Volvo’s Truck sales decline with tariffs clouding outlook

Volvo lowered its heavy-duty truck market forecast to 275,000 units

Volvo AB’s income declined in the first quarter as uncertainty around US tariffs hit demand for trucks in North America.

Operating income fell more than analysts expected to 13.3 billion kronor ($1.4 billion), down from 18.2 billion kronor last year, Volvo said Wednesday. The company also lowered its forecast for North America’s heavy-duty truck market to 275,000 from about 300,000 for the year.

Retail sales in North America dropped 13% in the quarter, weighed down by a weaker long-haul segment. The recent uncertainty surrounding tariffs and the US emissions legislation has caused customers to adopt a “wait- and-see approach,” the Swedish truckmaker said.

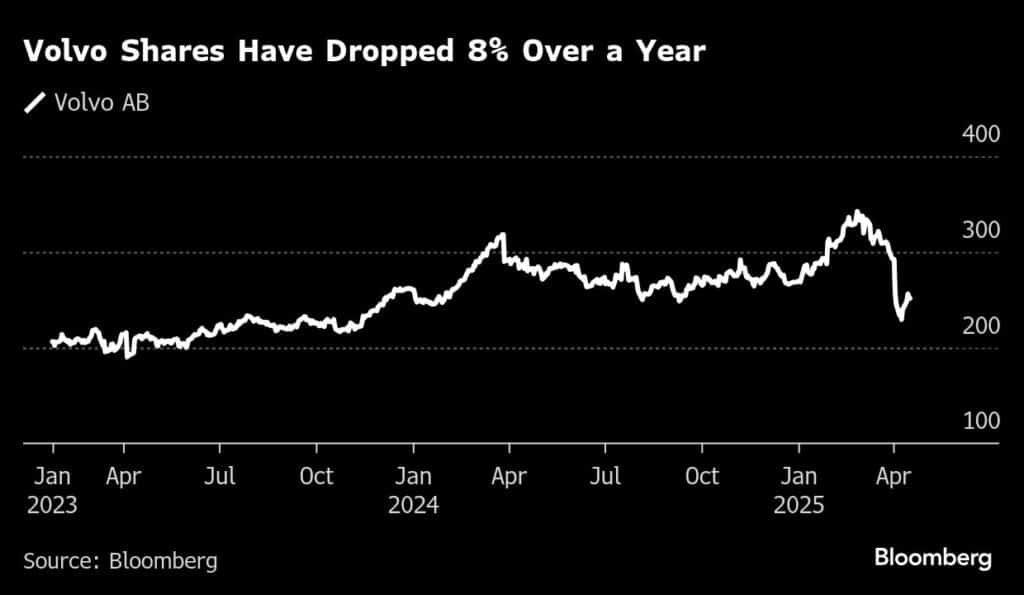

Volvo shares fell as much as 2.8% in Stockholm. The stock is down around 12% in the past year.

European truckmakers are under pressure to cut costs as softer demand in key markets and less favorable pricing weigh on profitability. The lack of clarity around US trade policies is expected to put a strain on freight markets and equipment purchases in upcoming quarters.

Volvo said over the weekend that it’s preparing to lay off as many as 800 workers at three US sites in the coming months amid the tariff uncertainty. The truckmaker, which produces all its North American trucks in the US, recently flagged that it will seek compensation from buyers as the new tariffs are set to impact the company’s cost of production.

Volkswagen AG’s commercial truck unit Traton SE — owner of the Scania and MAN brands — is also facing tougher times. The company issued a profit warning for the quarter earlier in the month citing lower deliveries and sales.

–By Rafaela Lindeberg (Bloomberg)