US inflation rose by less than forecast in April amid tame prices for clothing and new cars, suggesting little urgency so far by companies to pass along the cost of higher tariffs to consumers.

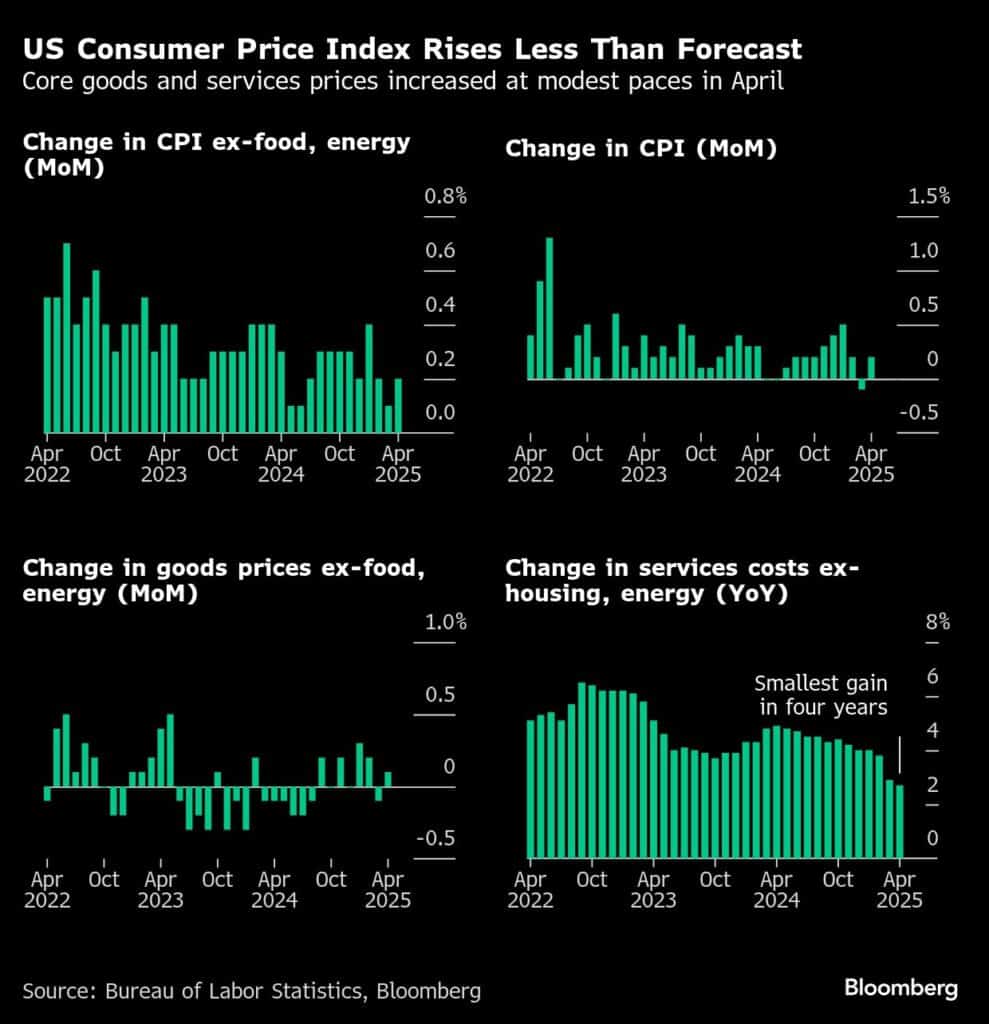

The consumer price index, excluding the often volatile food and energy categories, increased 0.2% from March, according to Bureau of Labor Statistics data out Tuesday. That marked the third-straight month of softer-than-forecast readings.

The CPI report highlights two underlying dynamics in the economy. Goods categories exposed to higher tariffs, including new cars and apparel, didn’t see the kind of price increases that economists had expected by now. That suggests importers and retailers are absorbing some of the extra costs and imported products sold now had arrived before the brunt of the tariffs — namely on China — were in effect.

Separately, some weakness in services categories like travel and recreation suggest consumers are cutting on leisure and other discretionary spending.

The temporary agreement reached over the weekend to de-escalate the trade war with China has largely scaled back projections of how much damage tariffs will inflict on the economy. While several economists say the US is now likely to avert a recession, the duties will still keep inflation well above the central bank’s target.

The 90-day reprieve — a move that brought the combined 145% US levies on most Chinese imports down to 30% — suggests some relief. But should the catch-up period to restock supply create congestion at ports, that may actually lead to faster price increases in the CPI, according to Bloomberg Economics.

And even with the reduction, US importers are still wrestling with higher trade costs and fear they could jump again when the pause is up.

The limited pass-through from tariffs could be seen in so-called core goods prices, which exclude food and energy and barely rose in April, per the CPI data.

“We might be in a bit of a sweet spot right now for core inflation trends. Core goods prices have yet to reflect the impact of the tariff hikes that have taken place since February, while services inflation continues to gradually ease,” Brian Coulton, chief economist at Fitch Ratings, said in a note. “Core goods inflation is likely to pick up in the next few months as inventories of goods imported pre-tariff hikes get depleted.”

| Metric | Actual | Estimate |

|---|---|---|

| CPI MoM | +0.2% | +0.3% |

| Core CPI MoM | +0.2% | +0.3% |

| CPI YoY | +2.3% | +2.4% |

| Core CPI YoY | +2.8% | +2.8% |

The S&P 500 opened higher, Treasuries extended a rally and the dollar fell following the data.

Given the extreme uncertainty of how the tariffs will evolve and how they’ll ultimately impact the economy, the Federal Reserve is keeping interest rates on hold for the foreseeable future. The soft inflation data offered support for bets on at least two rate cuts this year.

Companies from Nintendo Co. to Procter & Gamble Co. have suggested that they’ll try to pass on the cost of tariffs to consumers. However, the extent of their pricing power is unclear as demand slows. Consumer spending in retail sales data — which largely captures outlays for goods — was probably flat in April, ahead of a report due Thursday.

Elsewhere in the CPI data, grocery prices declined by the most since 2020, dragged down by the biggest drop since 1984 in egg prices. However, prices of furniture and appliances — goods that are largely imported — jumped.

What Bloomberg Economics Says…

“The report shows that the inflation impacts of Trump’s tariff policy have to be considered side by side with the indirect impact on services. Given the relatively higher importance of services in the CPI, disinflation in that sector could offset inflation in goods prices – as April’s report shows.”

— Anna Wong and Stuart Paul. To read the full note, click here

While all eyes have been on the impact tariffs will have on goods prices, one of the key drivers of inflation in recent years has been housing costs — which are the largest category within services. Shelter prices picked up to a 0.3% increase, led by rents.

Excluding housing and energy, services prices climbed 0.2% after declining in March. From a year ago, those costs advanced 2.7%, the weakest pace in four years. While central bankers have stressed the importance of looking at such a metric when assessing the overall inflation trajectory, they compute it based on a separate index.

That measure — known as the personal consumption expenditures price index — doesn’t put as much weight on shelter as the CPI, which helps explain why it’s trending closer to the Fed’s 2% target. A government report on producer prices due Thursday will offer insights on additional categories that feed directly into the April PCE, which is scheduled for later this month.

In addition to seeking fairness in bilateral commerce and shoring up national industrial security, the Trump administration contends tariffs will help stoke domestic manufacturing and investment over the longer term. Critics contend that the tariffs themselves are actually adding to a host of challenges already inhibiting reshoring.

Central bankers also pay close attention to wage growth, as it can help inform expectations for consumer spending — the main engine of the economy. A separate report Tuesday that combines the inflation figures with recent wage data showed real average hourly earnings climbed 1.4% from the year before, matching the highest since October.