Used heavy-duty and medium-duty truck values fell again in June as inventories remained elevated amid tariff concerns and freight rate pressures.

Used truck asking and auction values declined, with many buyers and sellers awaiting a pricing shift to overcome the tariffs and spot rates limiting the transportation sector, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

“Traditionally, when you see the inventory levels where they’re at now is when you see a shot in the arm on pricing, but we haven’t quite seen that yet,” he said. “Tariffs, spot rates and things like that are holding that side back, but there’s some optimism on the transportation side, at least the heavy-duty truck side.”

On the heavy-duty side, class 8 late-model lease returns with fewer than 500,000 miles are starting to see more attractive pricing, and transactions are beginning to pick up in that segment, Ryan said. Meanwhile, on the medium-duty side, truck values fell for the 10th consecutive month.

Truck finance woes

While some segments continue to experience strength, truck financing remains diminished as lenders remain hesitant to return to the market due to persistent tariff and freight rate concerns, Ryan said.

“There’s not a lot of lenders that have dove back into the finance pool yet on that side, so it becomes extremely difficult when you’re a smaller player in the field compared to some of these larger fleets,” he said. “The interesting piece we’ll be able to see is just how these larger fleets manage that as the cost of new goes up.”

Still, fewer delinquencies are occurring despite the total dollar value of delinquent accounts remaining high, mainly due to over-the-road (OTR) truck assets, Paul Fogle, managing director at Carmel, Ind.-based Quality Equipment Finance, told EFN.

“Take out over the road because the freight business really hasn’t recovered to its previous highs yet, and there’s so much uncertainty in the marketplace.” he said. “It seems like the imports and boats coming over to California go up one week and down the next, but the other non-OTR assets, they’re pretty steady.”

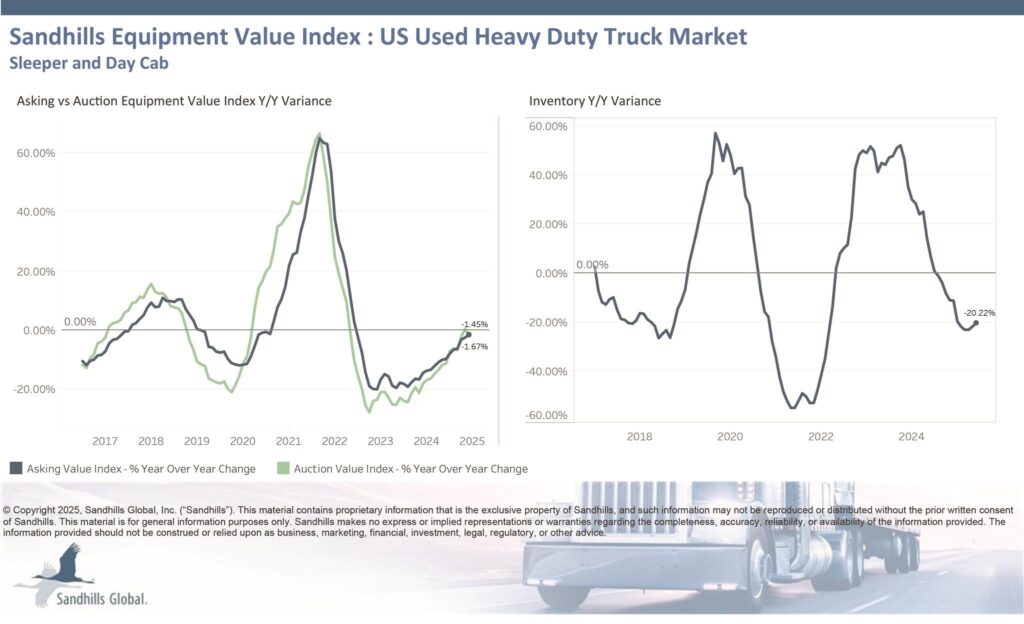

Sandhills used heavy-duty trucks

- Inventory dropped 20.2% year over year and 0.3% month over month;

- Asking values declined 1.5% YoY and 0.1% MoM; and

- Auction values decreased 1.7% YoY and 4% YoY.

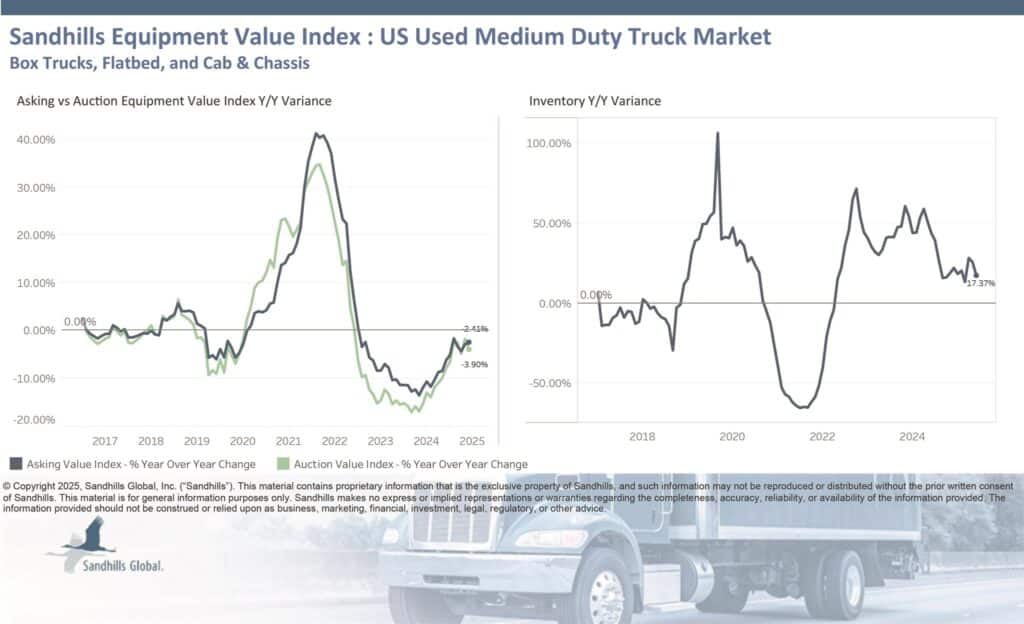

Used medium-duty trucks

- Inventory increased 17.4% YoY, but fell 6% MoM;

- Asking values fell 2.4% YoY and 0.6% MoM; and

- Auction values dropped 3.9% YoY and 3.7% MoM.

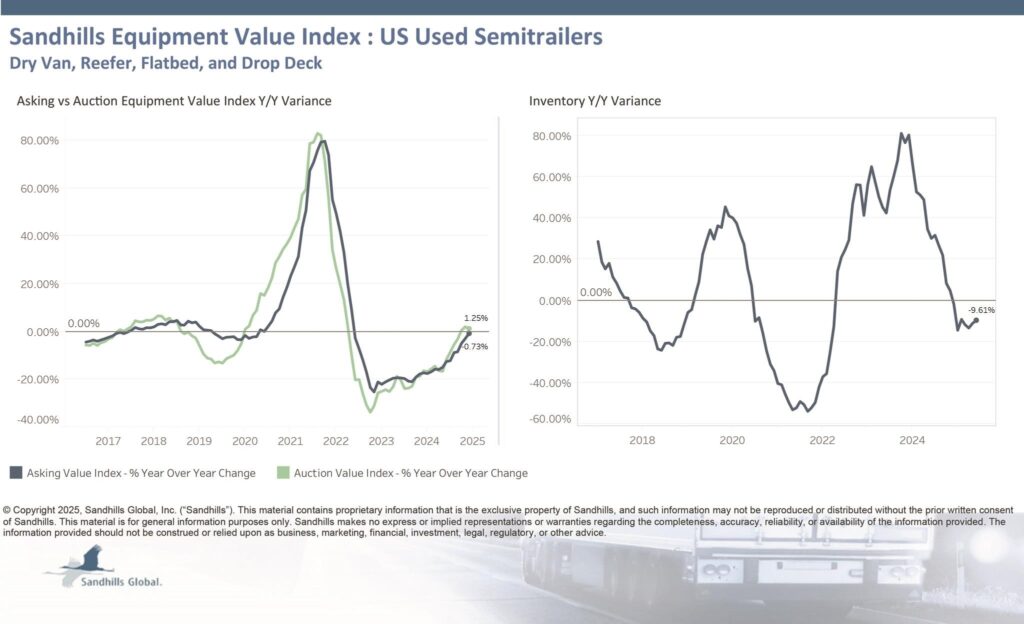

Used semitrailers

- Inventory decreased 9.6% YoY and 0.1% MoM;

- Asking values slid 0.7% YoY, but inched up 0.2% MoM; and

- Auction values increased 1.3% YoY, but declined 2.2% MoM.

Register here for the free Equipment Finance News webinar “Technologies to Advance Your Equipment Financing Business” set for Thursday, July 17, at 11 a.m. ET.