US inflation continues to cool, giving the Federal Reserve room to take a breather from interest-rate hikes this week. The details offer signs it might become a full stop.

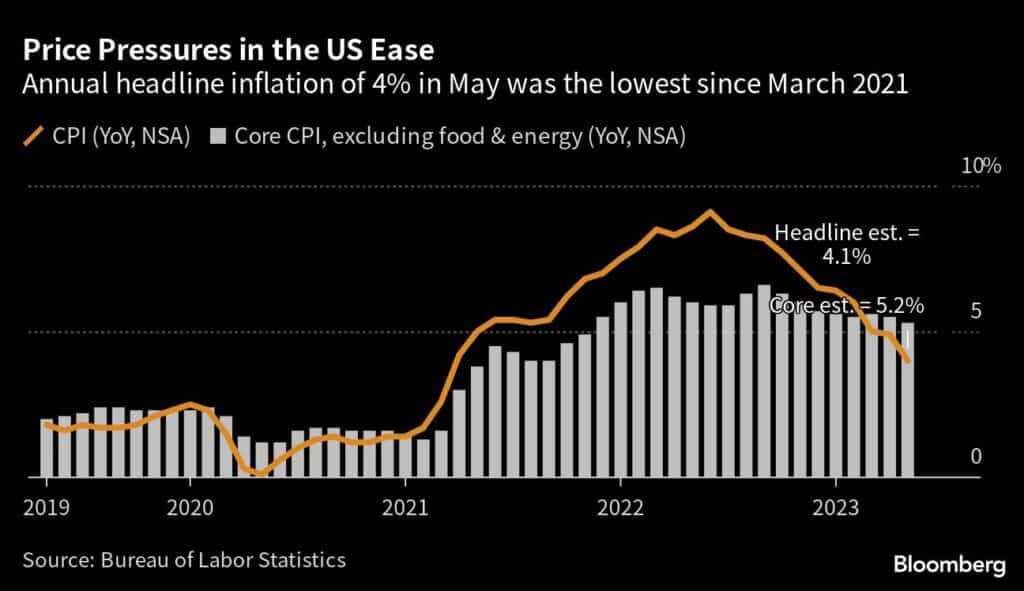

The consumer price index rose 4% in May from a year earlier, marking the smallest advance since March 2021. Core services inflation excluding housing, a category many forecasters see as key to the outlook, receded to the slowest pace in 15 months.

For the Fed, officials can breathe a sigh of relief at the beginning of a two-day policy meeting that Tuesday’s data came in as expected. While they will acknowledge that inflation remains well above their 2% target, the US central bank is still on track to skip a rate increase on Wednesday after 10 straight hikes, a decision which may very well turn into an extended pause.

“This CPI report is everything the Fed needs to pause — there is deflation and/or disinflation in every category,” Jamie Cox, managing partner at Harris Financial Group, said in a note. “If this trajectory holds in June, the need for further tightening is behind us.”

Investors marked down the odds of a rate hike this week after the report and stocks rose, though the probability of another increase in July remained a bit above 50%, according to overnight index swap prices.

Core inflation — a measure excluding food and energy items, which the Fed views as a better gauge of underlying price pressures — has been persistently elevated. Those prices rose 0.4% for a third-straight month, according to the data from the Bureau of Labor Statistics, which is roughly double the pre-pandemic pace.

What Bloomberg Economics Says…

“May’s CPI print will give the Fed space to skip a hike in June — but the slow progress in reducing core inflation highlights how unlikely it is that the Fed will cut rates this year.”

— Anna Wong and Jonathan Church, economists

But the details underneath that number were encouraging. Rising prices of used cars were a major factor preventing the core measure from slowing in May, and leading indicators compiled by the private sector suggest going forward, those prices are set to decline.

Rents, which make up the biggest portion of the index by weight, also posted monthly increases smaller than over much of the past year.

“We expect a more pronounced slowdown in core inflation in the coming months,” Wells Fargo & Co. economists Sarah House and Michael Pugliese said in a report. “That said, directional progress should not be confused with mission accomplished.”

Here are some of the main figures in the report:

| Metric | Actual | Median Estimate |

|---|---|---|

| CPI MoM | +0.1% | +0.1% |

| Core CPI MoM | +0.4% | +0.4% |

| CPI YoY | +4% | +4.1% |

| Core CPI YoY | +5.3% | +5.2% |

Fed officials like to look at an even narrower category of core inflation, services excluding housing, to assess the trajectory of the stickiest price pressures. That metric climbed 0.2% from a month earlier, according to Bloomberg calculations, which in line with pre-pandemic trends. It was up 4.6% from a year ago, representing ongoing moderation after peaking late last year.

Several Fed policymakers, including Chair Jerome Powell, have signaled they prefer to skip a rate hike at the June 13-14 policy meeting, while still leaving the door open to future tightening if needed.

And regardless of whether or not the Fed hikes again, it’s likely to resist cutting rates any time soon. Investors also marked down the odds of a rate cut by the end of the year, according to swaps.

For now, economists generally agree the central bank will leave rates unchanged Wednesday, but the next CPI report due in July will play a key role in determining what the Fed will do at its next meeting a couple weeks later.

“Such rapid headline disinflation will make it harder for the Fed to justify raising rates again, but we can’t rule out a July hike yet,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, said in a note. “Our base case remains that the Fed is done. But it will be close.”

–With assistance from Reade Pickert and Sophie Caronello.