Transportation shipments fall amid tariff uncertainty in trucking sector

TD Equipment Finance head weighs in on fleet response to tariffs

Shipments of transportation goods dipped in September as the impact of tariffs on the trucking industry remains uncertain.

Seasonally adjusted shipments for transportation fell 0.9% month over month in September, following a 0.2% dip in August, according to the Monthly Advance Report on Durable Goods Manufacturers’ Shipments Inventories and Orders, released Nov. 26 by the U.S. Census Bureau.

Tariffs under Section 232 affect trucking, directly with the 25% tariff on medium-duty and heavy-duty trucks, and indirectly through the 50% tariff on steel and aluminum goods.

Fleets are responding to the tariffs as just one challenge among many, Anthony Sasso, senior vice president and head of TD Equipment Finance, told Equipment Finance News. These challenges, he said, include:

- Economic uncertainty;

- Softening demand;

- High interest rates;

- Weak spot rates; and

- Regulatory concerns.

“What we’re seeing right now is in some verticals: delayed purchases, reassessing of spending budgets or extending replacement cycles.” — Anthony Sasso, senior vice president and head of TD Equipment Finance

“You’ve got multiple industries within that [trucking] transportation vertical. But overall, we’re seeing some of those strategies take hold,” he said.

Many fleet owners also have not yet faced meaningful sourcing or tariff-related challenges because most had purchased equipment early in the year. The full impact remains unclear until the next buying cycle in 60 to 90 days, he said.

“Dealer inventories may still be priced at some of the lower costs, pre-tariff, because sales of Class 8 trucks are down year over year, so you’re not seeing that full impact,” Sasso said. “That is something that we’re taking a close look at as we go forward to see if there are any impacts.”

Durable goods rise

While transportation goods shipments fell in September, shipments and new orders for durable goods rose.

September’s seasonally adjusted shipments for durable goods were $307.7 billion, up 0.1% MoM, following a 0.1% dip in August, according to the Census Bureau’s report.

Seasonally adjusted new orders for durable goods landed at $313.7 billion, up 0.5% MoM after a revised 3% rise in August.

The September durable goods report highlights the state of CapEx expenditures entering the final quarter of a year marked by uncertainty, with capital investment solid overall in 2025 but uneven across sectors, according to a Nov. 26 Wells Fargo research note.

“The strength has largely been concentrated in computers and electronics as well other electrical and communications equipment — or the sorts of things helping in the high-tech transition,” according to the note. The performance “does provide a modestly upbeat assessment as we hit the home stretch for 2025, in that it signaled a continued broadening in terms of the breadth of industries seeing growth.”

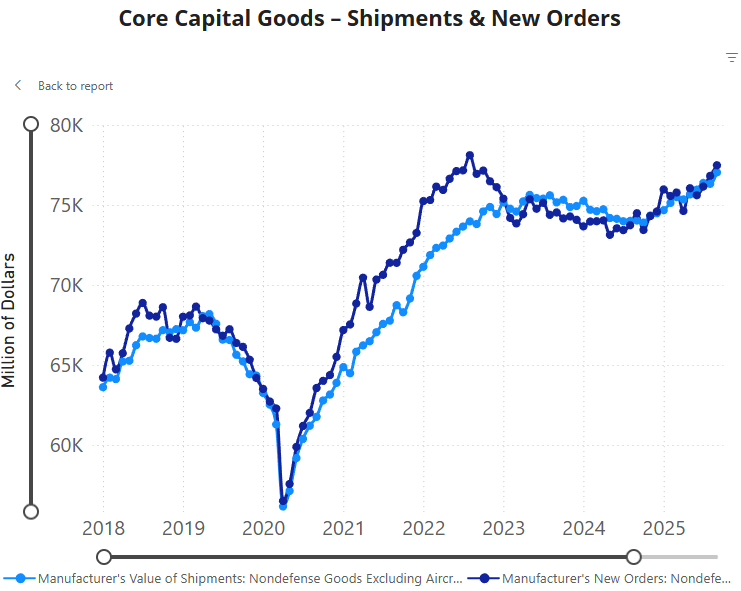

Core capital goods rise signals strength

In addition, the seasonally adjusted value of core capital goods orders, which excludes aircraft and defense equipment, totaled $77.5 billion, up 0.9% MoM for the second consecutive month. Seasonally adjusted shipments for core capital goods totaled $77 billion in September, up 0.9% MoM from a 0.1% dip in August.

The core capital goods increase wasthe sixth straight monthly gain and a 3.1% year over year increase as underlying investment activity broadens despite ongoing uncertainty, according to Wells Fargo.

“Computers and electronics and electrical equipment saw increases in September, but other older line manufacturing categories are also seeing orders pick up and, in some cases, saw upward revisions to past data as well,” according to the note. “Orders for primary and fabricated metals and machinery equipment, for example, were all up in September, and have now seen months of consecutive gains.”

Unfilled orders, total inventories

Seasonally adjusted unfilled orders for core capital goods reached $301.2 billion in September, up 0.1% MoM following a 0.2% decrease in August, according to the report. Seasonally adjusted total inventories for core capital goods hit $184 billion in September, up 0.4% from a 0.1% revised dip in August.

Seasonally adjusted unfilled orders for durable goods totaled $1.5 trillion in September, up 0.7% for the second consecutive month, according to the report. Seasonally adjusted total inventories for durable goods were $589.8 billion in September, down 0.1% for the second consecutive month.

Check out our exclusive industry data here.