Agricultural equipment values and inventory growth slowed at auction in October as the market stabilized with the return of traditional seasonality and an expected uptick at yearend.

Stability is returning to the agriculture equipment market following pandemic-induced supply chain issues that caused inventory shortages and value spikes, with much of the current price changes the result of minor valuation corrections, Jim Ryan, equipment lease and finance manager at Sandhills Global, told Equipment Finance News.

“Inventory is still increasing on the agriculture side,” he said. “We’ve seen a bit of stability in that market, as far as pricing goes, which leads us to believe there’s some corrections and some fixes in play.”

The slowdown in value and inventory changes in the agriculture equipment industry comes as traditional seasonality returns to the market following the pandemic, Ryan said.

“We saw the seasonal dip that we traditionally see in October,” he said. “A lot of guys are in the fields as harvest begins in the fall season.”

Equipment OEM John Deere expects used agricultural equipment transactions to pick up as the marketplace returns to normal, Deere & Co.’s Director of Investor Relations Brent Norwood said during the company’s Nov. 22 earnings call.

“North American yields are coming in better than expected, which could drive some tax buying for used equipment during the remainder of the calendar year,” he said. “After three years of healthy fleet replacement levels, customers will have a little more discretion on equipment capital expenditures decisions, creating a more dynamic volume environment for the next year.”

Farm equipment values steady

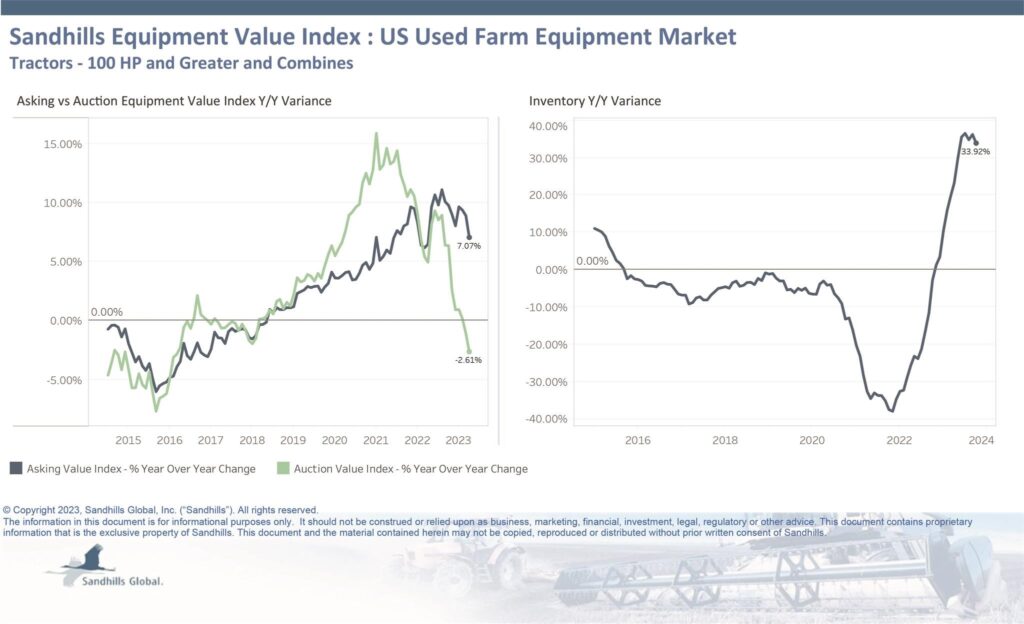

Farm equipment values and inventory remained almost unchanged on a sequential basis in October:

- Retail, or asking, values dipped 0.6% month over month for farm equipment, but remained up 7.1% year over year and are trending upward;

- Auction values for farm equipment inched up 0.2% MoM but declined 2.6% YoY;

- Inventory decreased 0.9% MoM although inventories remained 33.9% higher YoY.

“Combines have a slightly shorter useful life than other pieces of farm equipment, so over the last two to three years, we saw the fleet age come down more in combines than tractors,” Norwood said. “Right now, the fleet age is about in line with long-term averages, so that’s given producers more discretion on their combined CapEx decisions going into next year.”

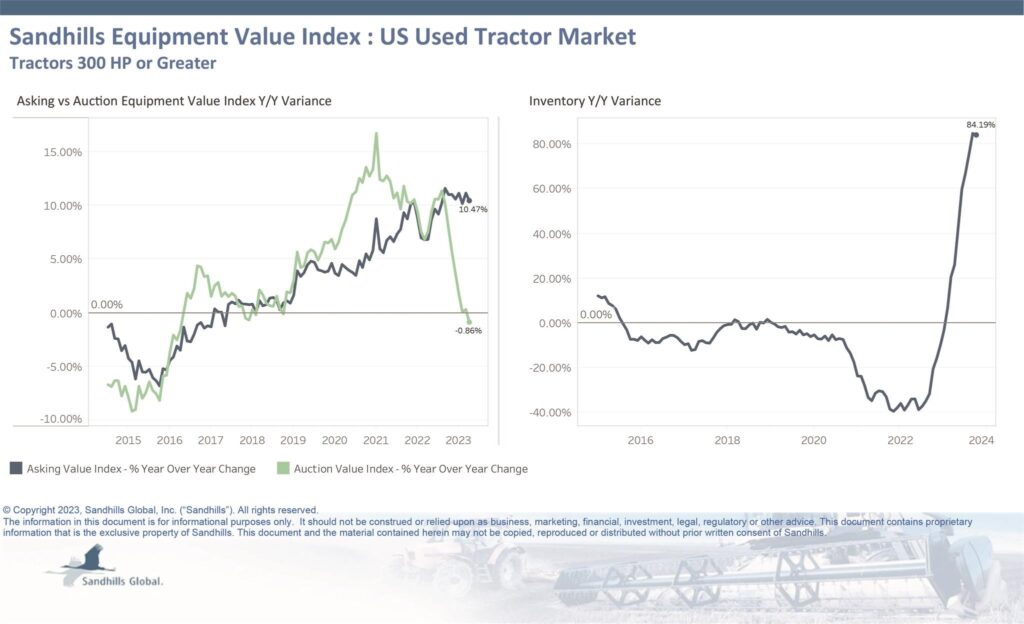

High-horsepower tractor inventory rises

Inventory increases continued for high-horsepower tractors, although values remained mostly steady sequentially, according to Sandhills.

- Retail values for used high-horsepower tractors, which are tractors over 300 horsepower, rose 0.3% MoM and 10.5% YoY;

- Auction values also inched up 0.7% MoM, but dipped 0.9% YoY;

- Inventory for high-horsepower tractors increased 3.3% MoM and 84.2% YoY.

“On the used inventory side, dealers have done an amazing job proactively managing volumes,” John Deere’s Norwood said. “Used high-horsepower tractors have recovered from historic lows, they are still about 20% below the 10-year average.”

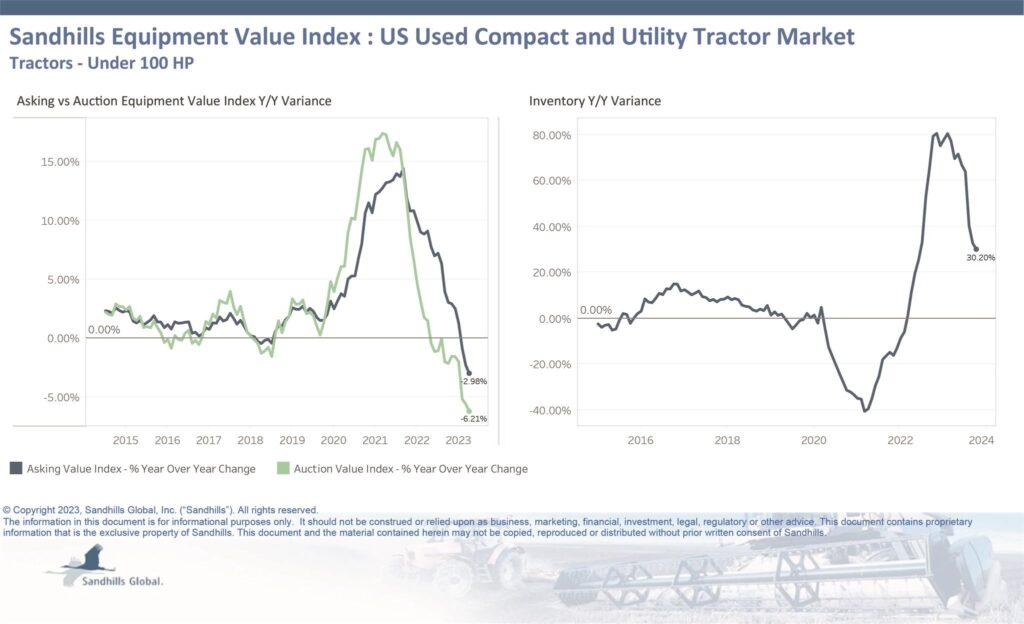

Compact and utility tractor inventories spike

Compact and utility tractor values, meanwhile, decreased slightly as inventory growth continued.

- Retail values for used compact and utility tractors inched down 0.1% MoM and 3% YoY;

- Auction values ticked down 0.8% MoM and 6.2% YoY;

- Inventory rose 6.8% MoM and 30.2% YoY.

“The compact utility ag side inventory levels are continuing to rise, and we’ve been following that for months,” Sandhills’ Ryan said. “That’s been going on most of the year, whereas the high-horsepower side began more recently than that. You’re still seeing on utility and compact tractors, auction values and asking values are down a little bit.”