Equipment finance credit approvals hit 2-year high

New business volume rose 1.7% in July

Equipment lenders are finding creative ways to close deals in the face of economic turbulence while origination volume continues to fluctuate monthly.

New business volume in equipment finance totaled $9.7 billion in July, up 1.7% month over month, following a 7.4% decline in June, according to the Equipment Leasing and Finance Association’s (ELFA) CapEx Finance Index, released today. Through July, new business volume decreased 3.8% year over year and has been seesawing in 2025.

The average credit approval rate rose 1.4 percentage points MoM to 78.2%, its highest mark in two years, according to the release. The overall delinquency rate ticked up 10 basis points to 2%, while charge-offs were unchanged at 0.5%.

July’s results show that “conditions in the equipment finance industry continue to be steady, even as economic and financial volatility remains high,” ELFA President and Chief Executive Leigh Lytle stated in the report.

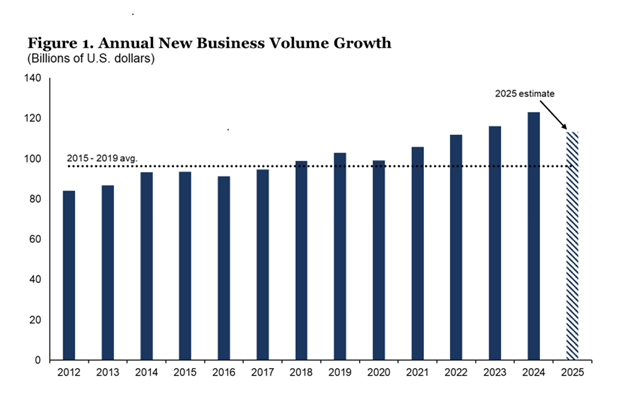

New business volume is projected to surpass $110 billion in 2025, down from last year’s record of $123.2 billion, but still “one of the best in the history of the CFI survey,” Lytle said.

High credit approvals in 2025 reflect flexibility among dealers and lenders as they work to close deals despite tariff uncertainty, high interest rates and other economic challenges.

For example, lenders are offering skip payments and “low upfront-cost loans that can get a business owner any equipment that they need,” Eduardo Cruz, president of Addison, Texas-based Commercial Equipment Financing, told Equipment Finance News.

“Business owners right now are focused on cash flow with the way the market is and what’s been happening,” he said.

Captive financing up

Increased new business volume in July was partly driven by captives, with originations totaling $2.9 billion, the highest level so far in 2025, according to ELFA.

Aggressive OEM incentives are yielding captive financing growth as interest rate buydowns, 0% APR and extended warranties benefit dealers, Matthew Isgrig, a sales representative at Landmark Equipment in Fort Worth, Texas, told EFN. Construction OEM Takeuchi, for example, is offering three-year, $3,000 warranties for new machines, he said.

“They have never done that, and I’ve been selling them for a long time,” he said. “It has helped me sell quite a bit.”

Meanwhile, bank originations rose 0.3% MoM to $4.6 billion, while financing volume remains steady among independents, totaling $2 billion to $2.1 billion every month since August 2024.

Small-ticket items — typically defined as deals valued at less than $250,000 — also contributed to last month’s growth, rising 8.3% MoM.

Check out our exclusive industry data here.