Trump plans to impose 25% tariffs on steel, aluminum imports

Steel tariffs come as Japan’s Nippon Steel struggles to buy US Steel for $14.1B

President Donald Trump plans to impose 25% tariffs on all US imports of steel and aluminum, broadening his trade restrictions to some of the country’s top trading partners and seeking to protect domestic industries that helped him win battleground states last year.

Speaking to reporters Sunday on Air Force One, Trump said the tariffs would apply to shipments from all countries, including major suppliers Mexico and Canada. He didn’t specify when the duties would take effect. Shares of steel and aluminum makers rose.

The president also said he would announce reciprocal tariffs this week on countries that tax US imports. Those would be enacted “almost immediately” after an announcement, Trump said, without providing further detail.

The Trump administration is likely to impose the tariffs under Section 232 of the Trade Expansion Act, according to a person familiar with the matter who requested anonymity to discuss the move before it’s official. The provision gives the president broad authority to restrict trade on domestic security grounds and was used in his first term to apply global duties on steel and aluminum imports. No exemptions are currently planned, the person said.

Sunday’s announcement is Trump’s latest in a series of threatened tariffs on countries and specific sectors that have rattled markets in recent weeks. Yet it’s uncertain whether he’ll follow through — he announced, then paused, tariffs on Canada and Mexico, while proceeding with a 10% levy on all shipments from China.

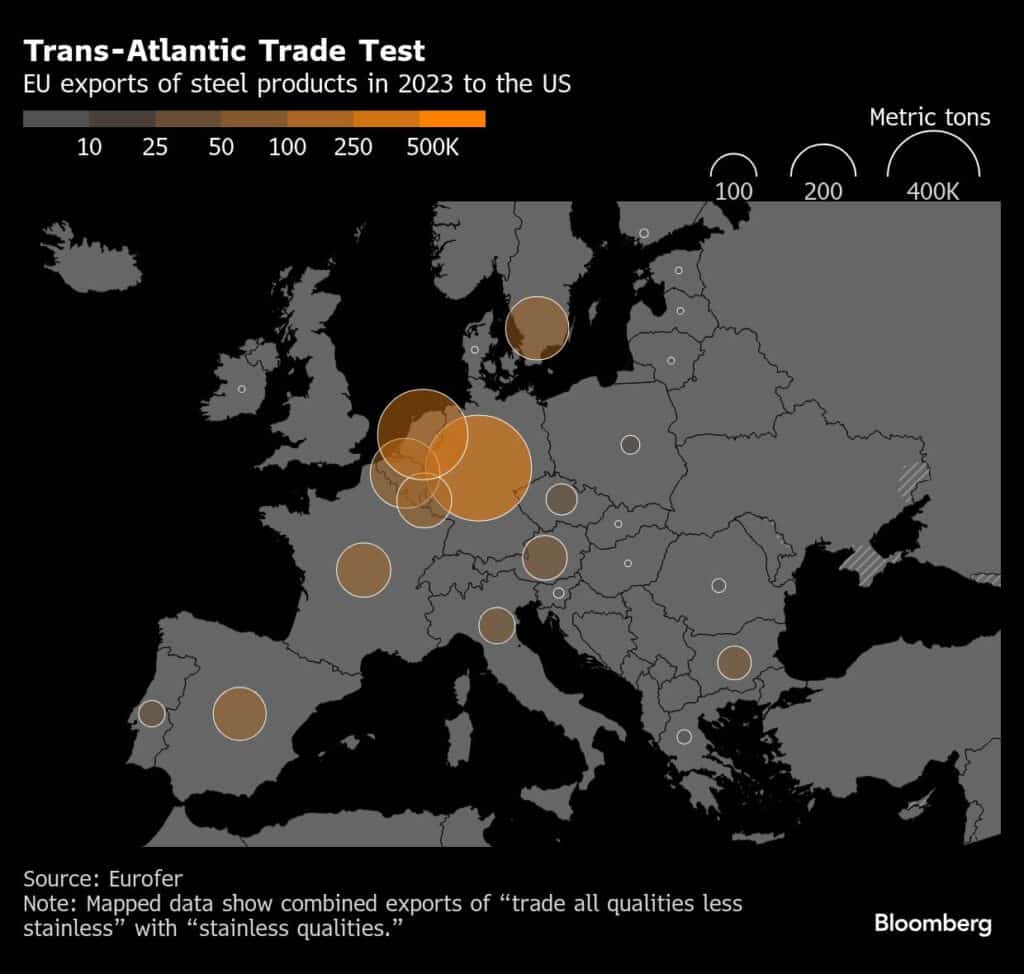

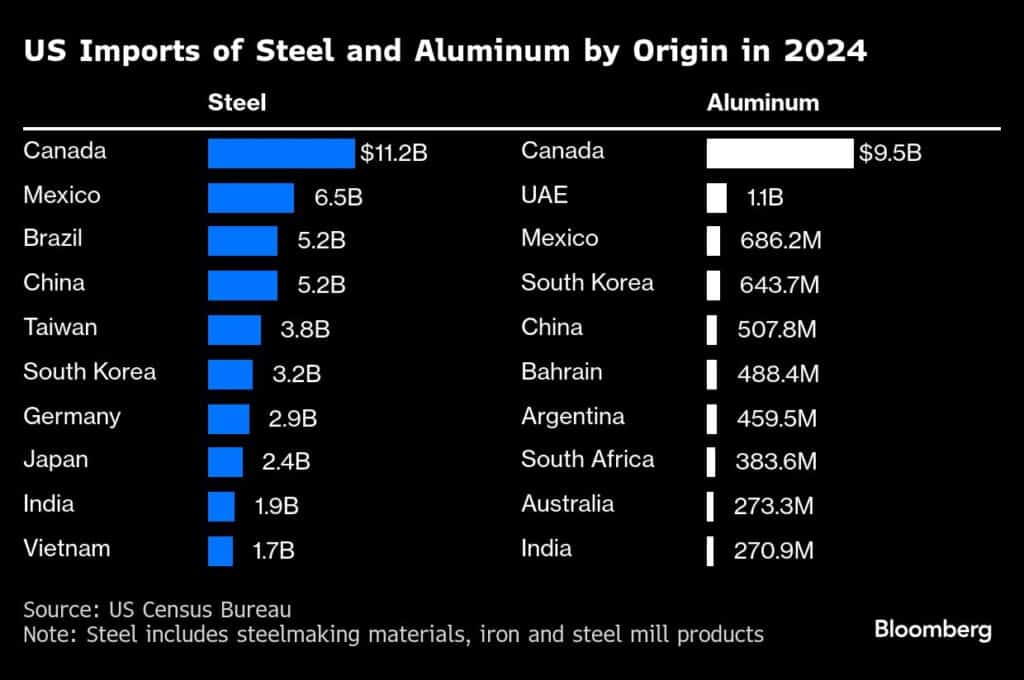

The US relies on aluminum imports from countries including Canada, the United Arab Emirates and Mexico, to meet the vast majority of demand — net imports added up to more than 80% in 2023, according to Morgan Stanley. Steel imports account for a smaller portion of overall consumption, but are vital for sectors leaning on specialty grades, including aerospace, auto manufacturing and energy, from wind developers to oil drillers.

Some oil companies won exclusions from tariffs on the metal during Trump’s first term.

Shares of metals producers Alcoa Corp., Cleveland-Cliffs Inc. and United States Steel Corp. rose after after Trump’s announcement. Shares of US carmakers — big users of steel and aluminum — were mixed, with Ford Motor Co. and Stellantis NV little changed and General Motors Co. down 1.4% around midday.

Many steel and aluminum buyers and sellers had expected they would have at least until March to prepare for any tariff implementation. Both sides will now have to scramble to find new markets and suppliers.

EU Fight

For the European Union, the fight over American metals tariffs started in 2018 during Trump’s first term, when the US hit nearly $7 billion of European steel and aluminum exports with duties, citing national security concerns. At the time, officials in Brussels scoffed at the notion that the EU posed such a threat.

The 27-nation bloc retaliated by targeting politically sensitive companies with retaliatory duties, including Harley-Davidson Inc. motorcycles and Levi Strauss & Co. jeans.

The two sides agreed to a temporary truce in 2021, when the US partly removed its measures and introduced a set of tariff-rate quotas above which duties on the metals are applied, while the EU froze all of its restrictive measures.

At the end of March, suspended EU tariffs on about $3 billion of US products are set to snap back into place, and the US quotas that replaced the punitive duties will expire at the end of the year.

On Monday, the European Commission, which handles trade matters for the EU, said it won’t respond until it has more details on the planned measures. But a spokesperson for the commission said that the imposition of duties “would be unlawful and economically counterproductive.” Previously, the EU has said that it would “respond firmly to any trading partner that unfairly or arbitrarily imposes tariffs on EU goods.”

A European government official said that unfreezing tariffs that the EU imposed on the US after steel measures introduced by Trump during his first term, which are on pause until the end of March, would be quick to do procedurally should that be the EU response.

In comments on CNN television, French President Emmanuel Macron cautioned against the use of tariffs given how connected the European and US economies are. Asked if he’s prepared to counter any of Trump’s moves on trade, Macron said “I already did so and I will do it again.”

Asia’s Response

In Asia, exporters like South Korea, which sells both aluminum and steel to the US, have already been seeking other markets. South Korea’s steel shipments are currently about 70% of the annual average for 2015-2017, before the first Trump trade blitz, though by value the US remains the largest destination for its steel. The country’s trade ministry said it was closely monitoring the US situation.

Trump didn’t clarify whether or not imports of metal from China would face double tariffs, given he has already imposed a 10% tariff on Chinese goods.

In response to the blanket duty, Beijing last week announced retaliatory measures that were set to take effect on Monday. Those were more calibrated in scope, targeting only imported goods from the US valued at $14 billion in 2024.

“Protectionism leads nowhere, and trade and tariff wars have no winners,” said Foreign Ministry spokesman Guo Jiakun on Monday, deferring questions on Trump’s tariffs to other authorities. The Commerce Ministry didn’t immediately respond to a request for comment.

Australian Prime Minister Anthony Albanese told parliament on Monday that he had a scheduled conversation with Trump and would seek an exemption for the country’s steel and aluminum exports.

Tariff Ambitions

The scale of Trump’s overall tariff ambitions remains unclear. His willingness to reverse course on occasion has reinforced the perception that the new president is using his pronouncements on levies primarily for leverage in negotiations.

“As we’ve already learned from President Trump’s first few weeks in office, it’s best not to second-guess, or even third-guess, his tariff strategy until they’re firmly in place and actively applied to trade,” said Atilla Widnell, managing director at Navigate Commodities.

Trump delayed tariffs he threatened to impose on imports from Mexico and Canada to March after they offered modest proposals to increase security at the borders. He has said he would impose duties on goods including pharmaceuticals, oil and semiconductors and said he’s considering import duties on the European Union.

Yet he has also alternated between tough talk against Beijing and signals that he wants to work with China’s President Xi Jinping as he seeks more balanced trade. The US president has ordered an agreement he signed in 2020, known as the Phase One deal, to be reevaluated, suggesting tariff talks with China could drag on.

The president has embraced tariffs as a centerpiece of his bid to remake the US economy, shrink trade deficits and find new sources of revenue to help deliver on his tax agenda. The moves threaten to wreak economic havoc, with economists saying the levies will raise costs for US manufacturers who import goods, raise prices for consumers already weary from inflation, reduce trade flows and fail to bring in the revenue Trump has predicted.

Steel and aluminum were among Trump’s earliest tariffs during his first term, implementing a 25% duty on steel and a 10% duty on aluminum in 2018 on grounds of national security.

The US steel industry is looking to recover from its worst year since Trump’s first term in office. Domestic steelmakers have complained that a renewed uptick in imports has hurt their profits and production numbers.

Analysts said on Monday that US steel mills, currently running below full capacity because of high costs, would have to crank up production to compensate for lower imports.

The steel tariffs also come as Japan’s Nippon Steel Corp. struggles to buy US Steel for $14.1 billion. The transaction was blocked by former President Joe Biden and is also opposed by Trump.

On Friday, after a meeting with Japanese Prime Minister Shigeru Ishiba, Trump said that Nippon Steel is now considering investing in US Steel instead of purchasing the company outright. Trump told reporters on Sunday that Nippon Steel cannot have a majority stake in the US firm.

“I don’t want US Steel being owned by a foreign country,” Trump said. “All they can have is an investment.”

The two companies are challenging the US block on the deal in court.

— By Josh Wingrove (Bloomberg)