Equipment finance industry digital transactions increased during the pandemic as lenders adapted to more touchless engagements.

Equipment finance e-contracting has increased by 31% over the past four years, Tim Yalich, head of motor vehicle strategy at vehicle finance software provider Wolters Kluwer, told Equipment Finance News. Despite the overall improvement over the course of the pandemic, e-contracting declined 4% year over year.

“This quarter was down a bit, and that seems to represent the industry quite well,” he said. “There’s good activity because of the government feeding some money into the industry for agricultural and solar that are impacting this segment, but we [don’t generally see] as great an amount of spending going on right now.”

While e-contracting in the equipment finance space achieved limited growth, the automotive industry saw significant growth over the same period, Yalich said.

“Over the same four-year trend on the automotive side, it was 120%, but that was driven more because of the pandemic, which forced us into touchless engagements, and the automotive industry had those platforms already in place before the pandemic happened,” he said. “On the equipment lease side, not so much, as we didn’t have as much of that type of platform in place during the pandemic”

Measuring digital transactions

Wolters Kluwer created a digital transformation index for the automotive industry in May 2022 that measures the digitalization shift. The company unveiled an equipment leasing and finance version of the index through the company’s digital asset management platform, or e-vault, in the third quarter, Yalich said.

The company’s e-vault is a digital platform used by auto lenders to manage e-contracts, Yalich said. Contracts, “whether it’s a retail installment contract or lease agreement, goes into the digital vault, or the asset platform,” he said.

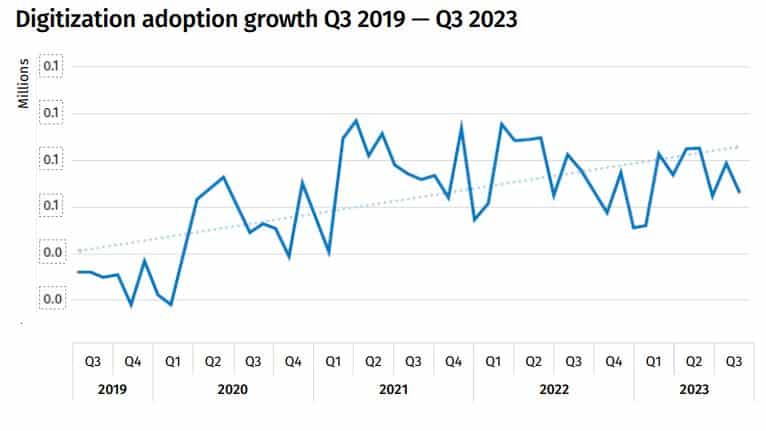

Wolters Kluwer’s Equipment Lease Finance Digital Transformation Index contains data on back-office document digitization from more than 160 of the company’s equipment finance customers, Yalich said.

“We wanted to start tracking this segment because we’re starting to see a bit of growth and trajectory in this segment of digital adoption, so this index’s purpose is to resemble that,” he said.