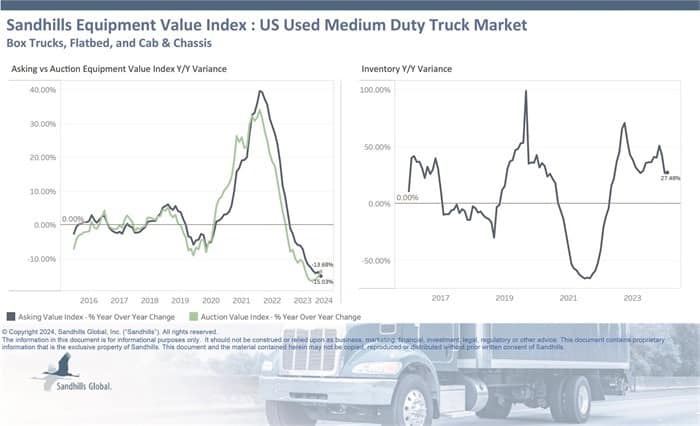

Medium-duty truck inventory rises

- Inventory levels in the medium-duty truck market were up 27.48% YoY and up 4.34% MoM.

- Values were down following months of decreases. Asking values were down 15.03% YoY and 3.05% MoM.

- Auction values were down 0.67% MoM and 13.68 YoY.

- Sandhills’ report oted the value declines tracked with the declines noted in the later half of 2022, and “were especially pronounced in the box truck category, which has been at the forefront of the downturn.”

Challenges in heavy-duty trucks

- Inventory levels of used heavy-duty trucks were up 12.18% YoY in February. Inventory levels were down 0.85% MoM.

- Asking values were down 19.09% YoY and 1.81% MoM.

- Auction values were down 23.86% YoY and 4.32% MoM. Sandhills noted this is “continuing a downward trend that has lasted for over 20 months.”

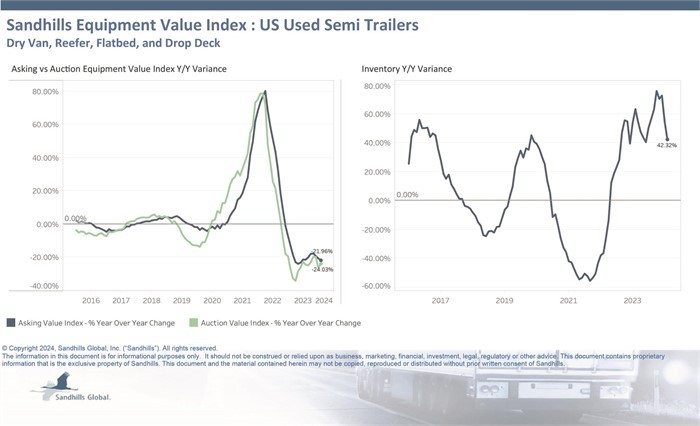

Semitrailer market faces fluctuations

- Used-semitrailer inventory was up 42.32% YoY, but fell 2.49% MoM, which the Sandhills report said indicated “a degree of stabilization” in the market. Inventory levels are trending “sideways,” Sandhills said.

- Asking values were down 21.96% YoY and 3.09% MoM.

- Auction values declined 24.03% YoY and 2.15% MoM.

Freight rates affect pricing

Values are overall lower than early 2023 and the pandemic market of 2022, said Steve Oliver, vice president of business development at truck auctioneer Taylor and Martin.

“A combination of lower freight rates and higher fuel costs started the downward trend,” Oliver told EFN, adding that, “although fuel prices have receded, freight rates have stayed the same.”

”The availability and supply of new equipment has increased, and that trickles down into a higher supply in the used market,” he said. “The combination of these things have created the lower values that we have seen in late 2023 and early 2024.”

Dry vans, which ship non-perishable goods, saw a notable change in auction values this year compared to last, and the Sandhills report stated that the segment was “exhibiting the largest inventory and value fluctuations.” Oliver said this tracks with what he’s seen in the market.

“There are pockets of strength regionally on the trailer side, and those fleets with dedicated freight have been able to make the investment in newer trailers because the pricing has been more favorable,” Oliver said. He added that Taylor and Martin has seen “pretty good stability” in the box truck market.

Alta Group’s Chrappa said heavy-duty truck prices are coming down but aren’t close to 2019 levels. This downturn in price could help flush out aging inventory, he said.

“Some of the truck prices are falling 25% to 36%, so they’re coming down pretty ferociously, but they’re still not there for the 2019 effect,” Chrappa said. “In November, they finally broke $60,000 for a [used] average Class 8 truck. So that’s what people watch, [if] used trucks can stay below the $60,000 line. That would be a sign of some kind of weakness, or if not weakness, getting into the existing opportunity.”

Falling prices might not stay around because new regulations could increase prices for trucks that are compliant. As such, dealers will likely look to stock up now.

“People are getting nervous, then will start pre-buying to try to avoid those new costs, [so] they’ll pre-buy in 2025 or 2026, and that will factor into the new truck price,” Chrappa said.

Registration is now open for Equipment Finance Connect, the nation’s only dealer-centric equipment lending and leasing event, which will take place May 5-7 in Nashville, Tenn. Learn about the event and free dealer registration at EquipmentFinanceConnect.com.