Transportation values continue months-long drop

Semitrailer inventories rose 39% YoY

Auction values for semitrailers, medium-duty trucks and heavy-duty trucks continued declining in June as the market dealt with tightening credit standards.

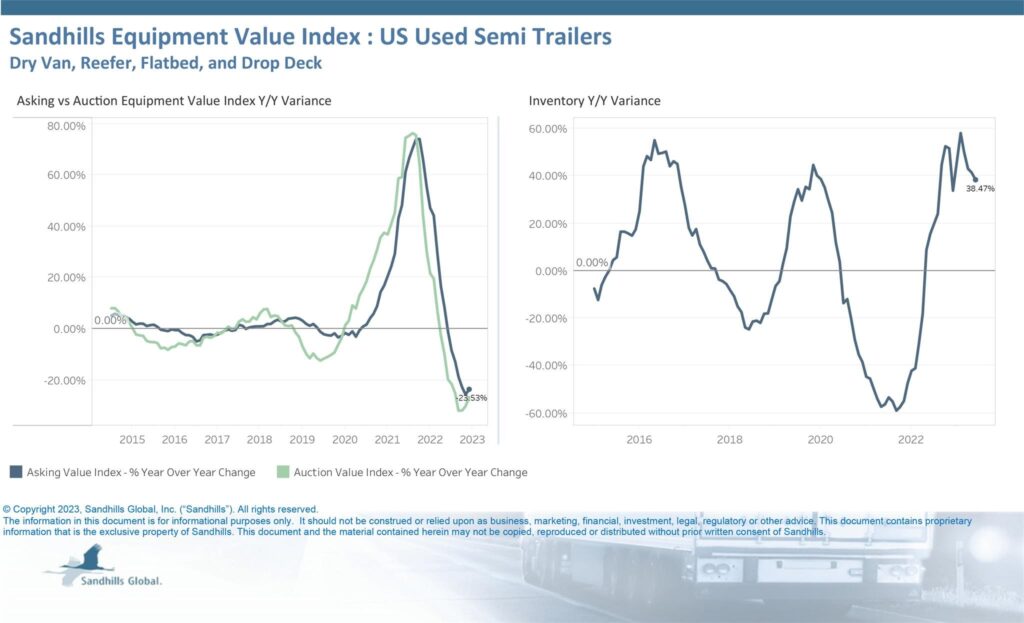

Asking values for used semitrailers fell 1.8% month over month in June and 23.5% year over year. Meanwhile, auction values declined 3.3% MoM and 27.7% YoY, according to Sandhills Global market reports. Inventory for used semitrailers increased 1.7% MoM and 38.5% YoY.

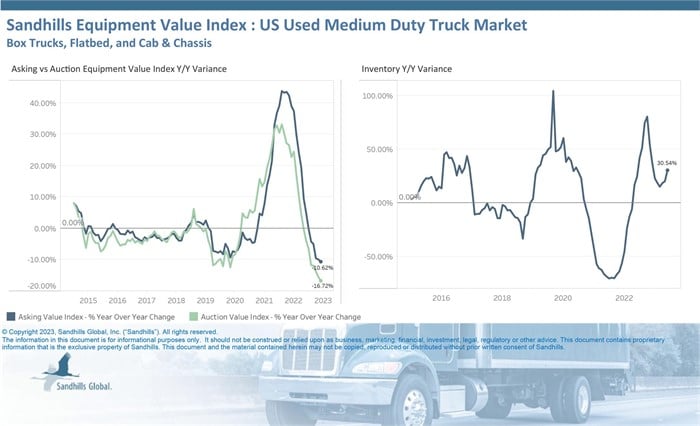

Values for used, medium-duty trucks continued their monthly trend of declining 2% to 4% in June, with asking values falling 2.5% MoM and 10.6% YoY, while auction values fell 4% MoM and 16.7% YoY, according to Sandhills. Inventory for used medium-duty trucks increased 8.6% MoM and 30.5% YoY.

“The biggest change we saw on the trucking side was the medium-duty trucks, as inventory jumped on those medium-duty trucks about 8.5% in the month of June, which was one of the larger jumps for the medium-duty so far this year,” Jim Ryan, equipment lease and finance manager at Sandhills Global, told Equipment Finance News.

“As far as trends go, inventory levels are increasing, values still taking that slow decline, but medium-duty trucks had a big jump,” he said.

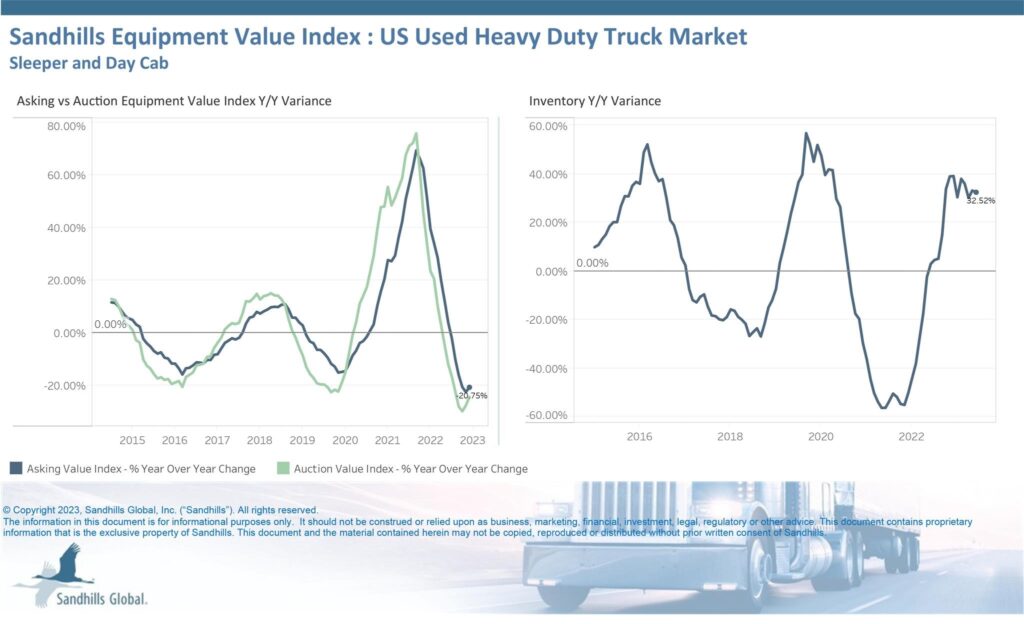

Asking and auction values for used heavy-duty trucks extended their long-term decline, with asking values declining 1.5% MoM and 20.8% YoY and auction values declining 2.1% MoM and 24.4% YoY, according to Sandhills. Like semitrailers and medium-duty trucks, inventory for used heavy-duty trucks increased in June, up 4.5% MoM 32.5% YoY.

The increase in inventory was led by a flood of day cabs coming to market, Ryan said. “On the heavy-duty truck side, it’s really been this past month that day cabs have been hitting the market,” he said. “Our whole conversation’s always been fleet trucks — sleeper trucks, basically —but the day-cab market had the biggest impact on that jump of about 4.5% last month with more day cabs coming onto the market.”

Tightening credit standards

With tightening credit standards and rising interest rates following the pandemic and the recent banking crisis, securing financing in the transportation industry is more difficult, Ryan said.

“On the trucking side, for the financing realm, it’s becoming harder and harder; there’s higher interest rates and higher down payment required a lot of [the] time,” Ryan said. “Coming out of the pandemic, [there’s] a lot of repos and lease returns on the heavy-duty truck side, as lenders are becoming a little shy to lend to owner-operators and smaller operations.”