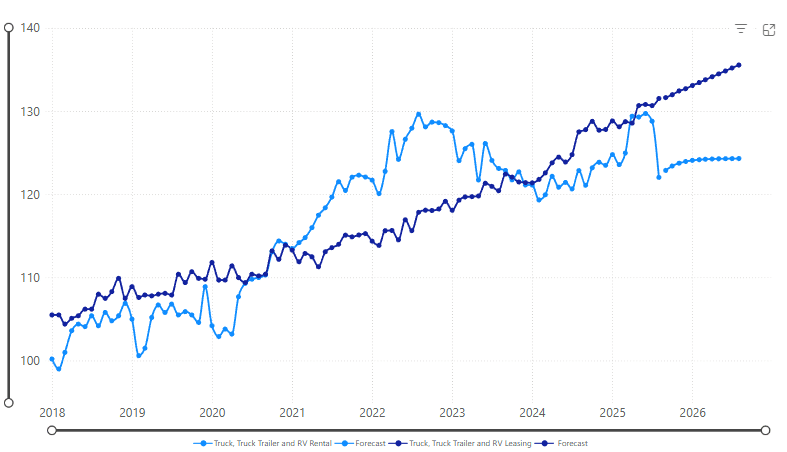

Truck, trailer, RV leasing price forecast rises 3.1% YoY

Rental price forecast rose 1.9% YoY

Truck, trailer and RV equipment leasing prices are forecast to increase in the first half of 2026, the result of higher tariffs and potential interest rate cuts by the Federal Reserve.

Leasing and rental prices are expected to improve during 2026, according to Equipment Finance News’ Equipment Pricing Index and Forecast, based on data from the U.S. Bureau of Labor Statistics and the Chicago Mercantile Exchange. The index for truck, trailer and RV lease prices is forecast to be 135.6 by August 2026, up 3.1% year over year, while the rental forecast is 124.3 by August 2026, up 1.9% YoY.

Index & Forecast: Truck, Truck Trailer and RV Pricing

Forecast Source: Equipment Finance News

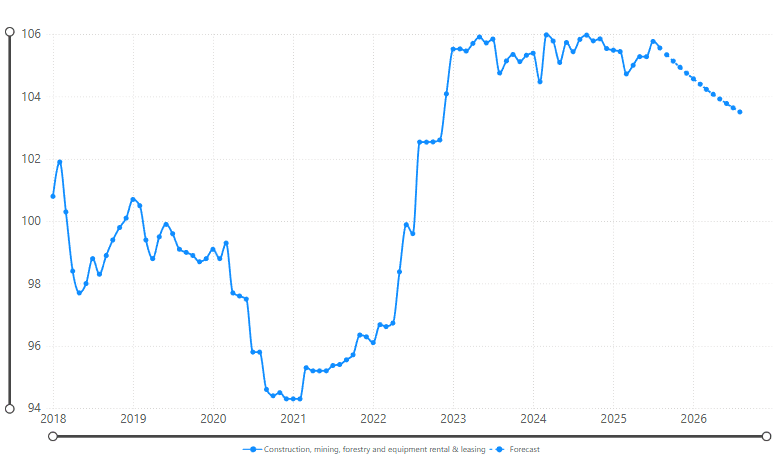

Rates for rental and leasing of construction, mining and forestry equipment will continue to drop, according to the forecast. The pricing index forecast is 103.5, down 1.9% YoY, through August 2026, with a consistent decrease expected over that period, according to the EFN data.

Index & Forecast: Rental and Leasing Pricing for Equipment and Truck, Trailers and RV

Forecast Source: Equipment Finance News

Market conditions

From April through August, OEM Komatsu saw prices in the United States rise about 40% compared with April levels, though the increase was slightly lower than initially projected, Kiyoshi Hishinuma, executive officer and general manager of the business coordination department at Komatsu, said during the company’s Oct. 29 earnings call.

Komatsu implemented a large price increase in August. However, competitors had made double-digit hikes in 2022 and 2023 and began reducing prices in the second half of 2024, when Komatsu did not hike prices at the same rate, Hishinuma said.

“During that period, we really didn’t have much price increase, so we probably still have room for a price increase, so that’s why we have executed that this August,” he said.

Komatsu revised its sales outlook for the U.S. construction market upward because conditions suggest that a decline in sales is unlikely, and construction demand in the United States is now projected to strengthen, Hishinuma said.

Business spending and capital expenditures declined slightly in late August and September, with weaker investment expectations and softer demand for truck transportation, even as freight rates ticked up modestly in the Federal Reserve Bank of Chicago coverage region, according to the Fed’s Oct. 15 Beige Book.

“One contact in the trucking industry called current conditions ‘recession-like,’” according to the Beige Book. “Retail inventories were lean, stocks of vehicles were lower and manufacturing inventories were a little high.”

The Chicago Fed represents Iowa and parts of Illinois, Indiana, Michigan and Wisconsin. It includes Chicago, Detroit, Indianapolis and Milwaukee.

Check out our exclusive industry data here.