Dealers see 35% surge in new work truck, van sales

Days-to-turn increased 70% YoY in Q2

A resilient construction sector and opportunistic lenders boosted new vocational vehicle sales in the second quarter, but dealers are still flush with inventory.

New work truck and van sales at dealerships jumped 35% year over year and 12.5% quarter over quarter in Q2, according to a report by dealer service provider Work Truck Solutions. That followed a 9.1% YoY increase and an 11% QoQ decrease in Q1.

The sales surge was attributed to the wide range of vocational vehicles needed to support strong construction activity, Work Truck Solutions founder and Chief Vision Officer Kathryn Schifferle told Equipment Finance News. Utility vans and trucks, for instance, are “used for so many different vocations,” she said.

“This is a stable industry,” she said. There are “increases in housing starts, road construction, money that’s going to infrastructure. … There’s constant growth of vocational things that we need in our daily lives — landscaping, HVAC, solar installation.”

Uncertainty over tariffs also led to pull-ahead purchases in Q2, according to the report.

Plus, financing is supporting sales as more lenders shift from the beleaguered heavy-duty transportation sector to the vocational vehicle segment for portfolio growth, Schifferle said.

To this end, lenders are seeking financing opportunities for equipment such as boom trucks, lowboy trailers and heavy tow trucks, John Gougeon, president of Ann Arbor, Mich.-based UniFi Equipment Finance, previously told EFN.

Inventory still excessive

Despite higher sales, days-to-turn for new work trucks and vans rose 69.7% YoY and 12.5% QoQ as “pockets of inventory remain mismatched to their market demand,” according to the report.

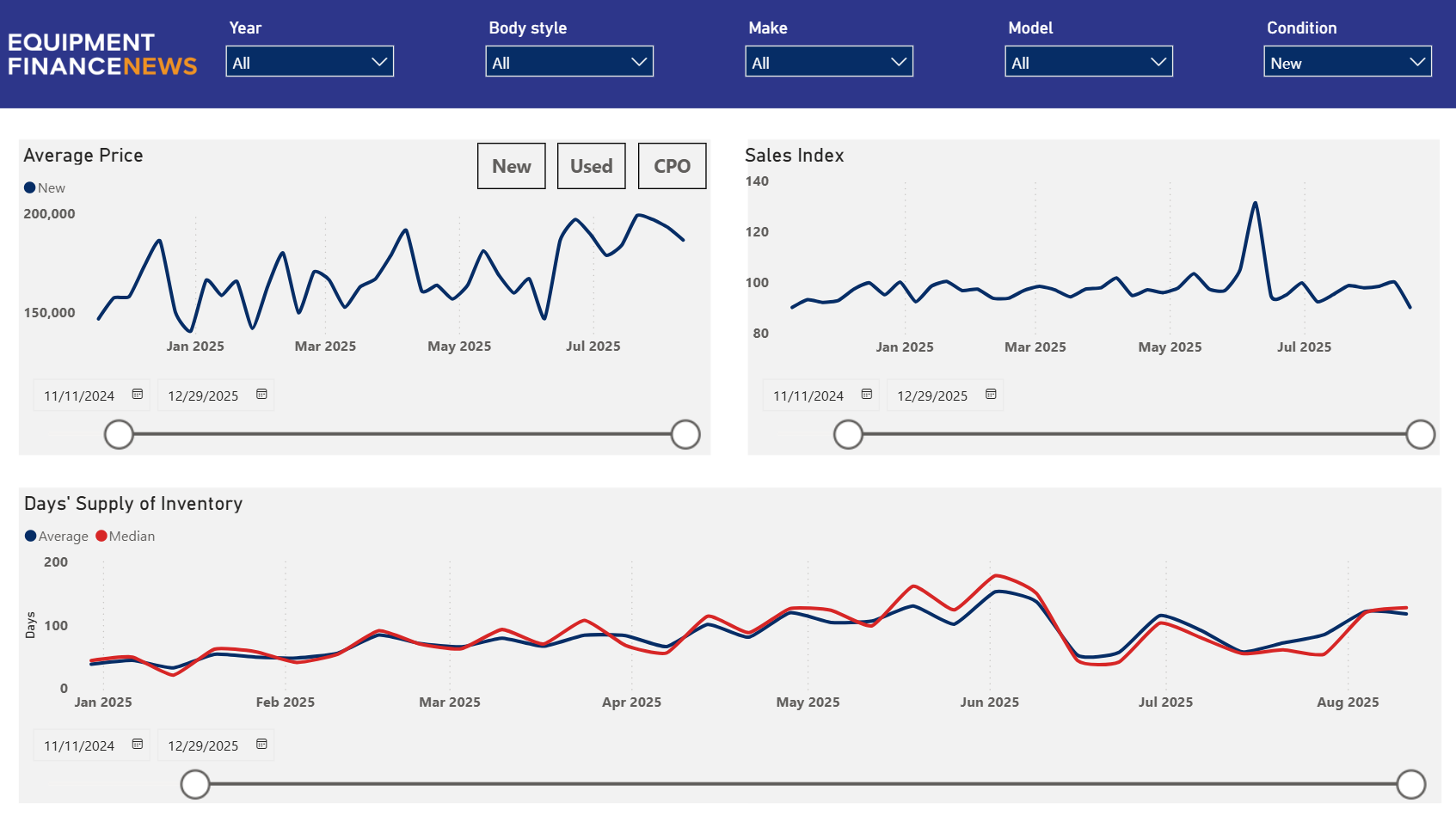

As of Aug. 11, the average inventory supply for new commercial vehicles stood at 117.7 days, up 41% since the start of Q2, according to EFN’s Average Truck Price Trends dataset.

Average Truck Price Trends

(Equipment Finance News)

The continued rise in days-to-turn comes amid greater competition among commercial vehicle dealers, Work Truck Solution Chief Executive Aaron Johnson stated in the report.

“For dealerships, this means the landscape is shifting,” he said. “Success will hinge on how well they differentiate and adapt — whether through pricing strategies, inventory mix, digital merchandising or, more likely, a combination of all of these.”

Auto dealers including Ford, General Motors and Ram also must continue to emphasize commercial sales, service and financing operations, Schifferle said.

“They’re looking at the big difference between how they manage retail operations and consumers compared to what you need to do when you’re doing [business-to-business] sales,” she said. “B2B financing is different when you go all the way down through the whole life cycle of the vehicles that are held by businesses. Everything is different.”

Check out our exclusive industry data here.